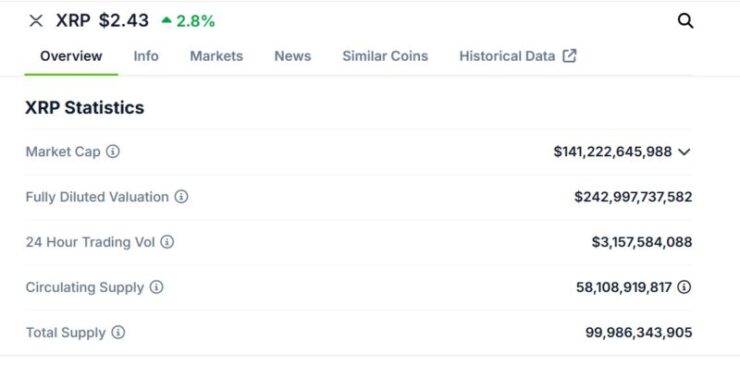

XRP’s fully diluted valuation (FDV) has overtaken Ethereum’s, marking a significant shift in the competition between layer-1 blockchain networks. According to 15 March data from CoinGecko, XRP’s FDV reached nearly $243 billion—over $10 billion higher than Ethereum’s.

While Ethereum still leads in market capitalization at $233 billion compared to XRP’s $144 billion, the FDV flip signals rapid momentum experienced by altcoins in the crypto market.

Fully diluted valuation represents the total value of a cryptocurrency, assuming all possible tokens are in circulation. While Ethereum’s market capitalization remains higher at $233 billion compared to XRP’s $136 billion, the FDV metric provides insight into the potential market value if all tokens were released.

XRP has experienced a remarkable 300% surge, climbing to $2.4 per token since Donald Trump’s victory in the U.S. elections on November 5. The shift in U.S. regulatory sentiment has played a crucial role in boosting XRP’s market outlook, with the new administration taking a pro-crypto stance.

XRP Project Triggers in Recent Times

Ripple’s institutional DeFi expansion has also contributed to XRP’s rally. In February 2025, the project introduced an enterprise-focused DeFi roadmap to solidify XRP Ledger as a financial hub. Meanwhile, XRP’s native decentralized exchange (DEX) has processed over $1 billion in swap transactions since launching in 2024, showcasing increasing adoption within its ecosystem.

Adding to XRP’s momentum, Trump has reportedly included XRP in the proposed U.S. Digital Asset Stockpile, alongside other major cryptocurrencies like Solana (SOL) and Cardano (ADA). However, this initiative does not involve direct government crypto purchases—only assets acquired through legal proceedings would be part of the reserve. Other possible triggers to the rising XRP FDV include:

Securing Regulatory Approval in the UAE

On March 13, 2025, Ripple announced that it had obtained full regulatory approval from the Dubai Financial Services Authority (DFSA) to offer regulated crypto payment services within the Dubai International Financial Centre (DIFC). This approval positions Ripple as the first blockchain-enabled payments provider licensed by the DFSA, marking a significant milestone in its expansion strategy.

The UAE has emerged as a pivotal market for Ripple, with approximately 20% of its global customer base operating in the Middle East region. The DFSA license enables Ripple to provide enterprise-grade payment solutions in the UAE, aiming to enhance transaction speed, reduce costs, and improve transparency for regional businesses.

Advancements in SEC Litigation

In parallel with its regulatory achievements, Ripple is reportedly nearing a resolution in its ongoing litigation with the SEC. The lawsuit, initiated in December 2020, alleged that Ripple’s sales of XRP constituted unregistered securities offerings. Recent reports indicate that settlement discussions have progressed, with the SEC considering classifying XRP as a commodity rather than a security.

This potential reclassification aligns with a 2023 ruling by U.S. District Judge Analisa Torres, which determined that XRP is not inherently a security, particularly when traded on secondary markets. The ongoing settlement talks are reportedly focused on adjusting the terms of the ruling, including a proposed $125 million fine and modifications to injunctions related to institutional sales of XRP.

Ethereum Faces Headwinds as Solana Gains Ground

While XRP’s FDV surge has positioned it ahead of Ethereum, Ethereum’s market performance has faced challenges. The March 2024 Dencun upgrade, which reduced transaction fees by approximately 95%, has paradoxically led to a slowdown in Ethereum’s price growth as revenue from fees has declined.

Meanwhile, Ethereum’s dominance is facing increased competition from Solana, which has established itself as a leader in high-speed transactions and was central to 2024’s memecoin boom. As of March 2025, Solana’s trading volume rivals that of Ethereum and all of its layer-2 scaling networks combined.

Quick Facts:

- XRP’s fully diluted valuation (FDV) has surpassed Ethereum’s, reaching nearly $235 billion, over $1 billion higher than Ethereum’s FDV.

- XRP has surged by 300% since Donald Trump’s election victory, climbing to $2.3 per token.

- Ripple’s institutional DeFi expansion has accelerated adoption, with over $1 billion in swap transactions processed on XRP’s DEX since 2024.

- Trump’s proposed U.S. Digital Asset Stockpile includes XRP, alongside SOL and ADA.