A Democratic lawmaker is pushing back against President Donald Trump’s reported plans to establish a Strategic Bitcoin Reserve, calling for the U.S. Treasury to shut down any efforts to build a national crypto stockpile.

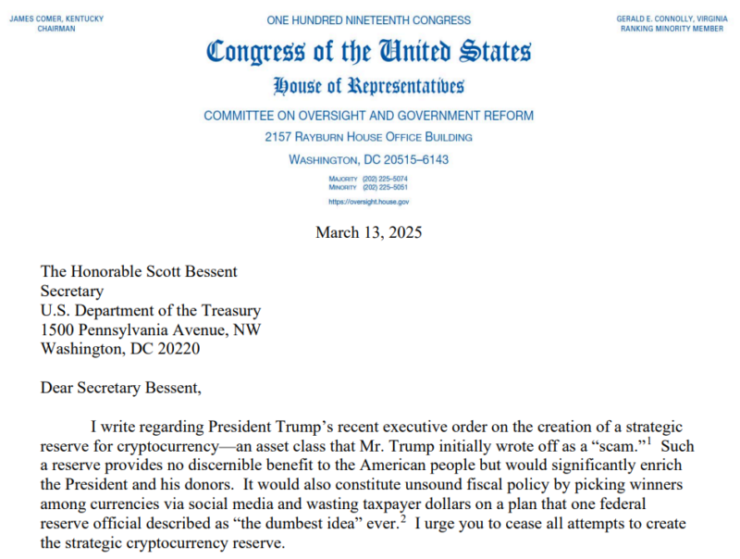

In a March 13 letter to Treasury Secretary Scott Bessent, House Representative Gerald E. Connolly (D-MI) criticized the initiative, claiming it would primarily benefit Trump and his donors rather than the American people.

The congressman raised concerns over fiscal irresponsibility, conflicts of interest, and a lack of congressional approval, escalating political tensions over crypto’s role in the U.S. economy.

Connolly’s letter did not distinguish between Trump’s proposed Strategic Bitcoin Reserve and the Digital Asset Stockpile, instead attacking both as “unsound fiscal policy”. He argued that investing government funds in Bitcoin would distort financial markets, favor certain cryptocurrencies over others, and waste taxpayer dollars on speculative assets.

“Such a reserve provides no discernible benefit to the American people but would significantly enrich the President and his donors. Connolly wrote.

The congressman went further, citing an unnamed Federal Reserve official who reportedly called Trump’s proposal “the dumbest idea ever”. He suggested that the administration’s plan was simply a “taxpayer-backed hedge” to reassure Bitcoin speculators that the government would intervene in a market crash.

White House Defends Crypto Stockpile Plan

Despite the criticism, the White House has maintained that the Digital Asset Stockpile will only hold confiscated cryptocurrency, while the Bitcoin reserve will be funded through budget-neutral strategies that do not impact taxpayers.

The administration’s goal, it claims, is to manage forfeited digital assets more effectively and establish a structured reserve for Bitcoin without direct government purchases.

Connolly also raised potential conflicts of interest between Trump’s crypto policies and his business holdings, particularly the Trump Organization’s ownership of the crypto platform World Liberty Financial and its connections to the Official Trump (TRUMP) memecoin.

He accused the former president of using the memecoin to rake in over $100 million in trading fees, calling it “Trump’s most lucrative get-rich scheme yet”.

Rep. Maxine Waters (D-CA) echoed similar concerns earlier this year, accusing Trump of “the worst of crypto” and comparing his memecoin to a rug pull.

Congress Demands Transparency from Treasury

Connolly has formally requested that the Treasury provide:

- All communications related to the Bitcoin reserve initiative

- A full list of measures taken to avoid conflicts of interest

- A disclosure of any Treasury holdings in crypto-related assets

- Clarifications on whether the Presidential Working Group on Digital Asset Markets has reviewed financial disclosures from administration officials, including Elon Musk

The congressman also demanded a list of non-Bitcoin assets that may be included in the Digital Asset Stockpile, such as XRP, Solana (SOL), Cardano (ADA), and Ethereum (ETH).

Crypto Becomes a Partisan Battleground

The growing divide over crypto policy reflects broader partisan tensions, with Democrats generally taking a more skeptical stance on digital assets. Meanwhile, Trump has positioned himself as crypto-friendly, with supporters touting Bitcoin’s potential role in strengthening U.S. financial sovereignty.

With crypto regulation emerging as a key political issue ahead of the 2024 elections, the outcome of this policy battle could shape the role of digital assets in the U.S. economy for years to come.

Will Trump’s Bitcoin reserve plan survive political opposition, or will regulatory hurdles derail it? The fight over crypto’s place in government is only just beginning.