A new report by blockchain analytics firm Chainalysis has shed light on a disturbing intersection between cryptocurrency transactions and the global fentanyl trade. The findings reveal how Chinese chemical suppliers and Mexican drug cartels are increasingly using digital assets to facilitate illegal fentanyl production, raising renewed concerns over crypto’s role in illicit finance.

According to Chainalysis, these suppliers, often operating under the guise of legitimate chemical companies, accept digital payments to move materials essential for producing fentanyl—a synthetic opioid responsible for a significant portion of the opioid crisis in North America.

The report highlights how these payments are typically made in Bitcoin (BTC) and Tether (USDT), cryptocurrencies preferred for their speed and ease of cross-border transactions. Chainalysis notes that between 2018 and 2023, at least 175 cryptocurrency wallets linked to these suppliers received substantial inflows, a sign of organized financial activity supporting illicit trade.

The majority of these chemicals are shipped to Mexico, where drug cartels process them into fentanyl and smuggle the final product into the U.S. market. The use of crypto payments streamlines the supply chain, providing anonymity and bypassing traditional financial systems that are subject to stricter anti-money laundering (AML) regulations.

Civil Case Unveils Crypto Trail Link to Cartels

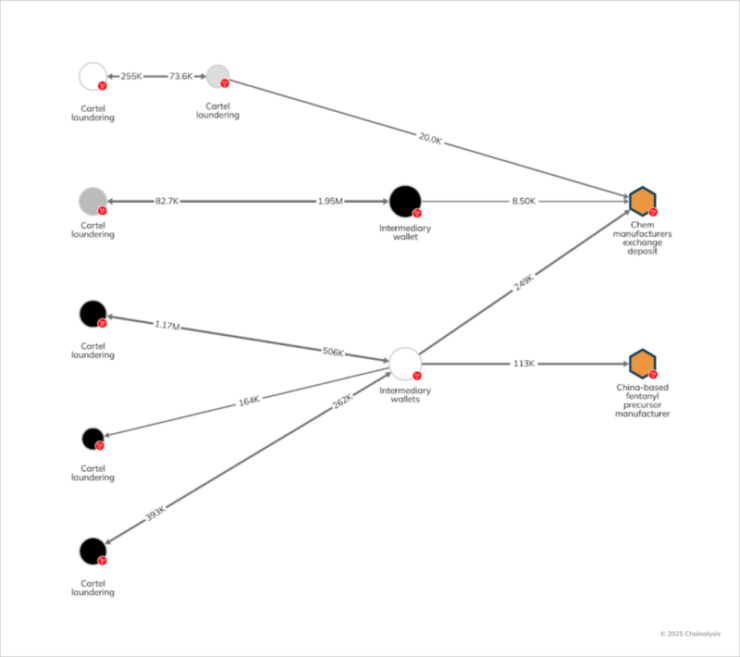

A crucial breakthrough in exposing the crypto-fueled fentanyl network came via a civil forfeiture case in Wisconsin, where U.S. authorities seized $5.5 million worth of cryptocurrency tied to money laundering activities. Investigators found that cartel-affiliated operatives inside the U.S. were moving digital assets directly to Chinese chemical manufacturers, effectively financing the pipeline of fentanyl precursors used in illegal drug production.

Chainalysis’ data further suggests that despite China’s official ban on cryptocurrencies, Chinese manufacturers continue to dominate the global supply chain of fentanyl ingredients, pill presses, and counterfeiting equipment. Mexican cartels were identified as the primary recipients of these goods, with crypto transactions serving as a discreet, efficient payment method.

One notable factor contributing to the prevalence of crypto in these transactions is China’s strict capital controls. Chinese nationals face legal restrictions on purchasing more than $50,000 in foreign currency annually, prompting many to bypass traditional banking systems by turning to cryptocurrencies and underground financial networks to circumvent these limitations.

Interestingly, the crypto laundering strategies employed by cartel-linked entities appear surprisingly rudimentary. Chainalysis noted that rather than relying on sophisticated privacy tools or obfuscation techniques, these networks prioritize speed and directness. Funds are funneled rapidly through centralized exchanges and unhosted wallets, leaving behind a trail that, while effective for swift transfers, remains visible to forensic investigators.

The report further explains how major Mexican criminal organizations, including the notorious Sinaloa Cartel and Cartel Jalisco Nueva Generación, are capitalizing on this cryptocurrency window to sustain their fentanyl production pipelines. Their operations are further enabled by postal services and logistics companies willing to accept cryptocurrency payments, ensuring seamless international deliveries without raising red flags in traditional financial systems.

Adding another layer to this network are darknet marketplaces, where transactions are facilitated anonymously, providing cartels and chemical suppliers with platforms to negotiate deals and transfer funds away from the prying eyes of regulators.

Chainalysis also cited data indicating that one specific group of suspected China-based chemical dealers had received over $37 million in cryptocurrency payments between 2018 and 2023, underscoring the scale and persistence of these operations.

Broader Implications for Crypto Regulation and Market Perception

The Chainalysis report comes amid an intensified global crackdown on money laundering and illicit activities involving cryptocurrencies. Regulators in both the U.S. and China have previously raised alarms over the misuse of digital assets in criminal enterprises, particularly in the narcotics trade.

These findings are likely to add fuel to ongoing discussions around implementing stricter Know-Your-Customer (KYC) and AML protocols within crypto exchanges and DeFi platforms. This isn’t the first time cryptocurrency’s involvement in illicit trade has come under the microscope. Earlier this year, the Financial Action Task Force (FATF) issued warnings on how bad actors exploit crypto to launder money across borders. Similarly, recent cases have exposed the use of privacy coins and mixer services to obscure illicit financial flows.

Quick Facts:

- Chainalysis reports over $37 million in crypto payments tied to Chinese fentanyl precursor suppliers between 2018 and 2023.

- Bitcoin and Tether were the primary cryptocurrencies used by suppliers to facilitate cross-border transactions with Mexican cartels.

- Regulatory bodies are expected to intensify KYC and AML enforcement as crypto’s role in illicit trade garners more scrutiny.