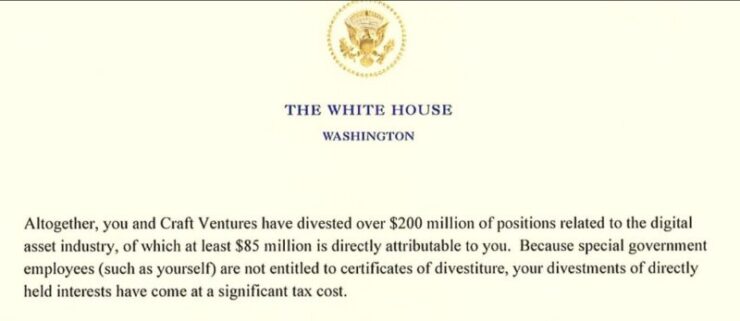

David Sacks, the well-known venture capitalist and a key figure in President Trump’s administration as the AI and crypto czar, has officially divested over $200 million in crypto-related assets to avoid conflicts of interest.

According to a March 5 memo from the Office of Government Ethics, Sacks sold off all his cryptocurrency holdings, including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), before assuming his White House role. Additionally, his firm, Craft Ventures, liquidated stakes in major crypto companies like Coinbase and Robinhood and exited limited partner positions in Multicoin Capital and Blockchain Capital, two of the most influential venture firms in the digital asset space.

Despite these divestments, Sacks and Craft Ventures still hold equity in certain crypto firms, including BitGo (crypto custody) and Lightning Labs (Bitcoin protocol development). These holdings account for roughly 2.5% and 1.1% of Sacks’ total assets, respectively. The government, however, has waived any conflict-of-interest concerns related to these ongoing stakes.

Criticism and Allegations of Favoritism

Sacks’ financial moves have drawn criticism, particularly after Trump announced plans to establish a Strategic Bitcoin Reserve and a national crypto stockpile. Some argue that Sacks could leverage his position to boost his own portfolio, especially after Trump’s early March post suggested that Solana—a cryptocurrency Sacks had previously held—would be included in the federal reserve initiative.

Ryan Grim, a political analyst, labeled the initiative “a direct transfer of wealth from the U.S. Treasury to David Sacks and other crypto barons.” However, Sacks refuted these claims, stating on X that he had completely exited his BTC, ETH, and SOL holdings before taking office.

Senator Warren Calls for Transparency Over David Sacks’ Crypto Holdings

Senator Elizabeth Warren intensified scrutiny on David Sacks over potential conflicts of interest tied to his past crypto investments and influence on government policy decisions.

In a March 6 letter, Warren called for full transparency regarding Sacks’ financial holdings, particularly his prior involvement in digital assets. Her concerns stemmed from allegations that Sacks could benefit from federal crypto policies, despite his claims of having divested his holdings before taking office.

As a ranking member of the Senate Banking Committee, Warren had long pushed for stronger oversight of the crypto industry. In her letter, she urged Sacks to publicly disclose all financial ties to digital assets to prevent undue influence on government decision-making.

Warren also requested that Sacks clarify his status as a “special government employee”, stressing the importance of ensuring policy decisions remained independent from private financial interests. She called on the Office of Government Ethics to review Sacks’ financial disclosures, reinforcing the need for accountability in shaping federal crypto policy.

Crypto Industry Backs Sacks

Several high-profile figures in the crypto industry have come to Sacks’ defense. Cameron Winklevoss, co-founder of Gemini, dismissed the allegations, asserting that Sacks has “zero personal financial gain” from any government crypto policies and is focused solely on advancing the industry in a responsible manner.

Meanwhile, supporters argue that Sacks’ expertise in both fintech and crypto makes him a strong advocate for regulatory clarity, particularly as the U.S. positions itself as a global leader in digital assets. His role in the White House marks a significant shift toward more industry-friendly policies—a stark contrast to the regulatory uncertainty that plagued the sector in previous administrations.

Quick Facts:

- David Sacks and Craft Ventures have divested over $200 million in crypto holdings, including Bitcoin, Ethereum, Solana, and stakes in Coinbase and Robinhood.

- Sacks still holds equity in BitGo and Lightning Labs, but the government has waived concerns over conflicts of interest.

- Trump’s Strategic Bitcoin Reserve sparked controversy, with critics arguing Sacks could benefit financially—a claim he has denied.

- Crypto industry leaders, including Cameron Winklevoss, defended Sacks, stating that his position in the White House will benefit the broader industry rather than any personal holdings.