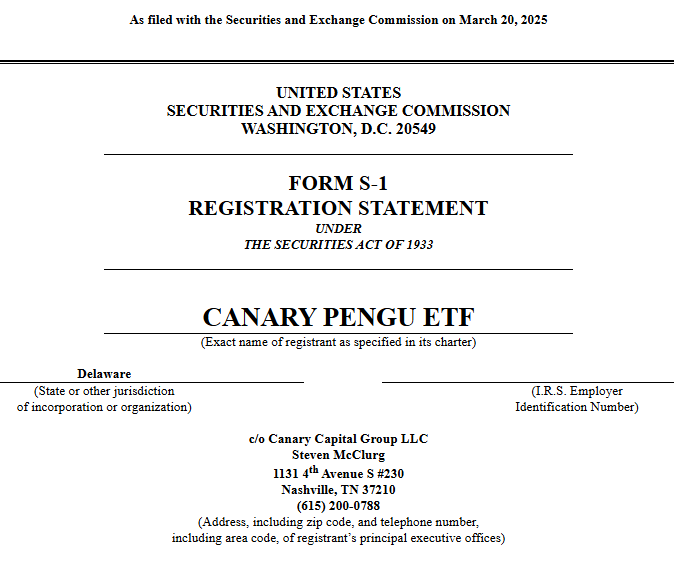

In a bold move that pushes meme coin mania into mainstream finance, Canary Capital has filed for a first-of-its-kind exchange-traded fund (ETF) tied to Pengu (PENGU), the governance token of the Pudgy Penguins NFT project. It would mark the first US ETF to directly hold non-fungible tokens (NFTs), signaling a dramatic shift in Wall Street’s appetite for speculative digital assets.

According to the filing, the proposed PENGU ETF will not only hold spot PENGU tokens but also various Pudgy Penguins NFTs. Additionally, the fund would maintain holdings in other digital assets like Solana (SOL) and Ethereum (ETH) necessary for managing the portfolio.

With PENGU boasting a market capitalization of around $438 million as of March 20, this filing adds to a growing list of crypto-based investment products racing to gain regulatory approval in the US. Just days earlier, Canary Capital also filed for an SUI ETF, reflecting the market’s deepening interest in altcoins and Layer-1 blockchains.

A New Era of Crypto ETFs — or a Fad?

The latest wave of ETF filings comes as the US Securities and Exchange Commission (SEC) faces a flood of proposals directly resulting from President Donald Trump’s aggressive pro-crypto stance. Since his return to office, Trump has reversed several restrictive policies on digital assets, vowing to transform the US into “the world’s crypto capital.”

This policy pivot has emboldened issuers, leading to ETF filings for not just blue-chip cryptocurrencies like Solana and XRP but also memecoins such as Dogecoin and even Official Trump (TRUMP) token. However, some analysts remain skeptical about the market potential of ETFs tied to fringe assets like PENGU.

“Pengu ETF announced. Price barely goes up. New ETFs for crypto assets have become an irrelevant joke,”

crypto researcher Alex Krüger commented on X, suggesting most of these ETFs risk failing to attract meaningful assets under management (AUM).

Regulatory Risks and Market Uncertainty Linger

While the potential for innovation is significant, so are the risks. ETFs holding meme coins and NFTs face unique challenges, including valuation uncertainties, liquidity concerns, and heightened regulatory scrutiny.

Despite this, Canary Capital appears confident that growing retail fascination with memes and digital collectibles could translate into investor demand.

Meanwhile, momentum in the crypto ETF space continues. On March 20, Volatility Shares launched the first Solana futures ETFs — SOLZ and SOLT — offering one- and two-times leveraged exposure to SOL’s price movements. Yet, spot SOL ETFs and other altcoin products still await green light from regulators.

What’s Next for Wall Street and Meme Coins?

Canary’s PENGU ETF filing is another sign that traditional finance is no longer ignoring crypto’s most viral and unpredictable sectors. Whether this signals a sustainable trend or a speculative bubble remains to be seen.

What’s clear, however, is that meme coin mania has officially reached Wall Street’s doorstep. With the SEC’s stance softening and more asset managers eyeing similar products, the race is on to see which — if any — of these ETFs will gain traction.

The Takeaway

As meme coins and NFTs break into the ETF market, investors should brace for a wild ride where internet culture collides with institutional finance, testing the limits of both markets.