A new congressional bill seeks to make President Donald Trump’s Strategic Bitcoin Reserve a permanent fixture of U.S. financial policy, preventing future administrations from dismantling it through executive action.

Rep. Byron Donalds, a Florida Republican and vocal crypto advocate, spearheads the legislation, framing it as a decisive move to end what he calls the Democratic “war on crypto.” in a statement to bloomberg. If passed, the bill would formalize Bitcoin’s role in U.S. fiscal strategy, positioning the nation at the forefront of state-backed digital asset adoption.

On March 7, 2025, Trump signed an executive order creating the U.S. Strategic Bitcoin Reserve, mandating that Bitcoin seized in criminal cases and enforcement actions be repurposed as a national financial asset.

Rep. Donalds’ bill aims to cement this initiative into law, ensuring that future presidents cannot eliminate the Bitcoin reserve with a single pen stroke.

“For years, the Democrats waged war on crypto,” Donalds said in a statement to Bloomberg. “Now is the time for Congressional Republicans to decisively end this war.”

With Republicans holding a Senate majority and growing bipartisan interest in crypto policy, the bill stands a realistic chance of passing. Given the shifting political landscape on digital assets, it would require 60 votes in the Senate and a simple majority in the House, a feasible scenario.

The Bigger Picture

This move represents a pivotal moment for crypto regulations in the U.S. If passed, the bill could:

- Provide long-term stability for Bitcoin as a government-held asset, reducing uncertainty for investors.

- Push federal agencies like the SEC and CFTC toward a more unified regulatory framework, resolving ongoing jurisdictional conflicts.

- Set a precedent for future Bitcoin acquisitions by the U.S. government, potentially influencing central bank reserve strategies.

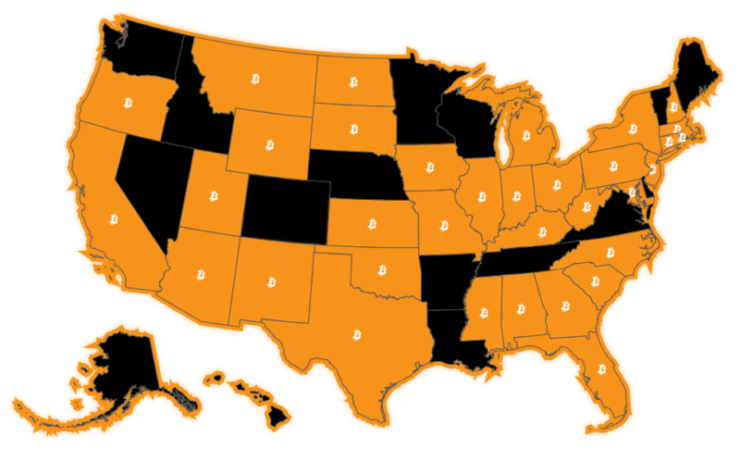

According to BitcoinLaws data, at least 23 U.S. states have already introduced Bitcoin reserve-related legislation, signaling increasing state-level interest in integrating crypto into fiscal policy.

Will the U.S. Government Buy More Bitcoin?

One of the most debated aspects of the Bitcoin reserve is whether the U.S. government will actively acquire more BTC beyond what is confiscated through law enforcement.

Currently, Trump’s executive order only applies to seized Bitcoin. Still, the order allows the Treasury and Commerce Department to develop “budget-neutral” strategies for purchasing more Bitcoin without increasing taxpayer burdens.

If Congress codifies the Bitcoin reserve into law, it could open the door for direct government Bitcoin purchases, a move that would dramatically alter the global financial landscape.

What’s Next?

The legislative push to protect the Bitcoin reserve is more than just a political maneuver, it’s a signal that Bitcoin is being integrated into the nation’s financial future.

- Will Democrats push back against the bill, framing it as financial risk-taking?

- Could this accelerate a wave of pro-crypto legislation at both the federal and state levels?

- How will institutional investors react to Bitcoin being positioned as a strategic reserve asset?

Regardless of the outcome, Bitcoin is no longer just a speculative asset—it’s now a subject of national policy.