A widening gap between crypto market sentiment and actual fundamentals is creating a prime opportunity for long-term investors, according to BlockTower Capital founder Ari Paul. While short-term traders express growing uncertainty, crypto builders and industry leaders remain more bullish than ever.

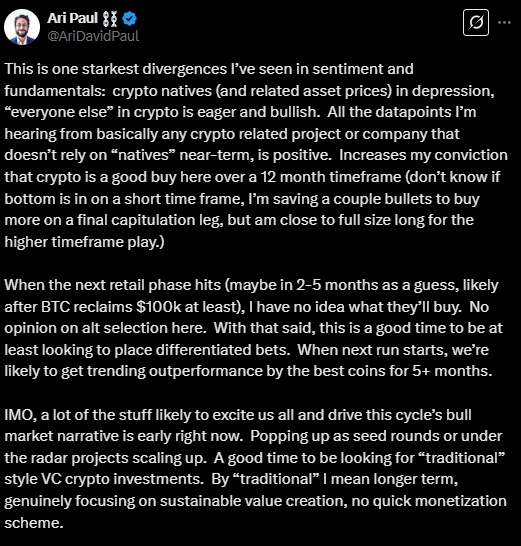

“This is one of the starkest divergences I’ve seen in sentiment and fundamentals,” Paul said in a March 14 X post, signaling that the disconnect could present a major investment opportunity.

Traders Turn Bearish, While Builders Stay Confident

Despite recent market volatility, Paul pointed out that optimism is growing among those focused on building within the crypto ecosystem. He highlighted that companies and projects that are not reliant on short-term market cycles show strong fundamentals.

“All the data points I’m hearing from basically any crypto-related project or company that doesn’t rely on ‘natives’ near-term is positive,” he stated.

Paul believes crypto is a “good buy” over the next 12 months but remains uncertain whether the market has reached a short-term bottom. His sentiment aligns with crypto analyst Matthew Hyland, who said Bitcoin must close a week above $89,000 to confirm a sustained recovery.

Meanwhile, traders saw a brief confidence boost on March 14 as the broader crypto market rose slightly. Bitcoin surged 3.16% to $84,638, while Ether and XRP gained 1.79% and 6.01%, respectively, according to CoinMarketCap. The Crypto Fear and Greed Index jumped 19 points to 46, moving closer to neutral territory but still reflecting market caution.

Bitcoin’s Path Forward

Michael van de Poppe, founder of MN Trading Capital, remains optimistic about Bitcoin’s trajectory, citing the recent price spike as a potential signal of an uptrend forming.

“Clearly made a higher low, clearly touching the highs,” van de Poppe noted in a March 14 X post. “It’s very likely that we’re starting a new uptrend on the lower timeframes going into a good Q2.”

If Bitcoin maintains its current momentum, it could mark a significant turning point for the broader market, reinforcing Paul’s argument that sentiment is disconnected from fundamentals.

A Market Ripe for Sustainable Investments

While many traders remain fixated on short-term price action, Paul sees this as an ideal moment to explore long-term crypto venture capital investments that prioritize sustainable value creation over quick monetization.

“A good time to be looking for ‘traditional’ style VC crypto investments,” Paul said, referring to projects with genuine innovation and long-term utility.

Final Thoughts

The growing divide between sentiment and fundamentals suggests that short-term fear may be obscuring long-term value. If the bullish outlook from industry insiders proves correct, the current uncertainty could present an overlooked opportunity for strategic investors.

As institutional interest in digital assets continues to rise and Bitcoin solidifies its role in the financial system, the market may soon see fundamentals realigning with sentiment, potentially fueling the next major rally.