A mysterious cryptocurrency trader known for executing high-leverage trades on Hyperliquid is shifting focus to Chainlink (LINK) after previously testing the platform’s liquidity with a massive 50x leveraged ETH bet.

On-chain data shows the trader, dubbed “ETH 50x Big Guy”, has now entered a $31 million leveraged position on LINK, fueling speculation about Chainlink’s next market move.

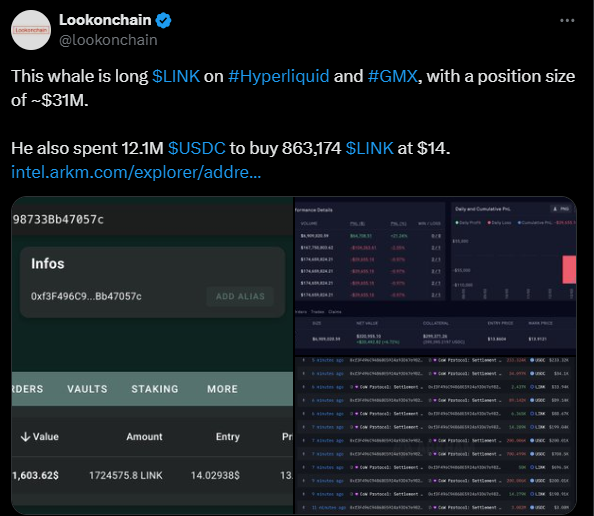

According to Lookonchain, a Web3 analytics platform, the trader opened long positions in LINK worth $31 million with 10x leverage on Hyperliquid and GMX, two of the largest perpetual trading platforms.

Additionally, he accumulated $12 million in spot LINK, reinforcing his bullish outlook on the asset.

However, in the hours following the trade, the whale began offloading portions of his LINK holdings, swapping them back into stablecoins, suggesting either profit-taking or risk management.

This comes just two days after the same trader shook Hyperliquid’s liquidity pool. On March 12, he intentionally liquidated a $200 million ETH long position, leading to a $4 million loss for Hyperliquid’s liquidity providers (HLP)—while personally securing a $1.8 million profit.

Hyperliquid Faces Stress Test

The Hyperliquid incident exposed key vulnerabilities in high-leverage decentralized trading. While the platform initially suffered losses from the whale’s liquidation, Hyperliquid defended the trade, stating it was a legitimate execution within the system’s design rather than an exploit.

In response, Hyperliquid announced new collateral requirements on March 13 to prevent similar incidents in the future. These adjustments strengthen liquidity pools and reduce exposure to traders manipulating liquidation mechanics.

Despite the controversy, Hyperliquid’s market dominance remains strong. A January report from VanEck revealed that Hyperliquid now holds 70% of the decentralized perpetual trading market, surpassing competitors like GMX and dYdX.

What This Means for Chainlink (LINK)

Chainlink’s price has been on a rollercoaster ride since President Donald Trump won the U.S. election, surging over 150% in late 2024 before retracing. Currently, LINK is trading below $14, down significantly from its December highs of nearly $30.

This latest whale activity could signal renewed institutional interest in LINK as the market searches for new narratives and breakout plays. Given that the trader previously executed a high-risk but profitable ETH strategy, his shift toward LINK raises questions about whether he anticipates a major price move.

Final Takeaway

While the whale’s massive LINK bet could indicate bullish sentiment, it also highlights the risks of high-leverage trading on decentralized platforms. The previous ETH liquidation event disrupted Hyperliquid’s liquidity, and whether his latest moves will boost or destabilize LINK’s price action remains to be seen.

Traders should monitor on-chain activity and liquidation levels, as any sudden unwinding of this position could cause short-term volatility for LINK. Whether this is a calculated long-term bet or just another quick flip, all eyes are now on Chainlink’s next move.