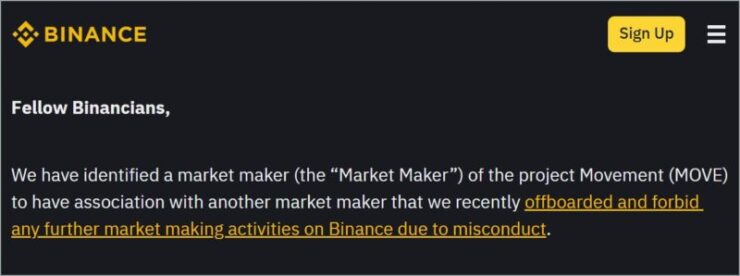

Binance has traced the source of suspicious trading activity around the MOVE token to a market maker with prior ties to entities previously removed from the platform for misconduct.

In a statement issued Tuesday, the exchange disclosed that the market maker responsible for offloading tens of millions of MOVE tokens shortly after listing was affiliated with another firm previously sanctioned in connection with the GPS and SHELL token launches. That earlier entity had already been offboarded on March 9 and permanently banned from participating on Binance.

According to the exchange, the entity made a staggering $38 million in profits shortly after MOVE went live without upholding its expected liquidity responsibilities.

Market makers typically maintain balanced bid and ask orders to ensure smooth, stable trading conditions. But in this case, the unidentified market maker dumped 66 million MOVE tokens into the market with minimal buy-side support just a day after the listing.

Binance described the behavior as “one-sided market making,” a clear breach of its standards designed to protect market participants from excessive volatility and manipulation.

The exchange identified and offboarded the firm on March 18 and informed the teams behind Movement Labs about the irregularities. Binance has since frozen the $38 million in profits and committed to redistributing the funds to users impacted by the skewed market activity.

Movement Lab’s Response

Binance reaffirmed its strict standards for authorized market makers, stressing that any partner must maintain balanced liquidity by placing both bid and ask orders, sustaining sufficient depth, and upholding stable spreads for an adequate period of time.

“Any project-authorized market makers who do not comply with or breach such principles and rules, Binance will take further actions against such market makers to best protect our users.” The announcement stated.

In a separate statement, the Movement Network Foundation acknowledged that Binance notified it on March 11 of an ongoing probe into suspicious activity involving MOVE.

According to the Foundation, both it and Movement Labs were unaware of the misconduct and had engaged the market maker in good faith due to its prior involvement with other projects in the ecosystem.

The market maker had acted independently, without the approval of the Movement team, and breached the terms of its agreement; the Foundation said, adding that the firm was instructed to provide balanced liquidity for the MOVE/USDT pair but failed to do so.

The Movement Network Foundation further said it immediately terminated all partnerships with the implicated market maker, including those tied to its broader ecosystem initiatives. The foundation also alerted other crypto exchanges and began working with Binance to recover the frozen funds.

In a bid to stabilize the market and demonstrate accountability, the foundation announced a $38 million USDT buyback program. Branded the “Movement Strategic Reserve,” the initiative is intended to repurchase MOVE tokens from the open market over the next three months via Binance. The acquired tokens will be deposited into an on-chain wallet designated for long-term strategic use and to reinject USDT liquidity into the ecosystem.

While the foundation emphasized that all proceeds from the rogue trades would be redirected toward supporting the community, it remains unclear how—or if—users directly affected by the price volatility will be individually compensated. Binance had originally frozen the market maker’s profits with the intent of reimbursing those harmed by the trading misconduct.

Quick Facts:

- Binance identified and offboarded a market maker for profiting $38 million through the improper trading of MOVE tokens.

- The entity engaged in one-sided market making by placing large sell orders without adequate buy orders.

- Binance has frozen the ill-gotten gains to reimburse affected users, with further details forthcoming from the Movement Labs on this.