Three high-profile executives from Trump Media & Technology Group have established a new special purpose acquisition company (SPAC) with a strategic focus on investing in U.S.-based crypto, AI, and data security firms.

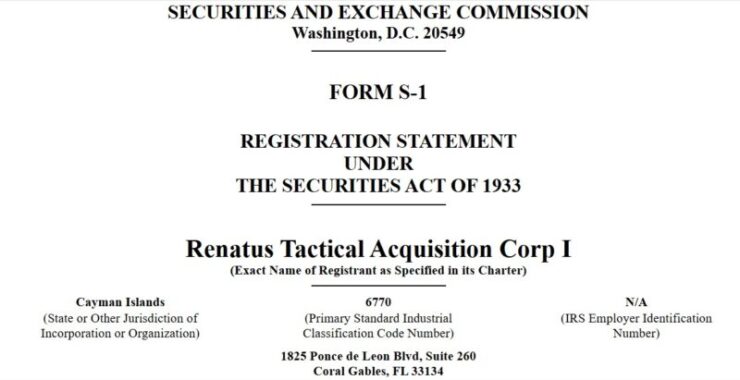

The newly registered entity, named Renatus Tactical Acquisition Corp I, filed its plans with the U.S. Securities and Exchange Commission (SEC), outlining its intent to focus on strategic sectors such as cryptocurrency infrastructure, blockchain technology, data security, and dual-use technologies with potential defense applications.

Interestingly, while the SPAC is incorporated in the Cayman Islands—a typical choice for financial vehicles seeking flexibility—its acquisition targets are strictly U.S.-based, reflecting a clear prioritization of bolstering American dominance in these emerging industries.

Renatus’ leadership roster is stacked with Trump Media insiders, further solidifying the connection between the administration’s policy direction and private-sector initiatives. Eric Swider, a board member at Trump Media, has been appointed as CEO of Renatus, while Devin Nunes, who chairs Trump Media, also chairs the SPAC. Additionally, Alexander Cano, known for his role in the media firm’s previous merger, will serve as Renatus’ chief operating officer.

“Our team brings extensive experience in digital assets, blockchain infrastructure, and regulatory and policy matters affecting the sector,” The SPAC said in its filing.

“With backgrounds spanning finance, technology, and public policy, our leadership has been at the forefront of navigating the intersection of crypto innovation and government oversight.”

In its SEC filing, the company also emphasized that the current administration is taking “unprecedented steps” to weave digital assets into the national financial fabric. This move is widely seen as part of a broader policy shift favoring domestic control over critical financial technologies, particularly in crypto, at a time when international competition in blockchain infrastructure and cybersecurity is intensifying.

Proven SPAC Track Record and Focused Acquisition Strategy

The team behind Renatus Tactical Acquisition Corp I is no stranger to the SPAC landscape. According to the company’s filing with the SEC, Renatus’ management draws heavily from its prior experience orchestrating the high-profile merger between Digital World Acquisition Corp (DWAC) and Trump Media & Technology Group.

That 2021 venture successfully raised $287.5 million and culminated in a completed business combination in March 2024, with additional funding secured through $310.6 million in trust non-redemptions, $50 million in convertible debt, and $11.3 million in equity capital beyond the initial raise.

This background positions Renatus as a well-equipped player in the current SPAC market, bringing both seasoned leadership and an established network to the table as it hunts for new acquisition targets.

In terms of strategy, Renatus has set its sights on U.S.-based businesses with enterprise valuations ranging between $500 million and $5 billion, signaling an appetite for mid-to-large scale acquisitions.

While its primary focus remains on blockchain, cryptocurrency, data security, and dual-use technologies, the SPAC also left the door open to pursue opportunities in other sectors should attractive targets emerge.

The filing further outlined that to finance any potential acquisition exceeding its available capital, Renatus may tap into additional funding sources, including debt instruments, equity offerings, or a blend of both.

The overarching business strategy is clear: leverage its capital, leadership experience, and influential connections to drive growth, improve operational efficiency, and generate long-term value across key emerging and mature markets.

Surge in Crypto-Affiliated Companies Under Trump Administration

The launch of Renatus Tactical Acquisition Corp I is the latest in a growing list of crypto-affiliated ventures emerging under the Trump administration. Since returning to office, President Trump’s administration has signaled a friendlier regulatory stance toward digital assets, triggering a noticeable uptick in the establishment of crypto and blockchain-focused firms across the U.S.

Several policy shifts, including the recent executive orders aimed at integrating cryptocurrencies into the national financial strategy, have contributed to renewed optimism in the sector.

This pro-crypto pivot has encouraged both startups and established players to either expand their operations domestically or set up new entities tailored to serve the evolving regulatory framework. The administration’s emphasis on bringing critical technologies like blockchain, AI, and data security under U.S. control has further incentivized the formation of firms aligned with these priorities.

Interestingly, many of these crypto-affiliated companies continue to register in offshore jurisdictions such as the Cayman Islands—a pattern Renatus itself follows. The Cayman Islands remain a favored destination for crypto businesses and SPACs alike, offering regulatory flexibility, tax neutrality, and streamlined corporate structures.

For companies seeking to balance regulatory compliance in the U.S. while maintaining operational agility, the Cayman Islands provide an attractive option for structuring funds and acquisitions.

Quick Facts:

- Trump Media executives launched Renatus Tactical Acquisition Corp I, a SPAC focused on acquiring U.S.-based crypto, blockchain, and data security firms.

- The SPAC aims to raise $179 million, targeting companies valued between $500 million and $5 billion.

- Despite being incorporated in the Cayman Islands, Renatus plans to acquire exclusively American firms to bolster domestic tech dominance.

- The Trump administration’s pro-crypto stance has triggered a surge in crypto-affiliated company formations fueled by regulatory support and offshore flexibility.