Markets are often viewed as unpredictable, volatile, and driven by sentiment, but history tells a different story. Market cycles—whether in stocks, real estate, crypto, or the global economy—follow repetitive patterns shaped by fundamental forces such as human behaviour, economic policies, and technological advancements.

While many investors focus on short-term fluctuations, understanding long-term market cycles provides an edge that can predict major shifts before they happen. In a recent discussion on The CoinRock Show, Matthias shared expert insights on how recognizing economic cycles can lead to better investment decisions and long-term financial success.

Understanding Market Cycles

Market cycles represent economic conditions’ natural ups and downs, impacting stocks, real estate, cryptocurrencies, and commodities. Understanding these cycles is crucial for investors to identify opportunities and manage risks.

Typically, a market cycle moves through four key phases. It begins with expansion, where economic growth is strong, stock prices rise, unemployment is low, and consumer confidence is high.

This is followed by the peak, where markets reach all-time highs, valuations become inflated, and speculative behavior increases. Eventually, the cycle moves into contraction (recession), characterized by economic slowdowns, falling asset prices, and rising unemployment.

Finally, in the trough (recovery) phase, the market stabilizes, asset prices bottom out, and new opportunities emerge for those who recognize them early.

“Market cycles may seem chaotic, but they follow fundamental principles. If you know what to look for, you can see the shift happening before the crowd does.” – Matthias

Historical data supports this cyclical behavior. Since 1854, the U.S. has gone through 34 recessions, with economic expansions lasting an average of 3.2 years and contractions averaging 1.5 years, according to the National Bureau of Economic Research. While market fluctuations may appear unpredictable in the short term, long-term trends show clear patterns that repeat over time.

Those who understand these shifts and adjust their investment strategies accordingly can capitalize on opportunities while avoiding common pitfalls. Whether in stocks, crypto, or real estate, recognizing where we are in the cycle allows investors to make informed decisions and position themselves for long-term success.

Role of Human Behavior in Market Cycles

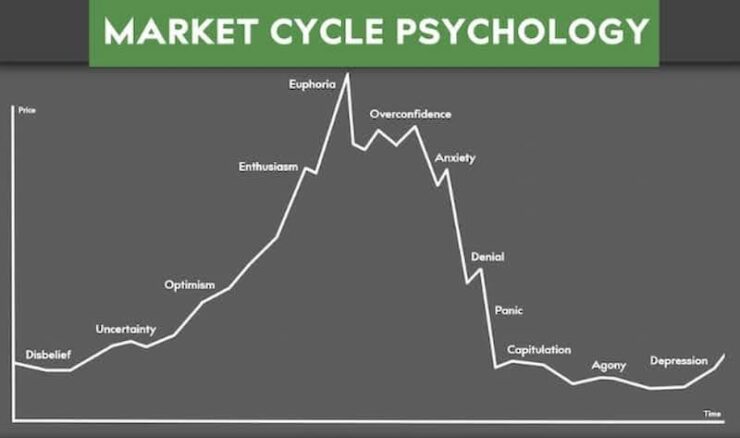

Despite advancements in AI, algorithms, and automated trading, human psychology still heavily influences market movements. Fear and greed drive investment decisions, often leading to booms and busts.

During a bull market, investors become overconfident, pushing prices higher than fundamentals justify. This was evident in the dot-com bubble (1999-2000) and the crypto boom of 2021. On the flip side, panic selling leads to prices falling below their actual value during a downturn, creating opportunities for savvy investors.

“The biggest mistake investors make is reacting emotionally. The key to winning is stepping back and seeing the bigger picture—cycles always repeat.” – Matthias

A classic example is Warren Buffett’s strategy of “being fearful when others are greedy and greedy when others are fearful.” Understanding market cycles helps investors stay rational and capitalize on opportunities others miss.

2008 Financial Crisis and Market Recovery

The 2008 global financial crisis is a prime example of market cycles at work. Leading up to 2008, low interest rates and easy credit fueled a housing bubble. When the bubble burst, housing prices collapsed, major banks failed, and markets crashed.

However, investors who recognized that this was part of a cycle and bought stocks in 2009 saw incredible returns. The S&P 500, which hit a low of 666 in March 2009, surged to over 4,000 by 2023—an increase of more than 500%.

This cycle played out again in 2020, when COVID-19 triggered a sharp market drop, followed by one of the fastest recoveries in history as stimulus packages and low interest rates fueled a new bull run.

“History doesn’t repeat itself exactly, but it rhymes. The same economic forces—debt, liquidity, and psychology—shape every major market cycle.” – Matthias

Make Smarter Investment Decisions

Understanding market cycles is only useful if investors know how to apply this knowledge strategically. The first step is identifying the phase of the cycle—whether in expansion, peak, contraction, or trough—to make better timing decisions.

During an expansion, growth investments like tech stocks, crypto, and real estate tend to perform well, whereas at the peak, reducing risk by shifting into bonds or gold can help protect wealth.

Undervalued assets present buying opportunities during a contraction, while during a trough, investing aggressively in strong, undervalued assets can yield high returns as the market recovers.

Interest rates and economic indicators also play a crucial role. When rates are low, borrowing increases, driving asset appreciation, but when rates rise, economic slowdowns often follow.

For instance, the Federal Reserve’s rate hikes in 2022-2023 triggered a market correction, affecting stocks, crypto, and real estate, highlighting the importance of staying ahead of policy shifts.

Since market cycles are never fully predictable, diversification is key. Holding assets like gold and Bitcoin can hedge against downturns, while dividend stocks and bonds provide income stability. Alternative investments such as real estate and private equity perform well across different phases, helping investors navigate volatility and protect long-term wealth.

Mastering Market Cycles for Long-term Wealth

Understanding market cycles is not about predicting the future with absolute certainty—it’s about recognizing patterns, being prepared, and making data-driven decisions.

The biggest financial opportunities don’t come from following the crowd but from understanding cycles and positioning yourself accordingly.

“If you can recognize where we are in the cycle, you’re already ahead of 90% of investors. The market rewards those who see the bigger picture.” – Matthias

Whether you’re investing in stocks, crypto, or businesses, knowing how to read economic patterns gives you a competitive edge, allowing you to buy when others panic and sell when others become greedy.

The key takeaway? Cycles repeat, and those who learn from history will always be ahead of the game.