In a bold move beyond traditional trading, Robinhood has launched a Prediction Markets Hub through its subsidiary Robinhood Derivatives, signaling a new era for the financial platform. Powered by Kalshi, a federally regulated prediction market, this expansion allows users to trade on the outcomes of politics, economics, and sports, with plans to broaden the offering in the future.

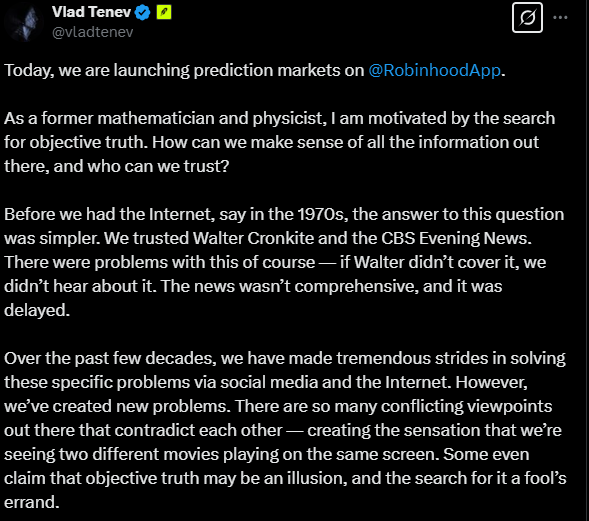

CEO Vladimir Tenev announced the launch on X, positioning prediction markets as capitalism’s purest pursuit of truth, leveraging market incentives and crowd wisdom to forecast real-world events.

Prediction markets, once considered niche, have exploded in popularity especially during high-stakes events like the U.S. presidential elections and major sports championships.

Robinhood’s entry places it squarely in competition with decentralized platforms like Polymarket and traditional players such as Kalshi. But unlike decentralized competitors, Robinhood is doubling down on regulated, federally approved offerings to appeal to mainstream users and institutional traders.

“At the most fundamental level, prediction markets are the application of capitalism to the pursuit of truth,” Tenev stated. “Markets sift through vast information to determine outcomes, sometimes even before they happen.”

How the Robinhood-Kalshi Partnership Works

The new Prediction Markets Hub will launch with contracts facilitated by KalshiEX LLC, a CFTC-regulated exchange.

- Kalshi operates as a Designated Contract Market (DCM), approved by the Commodity Futures Trading Commission (CFTC).

- Contracts offered through Robinhood’s app will allow users to speculate on well-defined, real-world events, from election outcomes to economic indicators and sports results.

Robinhood emphasized its close communication with the CFTC, signaling its commitment to compliance amid growing regulatory scrutiny in the futures and derivatives space.

“We look forward to continuing to work with [the CFTC] to promote innovation in the futures, derivatives, and crypto markets,” Robinhood noted.

Politics, Sports, and Economics

This isn’t Robinhood Derivatives’ first foray into futures, users previously wagered on the 2024 U.S. Presidential Election, competing directly with Polymarket and Kalshi. That event set records, with Polymarket’s trading volume exceeding $3 billion on election bets.

The success of these markets demonstrated massive appetite among retail and institutional traders to speculate on real-world events beyond traditional equities or crypto.

Robinhood now seeks to capitalize on this trend, turning prediction markets into a mainstream financial product within its app.

While Robinhood is leaning on Kalshi’s regulatory framework, prediction markets remain a hot-button issue for U.S. regulators.

- Kalshi’s ability to offer election-related contracts faced legal challenges from the CFTC, which argued such bets could undermine democratic processes.

- However, a federal appeals court ruled in Kalshi’s favor in October 2024, allowing it to list election contracts.

- More recently, the CFTC has probed both Kalshi and Crypto.com over Super Bowl derivatives markets, raising broader questions about the future of event-based prediction markets.

This scrutiny underscores how sensitive these markets are, especially as financial platforms blend entertainment, politics, and economics into tradeable assets.

What This Means for Robinhood and the Future of Trading

Robinhood’s Prediction Markets Hub signals an ambitious shift blurring the lines between financial speculation and event-driven forecasting.

Key Implications:

- Diversifies Robinhood’s product offering, attracting new users interested in politics, sports, and macroeconomic trends.

- Elevates prediction markets as legitimate financial instruments, moving them beyond novelty status.

- Challenges decentralized competitors by offering regulated, mainstream-friendly prediction markets.

- Keeps Robinhood at the center of the regulatory debate, as agencies grapple with the future of prediction markets in the U.S.

Final Takeaway

Robinhood’s partnership with Kalshi represents a strategic leap into one of the fastest-growing sectors in financial trading. By offering regulated prediction markets, the platform could reshape how investors, gamblers, and speculators engage with real-world events.

But the move comes with risks—regulatory hurdles, legal challenges, and public scrutiny over the ethics of betting on elections or social events.

As Robinhood pushes forward, the key question remains: Will prediction markets become a staple of everyday trading, or will regulators step in to slow their momentum?