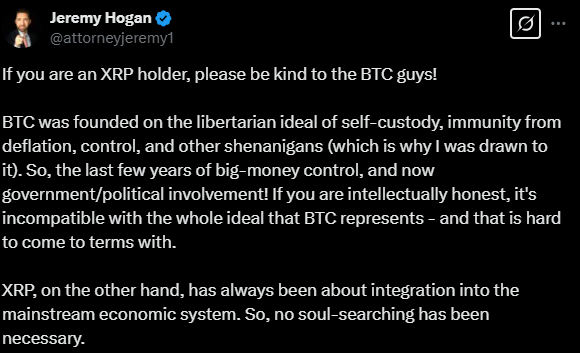

The crypto industry is built on decentralization and financial freedom yet internal divisions threaten its future. Pro-crypto attorney Jeremy Hogan is calling for an end to tribalism, urging the XRP community to show more support for Bitcoin advocates.

Hogan, a vocal supporter of digital assets, pointed out the deep ideological rift between Bitcoin and XRP. While Bitcoin was created as a self-custody, deflation-resistant asset, XRP was designed for mainstream financial integration. These differences have fueled tension between both camps for years.

Now, as big money reshapes the crypto landscape, Hogan warns that internal conflicts could weaken the industry’s collective strength when it needs unity the most.

Bitcoin’s Evolution From Libertarian Dream to Institutional Darling

Bitcoin was founded on decentralization and financial sovereignty, but it has drawn institutional giants into its orbit over the years. Michael Saylor’s MicroStrategy and asset managers like BlackRock and Fidelity now hold massive stakes in BTC.

Even governments are taking a seat at the table. In a controversial move, the U.S. government officially holds Bitcoin reserves, following an executive order signed by former President Donald Trump.

To Bitcoin purists, this is a betrayal of Satoshi Nakamoto’s original vision—a system free from government and corporate control. Hogan highlights this contradiction, arguing that BTC’s new trajectory clashes with its decentralized origins.

XRP, on the other hand, was always built for institutional adoption. Its goal was to facilitate cross-border payments, not challenge central authorities. This fundamental difference has been at the heart of the Bitcoin vs. XRP debate.

The Battle Over a National Crypto Reserve

The rivalry intensified when Trump’s administration considered a national crypto reserve including multiple assets like Bitcoin, XRP, and Cardano.

Bitcoin maximalists fought back. Their stance? If the U.S. were to hold any digital asset as a reserve, it should be BTC alone.

Eventually, the government settled on a Bitcoin-only reserve, leaving XRP and other altcoins on the sidelines for potential inclusion in a Sovereign Wealth Fund. The decision deepened divisions between the BTC and XRP communities, fueling another wave of tribalism in the crypto space.

But Hogan believes this infighting is short-sighted. The real battle isn’t between crypto communities—it’s between crypto and the traditional financial system.

Could an XRP ETF Change the Power Balance?

Bitcoin has always had a first-mover advantage, including in the ETF market. With multiple BTC spot ETFs now trading in the U.S., institutional capital is pouring into Bitcoin, giving it an even stronger foothold.

But the tide could turn. Several asset managers—including CoinShares, Bitwise, Grayscale, and WisdomTree—are actively pushing for an XRP ETF. There’s also speculation that BlackRock may enter the race after Ripple’s legal battle with the SEC concludes.

If approved, an XRP ETF could level the playing field, bringing institutional liquidity into XRP and potentially bridging the gap between Bitcoin and altcoins.

The Bigger Picture

Jeremy Hogan’s message is clear, crypto’s biggest threat isn’t internal competition; it’s external pressure.

Regulators, governments, and legacy financial institutions are watching closely. The more divided the crypto industry is, the easier it is to control.

Whether it’s Bitcoin, XRP, or any other digital asset, mainstream adoption and regulatory clarity are real challenges. Tribalism only slows down progress.

The future of crypto depends on collaboration, not conflict. Will the XRP and Bitcoin communities find common ground, or will infighting continue to hold the industry back? The answer could shape the next era of digital finance.