Bitcoin’s price surged to $86,000 following the latest Federal Open Market Committee (FOMC) meeting, signaling renewed bullish momentum across crypto markets. However, according to former BitMEX CEO Arthur Hayes, the rally is far from over.

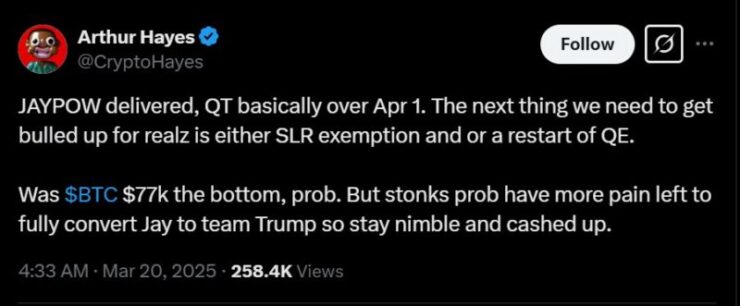

Hayes forecasts that the Federal Reserve’s next policy move—expected as early as April 1—could unlock further upside for Bitcoin, potentially pushing prices beyond the $90,000 mark.

Hayes bases his prediction on growing expectations that the Fed will not only pause its quantitative tightening (QT) program but may also implement interest rate cuts. The FOMC minutes released earlier this week lend weight to this outlook, confirming the Fed’s decision to significantly scale back its Treasury sales, reducing its monthly limit from $25 billion to $5 billion.

In Hayes’ view, this shift signals a pivotal moment. He argues that Bitcoin’s recent pullback to $77,000 likely marked the cycle’s bottom, and with liquidity conditions poised to improve, risk assets like Bitcoin stand to benefit.

He also points to mounting pressures in traditional markets—particularly the potential for continued weakness in U.S. equities—as another factor that may compel the Fed to ease its policies. For traders, Hayes’ advice is clear: be prepared for heightened volatility and keep capital on hand to capitalize on upcoming market moves.

Bitcoin Eyes $90K as Liquidity Conditions Improve

Following the latest FOMC meeting, Bitcoin quickly rallied, climbing 3.5% to trade near $87,000, a move closely watched by traders and analysts. The cryptocurrency is now testing key resistance levels, with market observers speculating that a sustained close above $86,350 could trigger a decisive breakout.

Notably, crypto analyst IncomeSharks highlighted this level as critical for initiating the next leg of Bitcoin’s rally.

Beyond technical indicators, macroeconomic factors are also stacking in Bitcoin’s favor. Analysts point to the recent rise in the U.S. M2 money supply—a key measure of liquidity in the financial system—as a significant tailwind for the crypto market. Historically, increases in M2 liquidity have correlated strongly with upward moves in Bitcoin’s price.

Experts suggest that even a modest 10% uptick in available liquidity could double Bitcoin’s value, given its sensitivity to expansionary monetary environments. Should current trends continue, some analysts believe Bitcoin could breach the $90,000 threshold as early as April, especially if the Fed follows through on easing its quantitative tightening stance.

Market Divided as Analysts Question Hayes’ QT Timeline

While Arthur Hayes’ bullish prediction has captured attention, not all experts are convinced the Federal Reserve’s tightening measures are nearing their end. Market sentiment remains split, with some analysts urging caution amid lingering macroeconomic uncertainties.

One notable skeptic is crypto analyst Benjamin Cowen, who challenges Hayes’ timeline, arguing that quantitative tightening (QT) is still very much in effect. Cowen points to the Fed’s continued balance sheet reduction, currently trimming approximately $35 billion per month, as evidence that liquidity conditions remain restrictive—at least for now.

These differing perspectives have left traders divided. On one hand, proponents like Hayes see upcoming rate cuts and reduced QT as a green light for a fresh Bitcoin rally.

On the other, skeptics caution that broader economic factors, including inflation dynamics and regulatory pressures, may keep financial conditions tight for longer than anticipated.

Quick Facts:

- Bitcoin surged to $86,000 after the latest FOMC meeting, with Arthur Hayes predicting a potential $90,000 breakout.

- Hayes believes Bitcoin’s recent dip to $77K marked the bottom, driven by expectations of the Fed halting quantitative tightening.

- The FOMC confirmed plans to reduce Treasury sales from $25B to $5B monthly, signaling looser liquidity ahead.

- Analysts remain divided, with some cautioning that QT may continue, while others anticipate a bullish Bitcoin rally if rate cuts materialize.