In another major blow to decentralized finance, Zoth, a Real-World Asset (RWA) restocking protocol, has fallen victim to a devastating $8.4 million exploit. The breach forced the platform offline, raising urgent questions about the vulnerabilities plaguing RWA-based DeFi projects.

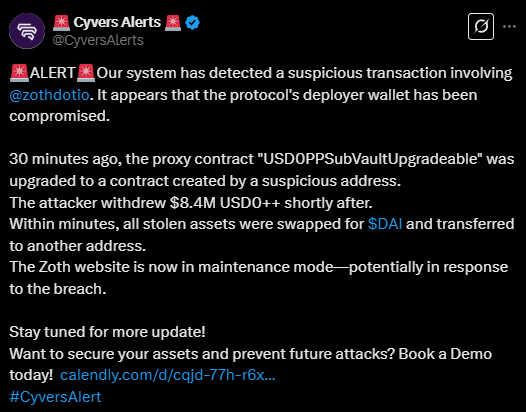

The attack, flagged on March 21 by blockchain security firm Cyvers, exposed how quickly sophisticated exploits can drain millions and how fragile user trust remains in this emerging sector.

Unlike typical flash loans or smart contract bugs, this exploit was frighteningly simple — and far more dangerous. According to Cyvers, the attacker compromised Zoth’s deployer wallet, granting themselves administrative privileges.

In less than 30 minutes, the hacker upgraded one of Zoth’s contracts to a malicious version deployed from a suspicious address. This maneuver effectively bypassed existing security measures, giving the attacker full control over user funds — instantly.

The stolen assets were swiftly converted into DAI stablecoins and funneled into a separate wallet. Later, blockchain sleuths at PeckShield confirmed the funds were swapped again into Ether (ETH), making a recovery even harder.

The Silent Killer — Admin Privilege Leaks in DeFi

According to Cyvers’ senior SOC lead, Hakan Unal, the root cause was clear: an admin privilege leak. This isn’t the first time such a flaw has wrecked a DeFi protocol, but Zoth’s case serves as a stark reminder of how critical key management and access control are in decentralized systems.

Unal stressed that adding multisig governance, timelocks on contract upgrades, and real-time monitoring of admin role changes could have prevented the attack or, at the very least, slowed it down.

Zoth’s breach is more than an isolated incident. It highlights a worrying trend: Real-World Asset protocols are becoming prime targets for hackers due to their growing liquidity and complex frameworks.

Unlike traditional DeFi projects, RWA platforms like Zoth aim to bridge crypto with real-world financial instruments, introducing new layers of risk. Their reliance on administrative roles to handle off-chain assets creates attractive single points of failure — perfect for exploits like this one.

As RWA projects expand, they risk inheriting not just the rewards but also the vulnerabilities of both traditional finance and decentralized systems.

What’s Next? The Industry’s Security Reckoning Is Overdue

For Zoth, the immediate focus is recovery. The platform has promised a full investigation and pledged to publish a detailed report. But the damage both financial and reputational is done.

For the broader DeFi sector, this attack underscores an uncomfortable truth: security models must evolve, especially for protocols handling real-world assets and large treasuries. The days of trusting a single deployer wallet are over.

Without swift changes, RWA platforms risk becoming the next frontier for exploits — and users may start thinking twice about where they stake their funds.

The Takeaway

Zoth’s $8.4 million loss isn’t just a one-off incident; it’s a flashing red warning for every project blending real-world assets with DeFi.

As capital floods into the sector, the next wave of successful protocols won’t be those chasing the biggest yields. They’ll be the ones who treat security as their first product — not an afterthought.