Crypto exchange OKX has temporarily shut down its DEX aggregator following reports that North Korea’s Lazarus Group was misusing the service for illicit activities.

The exchange announced the decision on March 17, citing a coordinated effort by the hacking syndicate to exploit its DeFi services. After consulting with regulators, OKX took preemptive action to halt the aggregator while implementing security upgrades.

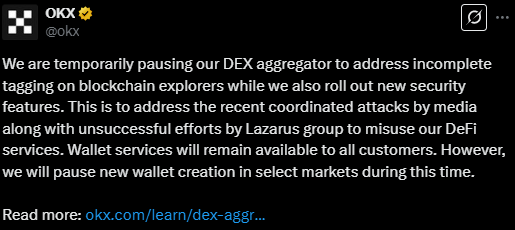

“We are temporarily pausing our DEX aggregator to address incomplete tagging on blockchain explorers while we also roll out new security features.” OKX stated.

The suspension raises critical questions about DeFi security, regulatory pressure, and how centralized exchanges should handle decentralized finance vulnerabilities.

OKX’s DEX aggregator enables users to access multiple decentralized exchanges (DEXs) through a single interface. While this feature provides enhanced liquidity and efficiency, it also presents an opportunity for cybercriminals to launder stolen funds.

According to OKX, Lazarus Group, a state-backed North Korean hacking collective known for executing multi-billion-dollar crypto heists, had been abusing its aggregator for illicit financial flows.

To counter this, OKX has:

- Paused its DEX aggregator for internal review and upgrades

- Restricted new wallet creation in select markets

- Kept other crypto wallet services active for customers

The firm did not specify a timeline for reactivating the aggregator.

The ByBit Hack Connection and Regulatory Scrutiny

The suspension comes amid growing regulatory concerns. On March 11, Bloomberg reported that European financial regulators were investigating OKX’s DEX aggregator and wallet services for their alleged role in laundering funds from the $1.5 billion Bybit hack.

Bybit CEO Ben Zhou claimed that nearly $100 million of stolen funds had been funneled through OKX’s Web3 proxy, making a portion of them untraceable.

In response, OKX dismissed the allegations, calling Bloomberg’s report “misleading.” The exchange clarified its role in the Bybit incident, stating:

- It froze stolen funds that attempted to enter its centralized exchange (CEX).

- It developed a new hack detection system to track illicit activity.

OKX emphasized that its aggregator does not hold customer assets and is merely a liquidity access point for various protocols.

“Some have deliberately misrepresented our platform,” the firm said, responding to allegations that its aggregator facilitated illicit transactions.

OKX’s Security Upgrades and Anti-Fraud Measures

In an effort to prevent further misuse, OKX has already implemented:

- A hacker address detection system to track and block suspicious addresses in real time.

- Market-specific IP blocking to prevent prohibited regions from accessing its services.

- Stronger transaction monitoring tools to ensure hackers cannot exploit its liquidity networks.

“We already rolled out a lot of controls for OKX Web3 to fight against misuse,” said OKX CEO Star Xu on March 17.

The exchange is also working on enhancing visibility for explorers, ensuring that actual DEXs processing trades are correctly identified instead of mistakenly flagging the OKX aggregator as the transaction source.

The Bigger Picture

The OKX case underscores a growing security challenge in DeFi—while decentralized finance offers permissionless access to financial tools, it is also being exploited for illicit activities.

Lazarus Group alone has stolen over $3 billion in crypto through hacks, exploits, and laundering schemes, often moving funds through DEXs, bridges, and mixing services.

OKX’s decision to halt its aggregator highlights an ongoing dilemma:

- Should centralized platforms take an active role in preventing illicit DeFi activity?

- Does this set a precedent for more CEX involvement in decentralized regulation?

- Will regulatory bodies tighten DeFi oversight in response to continued threats?

While OKX is making moves to prevent misuse, the broader question remains: How will DeFi security evolve to combat these growing threats?

Final Takeaway

OKX’s suspension of its DEX aggregator is not just a company decision it reflects a broader shift in the crypto industry’s response to financial crime.

With regulators closing in and state-sponsored hacking groups exploiting DeFi loopholes, centralized platforms may face increasing pressure to act as enforcers in the crypto space.

For now, OKX is taking a cautious approach, prioritizing security over accessibility. But as DeFi adoption grows, the balance between decentralization and regulatory compliance will become an even more pressing issue.

The battle against crypto-related financial crime is far from over. The question is: Who takes responsibility next?