After years of stops and starts, eToro is officially gearing up for Wall Street. The cryptocurrency-friendly social trading platform has publicly filed for an initial public offering (IPO) in the United States, marking a major step toward expanding its presence in the world’s largest capital market.

The move signals eToro’s ambitions to tap into growing US investor demand for fintech apps and crypto-friendly trading platforms, positioning itself among the elite on the Nasdaq Global Select Market under the ticker “ETOR.”

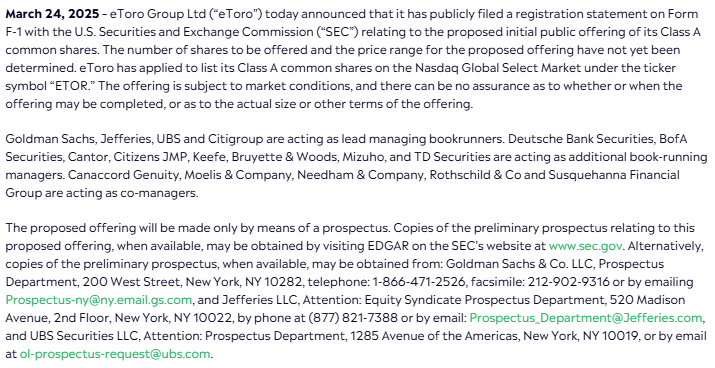

According to the company’s March 24 announcement, eToro submitted a Form F-1 registration statement with the US Securities and Exchange Commission (SEC). While the filing is not yet effective, it sets the stage for a public debut that could come as early as Q2 2025.

This marks a fresh attempt after eToro’s high-profile SPAC deal collapsed in 2022 when market turbulence derailed a planned $10.4 billion merger with Fintech Acquisition Corp V.

Now, eToro is taking the traditional IPO route, with Goldman Sachs, Jefferies, UBS, and Citigroup leading the charge as managing underwriters, signaling confidence from some of Wall Street’s biggest players.

Targeting a $5 Billion Valuation, with Crypto Still in Focus

While eToro’s UK roots remain strong, the company’s decision to list in the US reflects a desire to access deeper liquidity and broader investor interest, particularly in fintech and crypto sectors.

According to insiders, eToro’s IPO could value the company north of $5 billion, a sharp recovery from its $3.5 billion valuation in 2023 after raising $250 million in fresh capital.

Founded in 2007, eToro built its brand by simplifying stock and crypto investing for retail traders. The platform was one of the first in Europe to offer Bitcoin trading as early as 2013, capitalizing on crypto’s rise long before many competitors entered the space.

For eToro, the US listing is about more than capital, it’s about visibility and cementing its status in a market dominated by players like Robinhood and Coinbase.

CEO Yoni Assia previously pointed out that US markets offer both deep liquidity and global visibility, making the Nasdaq a natural fit. “Something in the US market creates a pool of both deep liquidity and deep awareness,” Assia noted.

Though the UK remains eToro’s largest market, most of its global users gravitate toward US-listed assets, reflecting the dominance of American markets in global trading activity.

A Test for Investor Appetite in the Fintech Space

eToro’s filing comes as investor sentiment around fintech and trading apps shows signs of recovery after a brutal 2022. If successful, the IPO could reignite interest in fintech platforms, especially those offering crypto exposure alongside traditional assets.

The platform’s hybrid model—blending stocks, cryptocurrencies, and social trading may appeal to a new wave of investors seeking versatility and access to digital assets.

What’s Next?

With the IPO filing now public, eToro’s path forward hinges on market conditions and regulatory approval. If it clears those hurdles, eToro could soon join the ranks of Nasdaq-listed fintech giants, further intensifying competition in the US market.

For eToro, the listing isn’t just a financial milestone, it’s a strategic leap toward becoming a global trading powerhouse at a time when the lines between traditional finance and crypto are increasingly blurred.