Bitcoin’s meteoric rise over the past year may be running out of steam, with one veteran commodity strategist predicting a severe correction that could see BTC plummet to $10,000. The warning comes as gold surges past $3,000, global risk sentiment shifts, and speculative bubbles start to show cracks.

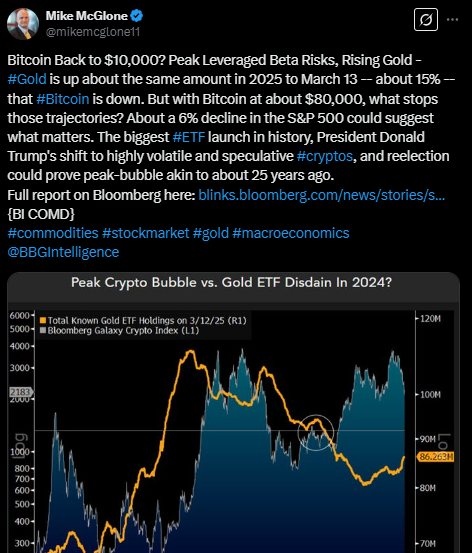

Bloomberg’s Senior Commodity Strategist Mike McGlone believes Bitcoin’s price action resembles previous speculative frenzies, such as the dot-com bubble of the early 2000s. In a March 14 post on X, McGlone pointed to declining liquidity, increasing macro uncertainty, and the inverse relationship between Bitcoin and gold as signs of potential trouble ahead.

Bitcoin Losing Momentum? Key Factors Behind the Bearish Outlook

McGlone argues that Bitcoin’s rally has been overextended and that the current economic landscape does not support continued upside. Among his top concerns:

- Gold vs. Bitcoin: Gold prices have surged 15 percent in 2025, while Bitcoin has fallen by the same percentage. This inverse correlation suggests investors may be pivoting away from risk assets and toward safe-haven investments.

- Macroeconomic Pressures: President Donald Trump’s aggressive trade tariffs have fueled economic uncertainty, leading investors to seek shelter in traditional stores of value like gold rather than volatile assets like Bitcoin.

- Correlation with Equities: Historically, Bitcoin has tracked the S&P 500, which is now struggling under economic strain. A sharp downturn in equities could spill over into the crypto markets.

- Speculative Bubble Concerns: McGlone likens Bitcoin’s record-breaking ETF inflows and retail investor speculation to past market bubbles, hinting at an impending reversal.

Could Bitcoin Really “Lose a Zero”?

In a follow-up post, McGlone warned that Bitcoin could “lose a zero,” suggesting a potential nosedive to $10,000, a level not seen since late 2020. He believes heightened political focus on crypto under Trump could exacerbate volatility, pushing investors further into gold.

While some analysts agree that Bitcoin is facing short-term risks, others remain bullish, arguing that Bitcoin is forming technical patterns that typically precede explosive rallies.

What Does the Chart Say?

Despite the bearish predictions, technical analysts see that Bitcoin could still push toward six figures.

- Pseudonymous analyst Patron noted that BTC broke out of an ascending triangle, a bullish pattern that projects a measured move to $90,405. However, $82,000 is now critical support, and failure to hold could lead to a retest of $80,000.

- TradingShot, a top analyst on TradingView, highlighted a falling wedge pattern, historically a strong buy signal for Bitcoin. His analysis suggests BTC is following a long-term uptrend, mirroring past cycles that resulted in 26 percent to 106 percent breakouts, with upside targets between $96,800 and $150,000.

A Make-or-Break Moment for Bitcoin

Bitcoin is at a crucial juncture. While McGlone’s bearish warning paints a grim picture, other experts see historical precedents for a strong rebound. The next few weeks will determine whether BTC breaks out toward $100,000 or faces a painful correction.

All eyes are now on $82,000 support and $85,000 resistance. The bulls may regain control if Bitcoin can sustain a rally above these levels. But if macro conditions worsen, the crypto market could be in for a volatile ride.