The memecoin mania has claimed another victim. The Wolf (WOLF) token, created by the same developer behind the Libra and Melania tokens, has crashed 99%, wiping out nearly its entire market cap.

At its peak, WOLF reached a staggering $42 million valuation before plummeting to just $570,000 in a matter of days. But this wasn’t just another volatile crypto swing, it was a well-executed insider operation, according to blockchain analysts.

Once again, retail investors were left holding the bag.

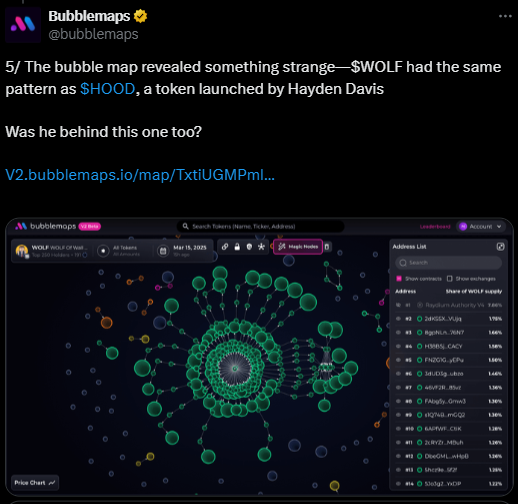

Blockchain analytics firm Bubblemaps sounded the alarm, revealing that 82% of WOLF’s supply was concentrated under a single entity.

Their findings showed that WOLF shared an identical pattern to HOOD, another memecoin linked to Hayden Davis, the controversial developer behind multiple rug pulls.

“The bubble map revealed something strange—$WOLF had the same pattern as $HOOD, a token launched by Hayden Davis. Was he behind this one too?” – Bubblemaps

Further investigations traced the money flow across 17 different wallets and two blockchains, all linked to a single address—’OxcEAe’—belonging to Davis.

The pattern was clear: fund wallets, hype the token, dump the supply, and exit with millions.

Memecoins as “Retail Value Extraction Tools”

Davis’ latest scheme comes just weeks after the catastrophic collapse of LIBRA, where insiders cashed out $107 million in liquidity, triggering a $4 billion market cap wipeout.

LIBRA’s implosion even spilled into politics, with Argentinian President Javier Milei facing impeachment risks over his public endorsement of the token. Now, Argentine authorities are calling for an Interpol Red Notice against Davis, citing a high flight risk.

The repeated cycle of memecoin scams exposes a dangerous industry trend.

“Memecoins have evolved from community-driven social experiments into a chaotic landscape dominated by value extraction from retail investors.”

– Anastasija Plotnikova, CEO of Fideum told Cointelegraph.

She warned that the original concept of memecoins—, lighthearted, community-driven collectibles, has been hijacked by insider rings and sniper groups, turning the space into an unregulated casino for whales.

For retail investors, the challenge is now distinguishing between a genuine memecoin project and outright fraud.

With rug pulls and pump-and-dump schemes running rampant, U.S. lawmakers are stepping in.

Earlier this month, a New York legislator introduced a bill to criminalize virtual token fraud. The proposal seeks new legal definitions for crypto-related scams, including offenses targeting rug pulls and deceptive investment schemes.

If passed, insider-driven memecoin frauds could soon face legal consequences.

The Rise and Fall of Memecoins: Is the Party Almost Over?

While memecoins once thrived as fun, viral assets, the increasingly exploitative nature of the space is raising serious concerns.

The Wolf token collapse is the latest example of how bad actors manipulate hype, mislead investors, and walk away with millions. But with regulators now paying attention, could the golden era of memecoins be coming to an end?

The memecoin frenzy continues for now, but as more retail investors get burned, the calls for stricter oversight will only grow louder.

The real question is: will the industry clean itself up before authorities do it for them?