The U.S. Securities and Exchange Commission (SEC) has yet to provide clear guidance on the regulatory status of XRP, Solana (SOL), and Cardano (ADA), despite circulating reports suggesting otherwise. While speculation is growing about how these digital assets could fit into the U.S. financial system under President Donald Trump, crypto lawyer John Deaton has dismissed recent claims that the SEC has acknowledged any specific roles for these cryptocurrencies.

False Reports Claim SEC Defined XRP, SOL, and ADA’s Government Roles

A series of reports surfaced this week suggesting that the SEC had outlined strategic roles for XRP, SOL, and ADA in U.S. government operations. Allegedly, these claims stated:

- XRP would be used for state-level financial transactions, improving interbank liquidity and optimizing government payments.

- Cardano (ADA) was identified for academic credentialing, government smart contracts, and infrastructure security.

- Solana (SOL) would be integrated into high-speed government blockchain applications, including real-time databases, digital identity systems, and secure voting mechanisms.

These assertions quickly gained traction, fueling speculation that the Trump administration is looking to incorporate select altcoins into its broader digital asset strategy.

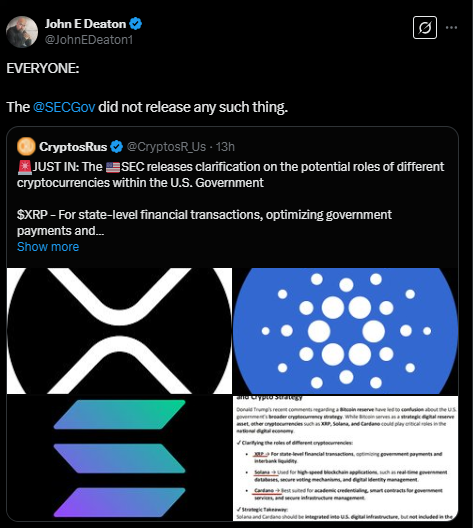

However, John Deaton, a well-known XRP advocate and legal expert, shut down the rumors, stating that no such SEC announcement had been made.

“The SEC did not release any such thing,” Deaton wrote on X, refuting the claims outright.

The So-Called ‘SEC Document’—More Misinformation?

Adding to the confusion, some reports claimed that the SEC had published a document titled “Comprehensive Proposal: XRP as a Strategic Financial Asset for the U.S.” The supposed report suggested that XRP would play a pivotal role in the U.S. financial system, while SOL and ADA would be integrated into government infrastructure but not included in a national reserve strategy.

Some community members later clarified that the so-called SEC document was merely a proposal submitted by a third party and not an official stance from the SEC. This has reinforced the growing issue of misinformation in the crypto space, where unverified claims can easily spread before being fact-checked.

The lack of regulatory clarity surrounding XRP, SOL, and ADA remains a significant issue for investors and institutions. Despite multiple lawsuits and enforcement actions, the SEC has yet to issue definitive guidance on whether these cryptocurrencies should be classified as securities or commodities.

This uncertainty has had a chilling effect on institutional adoption, with companies hesitant to fully integrate these assets into their portfolios until regulatory concerns are addressed. The ongoing legal battle between the SEC and Ripple has only added to this confusion, with the industry closely watching the outcome as a potential precedent for other altcoins.

While the SEC remains tight-lipped, the Trump administration has been vocal about its pro-crypto stance. Following the announcement of the U.S. Strategic Bitcoin Reserve, speculation has intensified about whether other digital assets—including XRP, SOL, and ADA—could eventually find a place in federal financial strategies.

Despite this, without clear regulatory guidance, uncertainty continues to dominate discussions around altcoin adoption at the governmental level.

Community Response

John Deaton’s clarification has been met with appreciation from the XRP and broader crypto community, as it helped debunk misleading reports before they could further impact market sentiment.

This situation also underscores the critical need for regulatory transparency. The SEC’s prolonged silence on altcoin classification is creating an environment where rumors fill the void, leading to market confusion and speculation.

Final Thoughts

As the Trump administration continues its pro-crypto policies, pressure on the SEC to define its stance on major altcoins will likely increase. Whether XRP, SOL, and ADA secure official recognition as strategic financial assets remains uncertain.

For now, crypto investors should remain cautious, verify claims from trusted sources, and continue advocating for clear, definitive regulations to bring stability to the evolving digital asset landscape.