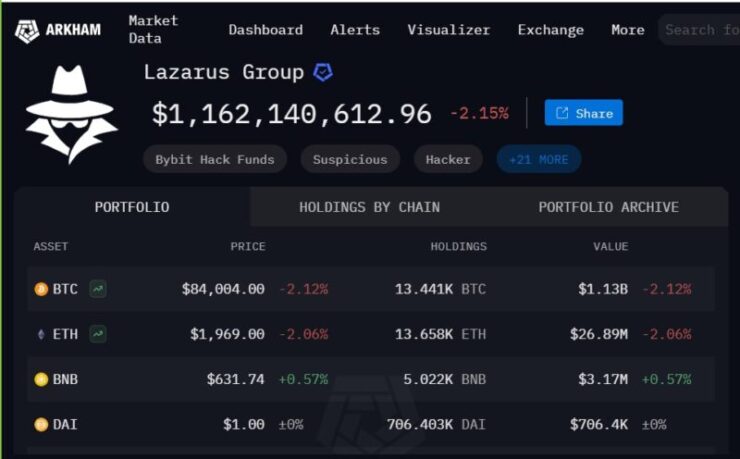

North Korea-linked hacking collective Lazarus Group now holds more Bitcoin than one of the most high-profile corporate investors in the asset: Elon Musk’s Tesla. According to data from blockchain intelligence platform Arkham Intelligence, Lazarus currently controls 13,441 BTC, valued at approximately $1.14 billion. This figure surpasses Tesla’s 11,509 BTC stash, marking a 16% lead over the electric vehicle giant.

The revelation spotlights the staggering scale of Lazarus’ illicit crypto operations, built over years through a series of coordinated cyberattacks. The group, widely believed to operate under North Korean directives, has been linked to some of the largest hacks in crypto history, with the accumulated Bitcoin allegedly used to bypass international sanctions and finance state-driven agendas.

Lazarus Group’s and Tesla’s Bitcoin Acquisition

Lazarus Group’s Bitcoin stockpile grew substantially after the hacking collective struck again last month, targeting leading crypto exchange Bybit. The group reportedly siphoned off $1.4 billion worth of Ether (ETH) in one of the largest recent crypto heists. According to Bybit CEO Ben Zhou, a significant portion of the stolen Ether has since been converted into Bitcoin, with roughly 12,836 BTC spread across 9,117 separate wallets—further solidifying Lazarus’ growing dominance among major Bitcoin holders.

For comparison, Tesla, which acquired its Bitcoin holdings in early 2021, continues to rank as the fourth-largest publicly listed company by BTC holdings but now finds itself overshadowed by Lazarus’ sprawling crypto network.

The stark contrast between a state-sponsored hacking group and a publicly traded corporation underscores growing tensions in the global Bitcoin landscape.

Compounding this dynamic, President Donald Trump’s renewed pro-crypto rhetoric—including recent remarks positioning the U.S. as the future “Bitcoin superpower”—has triggered fresh calls for American corporations to ramp up their digital asset strategies.

Adding to the geopolitical dimension, the U.S. government itself holds over 198,000 BTC—valued at more than $16 billion—through crypto assets seized in enforcement actions. Trump recently declared this reserve part of his strategic crypto stockpile, further intensifying global competition over Bitcoin dominance.

Top Organizational Bitcoin Holders

1. Strategy (formerly MicroStrategy): Holds Approximately 499,226 BTC: Under the leadership of Michael Saylor, Strategy has transformed into a major Bitcoin investment vehicle. The company has raised substantial capital through equity and debt offerings to acquire Bitcoin, holding nearly 2% of all bitcoins in existence.

2. Marathon Digital Holdings: Holds approximately 46,374 BTC: As a leading Bitcoin mining company, Marathon Digital has accumulated a significant amount of Bitcoin through its mining operations and strategic acquisitions.

3. Riot Platforms, Inc.: Holds approximately 18,692 BTC: Riot Platforms focuses on Bitcoin mining and has steadily increased its holdings as part of its growth strategy in the cryptocurrency space.

4. Tesla, Inc.: Holds approximately 11,509 BTC: The electric vehicle manufacturer, led by Elon Musk, made headlines with its significant Bitcoin purchase in early 2021, positioning itself among the top corporate Bitcoin holders.

Top Governmental Bitcoin Holders

- United States: Approximately 207,189 BTC. The U.S. government has acquired a substantial amount of Bitcoin through seizures related to criminal investigations and enforcement actions.

- China: Approximately 194,000 BTC. Similar to the U.S., China has accumulated Bitcoin primarily through confiscations linked to illegal activities.

- United Kingdom: Approximately 61,000 BTC. The UK government has become a significant Bitcoin holder following substantial seizures from criminal enterprises.

Quick Facts:

- North Korea-linked Lazarus Group now holds 13,441 BTC, valued at approximately $1.14 billion.

- The group’s Bitcoin stash surpasses Tesla’s 11,509 BTC holdings by 16%.

- Lazarus has accumulated Bitcoin over years of high-profile cyberattacks and hacks.

- The revelation comes as President Trump pledges to make the U.S. the global crypto capital, intensifying the spotlight on Bitcoin accumulation strategies.