Bitcoin’s recent price action suggests that the leading cryptocurrency may remain in a consolidation phase for months, according to 10x Research head Markus Thielen. With little evidence supporting a strong recovery, analysts caution investors against expecting a near-term breakout.

Thielen argues that Bitcoin’s chart resembles a “High and Tight Flag” pattern—typically considered bullish—but its structure appears weaker due to the presence of two flags rather than one.

“As a result, the pattern currently suggests market indecision rather than a straightforward bullish consolidation,” he stated in his March 15 market report.

Bitcoin’s price reached an all-time high of $109,000 on December 4th, 2024, fueled by optimism surrounding Donald Trump’s inauguration. Since then, the cryptocurrency has declined by 23%, trading at $84,290 at the time of publication.

This downward trend has raised concerns that Bitcoin may repeat its 2024 trajectory, where it fluctuated within a $20,000 range for most of the year after peaking at $73,679 in March.

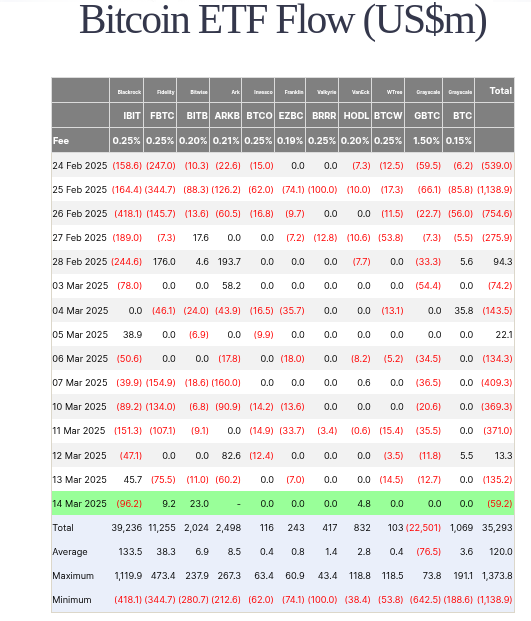

Bitcoin ETFs See Persistent Outflows

A significant factor influencing Bitcoin’s sluggish performance is the lack of strong buying pressure from exchange-traded funds (ETFs). Thielen noted that most inflows into Bitcoin ETFs have been arbitrage-driven, with hedge funds taking advantage of price inefficiencies rather than investing for long-term appreciation.

“Given the persistently low funding rates, there’s little incentive or willingness to deploy additional capital despite the recent price correction,” he explained.

Data from Farside reveals that since March began, U.S. spot Bitcoin ETFs have recorded outflows totaling approximately $1.66 billion. Some of the largest withdrawals have come from major players like BlackRock and Fidelity, signaling weakening institutional demand.

The most significant single-day outflow was recorded on Feb. 25, when Bitcoin ETFs collectively lost $1.13 billion.

Short-Term Price Movements and Key Levels to Watch

Despite the broader consolidation, some traders are eyeing short-term price movements. Crypto analyst Ali Martinez highlighted that Bitcoin is currently forming an ascending triangle, a technical pattern that could indicate an upcoming breakout.

“#Bitcoin $BTC is consolidating within an ascending triangle. A breakout from this pattern could trigger a 9% price move,” Martinez posted. His latest update suggests that Bitcoin is now breaking out, targeting $90,000 as long as the $84,000 support level holds.

Meanwhile, Arthur Hayes, co-founder of BitMEX, warned that Bitcoin could retest the $78,000 level and potentially fall to $75,000 if further selling pressure emerges. Nexo analyst Iliya Kalchev echoed a similar sentiment, stating that the low $70,000 range could provide a stronger foundation for a sustained recovery.

While short-term movements may bring volatility, Thielen remains cautious about predicting a renewed uptrend.

“It may be prudent to close short positions at this stage, although there remains little evidence to support a strong price recovery,” he said.

Bitcoin’s struggle to reclaim its January highs, along with ETF outflows and uncertain market sentiment, suggests a prolonged consolidation phase is increasingly likely. As investors navigate these conditions, key support and resistance levels will determine whether Bitcoin can sustain a recovery or face further declines.