In a bold show of confidence in Bitcoin’s long-term value, Metaplanet has increased its Bitcoin holdings to 3,350 BTC with a fresh $12.6 million purchase, solidifying its position as one of the world’s largest corporate Bitcoin holders.

With an ambitious goal of securing 1% of all Bitcoin ever mined, the company is accelerating its treasury strategy and drawing global attention in the process.

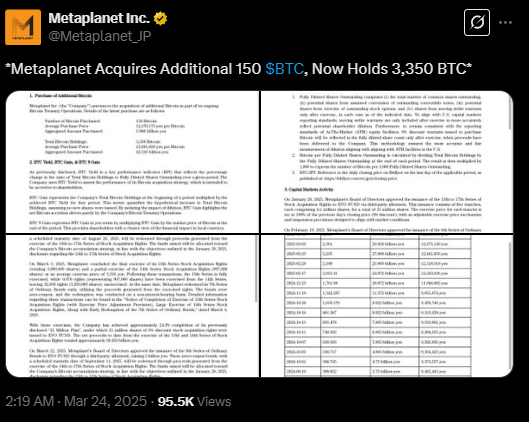

Throughout March, Metaplanet aggressively expanded its Bitcoin reserves with a series of large acquisitions: 156 BTC on March 3, 497 BTC on March 5, 162 BTC on March 12, and 150 BTC on March 18. These steady buys reflect the firm’s growing conviction in Bitcoin’s role as a long-term treasury asset.

So far in 2025, Metaplanet has added 1,288 BTC in just 11 weeks, achieving an impressive 68.3% BTC yield. Still, with its sights set on 10,000 BTC by year-end and 21,000 BTC by 2026, the company has significant ground to cover.

Chasing a 1% Slice of Bitcoin’s Fixed Supply

If Metaplanet succeeds, it will own nearly 1% of Bitcoin’s total supply, a feat that could cement its status as a corporate Bitcoin heavyweight alongside names like MicroStrategy.

This aggressive accumulation mirrors the broader trend of institutional Bitcoin adoption, as companies worldwide begin shifting their treasuries into digital assets to hedge against fiat currency risks.

In a headline-grabbing development, Eric Trump has joined Metaplanet’s Strategic Board of Advisors. Known for his background in real estate, finance, and branding, Trump’s appointment signals Metaplanet’s ambitions to expand its influence not just in crypto circles, but in global finance and politics.

Trump’s dual role as an ambassador for World Liberty Financial, a crypto project backed by his brothers Donald Jr. and Barron Trump, raises new questions about potential conflicts of interest — especially as U.S. crypto regulations heat up.

A Growing Force in the Corporate Bitcoin Landscape

Metaplanet’s stock reflects growing investor confidence, up over 3% to 4,895 JPY. The company’s roadmap demonstrates a clear belief in Bitcoin’s future, leveraging financial tools and strategic partnerships to fuel its treasury growth.

As traditional markets struggle with liquidity and valuation concerns, Metaplanet’s move toward Bitcoin marks a shift in corporate thinking — one where digital assets take center stage in treasury management.

The Takeaway

Metaplanet’s rapid Bitcoin accumulation is more than just a bold move — it’s a clear signal of growing corporate confidence in Bitcoin as a long-term store of value. With its sights set on 21,000 BTC, the company is positioning itself not just as a participant but as a future leader in the institutional Bitcoin space.

As more companies watch from the sidelines, Metaplanet is showing what aggressive digital asset adoption could look like in the years ahead.