Argentina’s National Securities Commission (CNV) of Argentina, has taken a major step toward regulating the country’s growing cryptocurrency sector by finalizing new virtual asset service provider (VASP) regulations under General Resolution No. 1058, published on March 13. The move aims to enhance transparency, financial stability, and investor protection while addressing concerns about unregulated digital asset activities.

The resolution introduces a mandatory registration requirement for all crypto service providers operating in Argentina. Companies that fail to register with the CNV’s official registry of virtual asset service providers (PSAV) will risk losing their ability to operate in the country. To ensure financial security, the framework also enforces strict separation of user funds from corporate assets to prevent financial mismanagement.

Additionally, crypto firms must conduct annual audits and submit monthly reports to maintain regulatory compliance. The CNV is also mandating cybersecurity enhancements and anti-money laundering (AML) protocols to combat financial crimes associated with digital assets. The final guidelines also include mandatory separation of company and client funds in monthly reporting with the CNV.

To facilitate a smooth transition, the CNV has set compliance deadlines. Individual registrants must meet requirements by July 1, 2025, while domestic crypto firms have until August 1, 2025, to align with the regulations. Foreign companies operating within Argentina have until September 1, 2025. CNV President Roberto E. Silva has emphasized that firms failing to meet these deadlines will not be permitted to continue operations in the country.

Argentina’s Rising Crypto Adoption

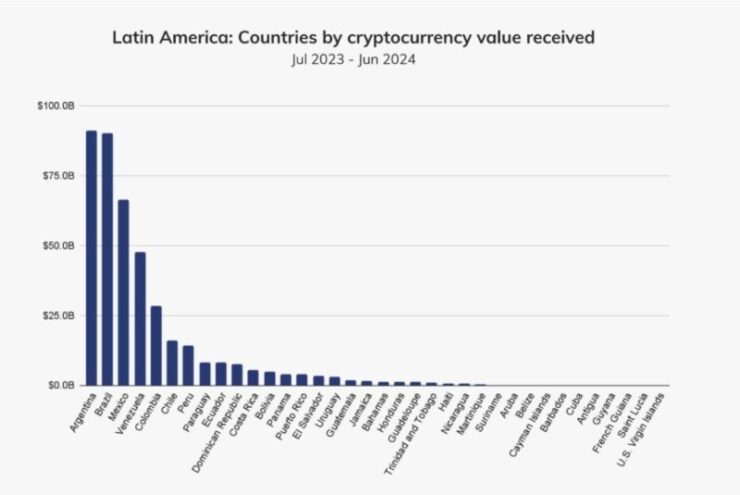

The new regulations come at a time when cryptocurrency adoption in Argentina is at an all-time high, largely due to economic instability and the devaluation of the peso. Between July 2023 and June 2024, Argentina recorded approximately $91 billion in cryptocurrency transactions, surpassing Brazil as the leading crypto market in Latin America. Many Argentines are turning to digital assets as a hedge against inflation, prompting regulators to implement stricter oversight to protect consumers and prevent illicit financial activity.

The urgency for regulation has also been influenced by recent crypto-related controversies in Argentina, most notably the LIBRA memecoin scandal, which has tightly entangled President Javier Milei in a series of lawsuits and fraud accusations. The incident misled investors and fueled public skepticism, reinforcing the need for stronger consumer protections. The CNV’s new rules are designed to establish a more secure and structured framework for Argentina’s booming crypto ecosystem, balancing innovation with regulatory oversight.

Argentina’s Position as a Crypto Regulatory Leader

With these new regulations, Argentina is positioning itself as a leader in Latin American crypto governance, setting a precedent for other nations in the region. While some industry participants have raised concerns about how stringent regulations might impact innovation, many see the CNV’s approach as a necessary step toward establishing trust, reducing fraud, and ensuring long-term stability in the crypto sector.

Quick Facts:

- CNV’s General Resolution No. 1058 introduces mandatory registration, fund segregation, and rigorous reporting requirements for VASPs.

- Compliance Deadlines: Individual registrants by July 1, domestic companies by August 1, and foreign entities by September 1, 2025.

- Argentina’s Crypto Inflows: Approximately $91 billion between July 2023 and June 2024, leading in Latin America.

- Regulatory Objective: Enhance transparency, stability, and user protection in the crypto ecosystem.