Ethereum faces a critical challenge as DEX trading volumes plummet. This sharp decline highlights the urgent need for change to maintain its dominance in the blockchain space.

Ethereum is at a turning point. Trading on its decentralized exchanges (DEXs) has dropped by a staggering 34% in just a week. This sudden drop has sent shockwaves through the DeFi community, raising serious questions about whether Ethereum can hold onto its top spot in the ever-competitive blockchain world.

A Shocking Decline in DEX Activity

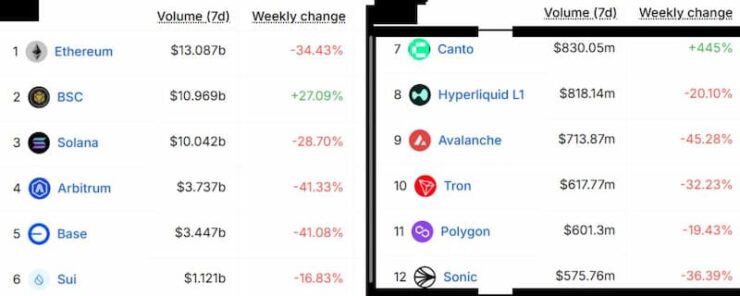

The data is clear. Trading on Ethereum-based platforms like Uniswap and SushiSwap has dropped a lot. These platforms are key for DeFi because they help with token trading and liquidity. A 34% drop in one week is a big deal, not a small problem. This drop hurts liquidity, which is essential for smooth trading.

Without enough liquidity, trading slows, and prices can become unstable. Smaller tokens that rely on these platforms are struggling the most. People are now wondering: what’s causing this sudden drop in Ethereum’s activity?

What’s Behind the Decline?

The drop in DEX activity isn’t due to just one thing—it’s a mix of challenges. For starters, Ethereum’s gas fees are still a headache. When the network gets crowded, these fees can skyrocket, making it tough for regular users to stick around.

Smaller traders, in particular, are packing their bags and heading to blockchains like Binance Smart Chain or Solana, where transactions are faster and cheaper. But it’s not just about the fees. The shaky global economy and unpredictable crypto prices are making people think twice about diving into risky DeFi projects.

At the same time, centralized exchanges like Binance and Coinbase are stealing the spotlight. They’re cheaper, easier to use, and offer a smoother experience overall. New projects like NFTs and blockchain gaming are grabbing attention. While exciting, they might be pulling users away from traditional DeFi platforms.

What Does This Mean for Ethereum and DeFi?

This drop impacts more than just Ethereum. The entire DeFi sector could suffer. Lower DEX activity may slow innovation. Without enough liquidity, creating new financial products becomes harder, and DeFi growth could stall.

Trust in decentralized platforms hinges on their ability to offer something centralized exchanges can’t—like full decentralization and censorship resistance. If Ethereum struggles to deliver a competitive user experience, the entire DeFi movement could face setbacks. For Ethereum specifically, the pressure is mounting.

Blockchains like Avalanche, Solana, and Polygon are growing quickly. They offer faster and cheaper alternatives to Ethereum. Ethereum 2.0 is expected to fix these issues with proof-of-stake (PoS) and sharding. However, the upgrade has no clear release date. Without it, Ethereum risks falling behind.

The Road Ahead

Ethereum is facing a critical moment. To stay a leader in blockchain, it must act quickly. It needs to lower transaction costs and improve scalability. Making the user experience better is also essential. Meanwhile, the DeFi community must keep users engaged.

They need to ensure liquidity remains strong, even with high fees and market volatility. The 34% drop in DEX volumes may seem temporary, but it’s a clear warning that change is needed. How Ethereum and its community respond in the coming months will shape not just its future, but the future of DeFi as a whole.