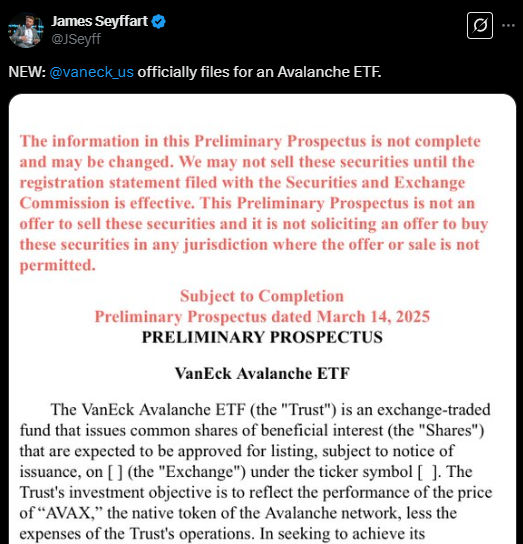

VanEck is making another bold move in the crypto space, filing for an Avalanche (AVAX) exchange-traded fund (ETF) in a bid to expand institutional access to Layer-1 blockchain assets. The asset manager, which was among the first to launch a spot Bitcoin ETF, is now looking to capitalize on the growing interest in Ethereum alternatives.

If approved, the AVAX ETF would be one of the first investment products allowing traditional finance players to gain exposure to Avalanche without directly holding the token. This move signals a potential shift in institutional sentiment, with major firms increasingly looking beyond Bitcoin and Ethereum.

VanEck has been one of the most aggressive traditional firms in expanding its crypto investment products. The firm was an early adopter of Bitcoin ETFs, and it has since filed for Ethereum, Solana, and now Avalanche ETFs.

While Bitcoin and Ethereum ETFs have gained regulatory traction, Layer-1 blockchain assets like AVAX face steeper hurdles. The U.S. Securities and Exchange Commission (SEC) has not approved altcoin ETFs, citing concerns over liquidity, market manipulation, and regulatory clarity.

However, VanEck’s continued push into the space suggests growing confidence that approval is a matter of when—not if.

Why Avalanche?

Avalanche has positioned itself as a high-performance Layer-1 blockchain, offering faster transaction speeds and lower costs compared to Ethereum. The network’s subnet architecture allows enterprises and institutions to launch customized blockchain ecosystems, a feature that differentiates AVAX from other Layer-1 networks like Solana and Ethereum.

Institutional interest in Layer-1 solutions is rising, particularly as firms explore alternative blockchain ecosystems that offer greater scalability. VanEck’s ETF filing could be a major milestone in bringing Avalanche into mainstream finance.

Regulatory Challenges and Market Impact

Despite the growing institutional demand, the regulatory path for an AVAX ETF remains uncertain. The SEC has slowly approved altcoin ETFs, recently delaying decisions on Solana, Litecoin, Dogecoin, and XRP products.

VanEck’s application will likely face heavy scrutiny, particularly given the regulatory uncertainty surrounding Avalanche’s classification as a security or commodity.

Still, approval of an AVAX ETF could open the floodgates for other Layer-1 blockchain ETFs, bringing new liquidity and institutional capital into the sector.

Final Takeaway

VanEck’s move to expand beyond Bitcoin and Ethereum ETFs suggests a growing appetite for diversified crypto exposure. While regulatory hurdles remain, the filing indicates that Layer-1 networks like Avalanche are gaining credibility among institutional investors.

If approved, the AVAX ETF could drive mainstream adoption, offering traditional investors a new way to access the Avalanche ecosystem—and potentially setting a precedent for more blockchain-based ETFs.