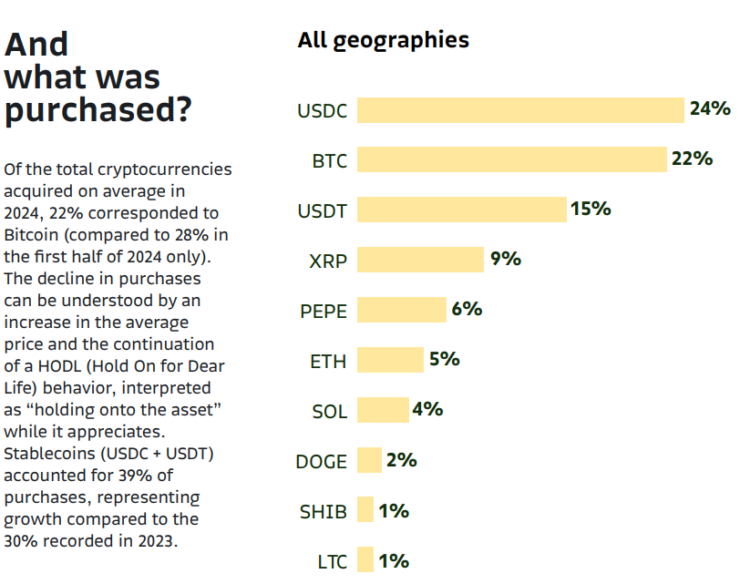

Latin America’s economic uncertainty is driving a surge in stablecoin adoption, with USDC and USDT becoming preferred financial safe havens. According to Bitso’s latest report, stablecoin purchases accounted for 39% of total crypto acquisitions on its platform in 2024, outpacing Bitcoin in some regions.

With inflation skyrocketing and local currencies losing value, more individuals and businesses are turning to stablecoins—not just for trading but as a store of value, cross-border payments, and remittances. Is this the beginning of a financial shift in the region?

Bitso’s Latin America Crypto Landscape report, released on March 12, highlights a 9% rise in stablecoin purchases compared to 2023. The report attributes this increase to macroeconomic instability, where stable assets pegged to the U.S. dollar provide a financial cushion against currency devaluation.

“In Latin America, challenging macroeconomic conditions, characterized by high inflation and currency devaluations, drove increased cryptocurrency adoption, particularly stablecoins — as a reliable store of value,” Bitso stated.

Argentina, a country battling triple-digit inflation, is leading the trend. 50% of all crypto purchases in the country were made in USDT, while USDC accounted for another 22%, making stablecoins the go-to financial instrument for everyday transactions.

Bitcoin Takes a Backseat as Investors HODL

While stablecoin adoption surged, Bitcoin’s share in Bitso’s total trading volume declined to 22% in 2024 from 38% in late 2023. Analysts suggest this isn’t due to a loss of faith in BTC but rather a shift in investment strategy.

With Bitcoin surpassing $100,000 in December 2024, many investors opted to hold rather than trade, anticipating further long-term price appreciation. The “HODL” mindset is gaining traction, reinforcing Bitcoin’s reputation as digital gold rather than a day-to-day financial instrument.

Bitso’s report also highlighted differences in crypto preferences across Latin America.

- Argentina: Stablecoins dominate, with USDT leading at 50% and USDC at 22% of all crypto purchases. Bitcoin, by contrast, accounts for just 8%, reflecting a preference for dollar-pegged assets amid an unstable economy.

- Brazil & Mexico: Bitcoin remains the most purchased asset, accounting for 22% and 25% of transactions. Unlike Argentina, these countries are experiencing more measured inflation, allowing Bitcoin to maintain its position.

Are Stablecoins Challenging Traditional Banking?

The shift toward stablecoins as a store of value suggests a growing disillusionment with traditional banking systems in Latin America. With restrictive financial policies, capital controls, and banking limitations, many citizens are turning to crypto-backed alternatives that provide stability, accessibility, and ease of cross-border transactions.

Moreover, stablecoin remittances are rising. As families receive payments in USDT or USDC, they avoid bank fees and unfavorable exchange rates, ensuring greater financial security.

What’s Next?

The growing dominance of stablecoins in Latin America signals an economic transformation. As inflation persists and traditional financial systems struggle, stablecoins could become a mainstream financial instrument for savings, payments, and everyday transactions.

However, regulatory uncertainty remains a key challenge. Governments may seek to impose restrictions on stablecoin usage, fearing a loss of control over monetary policy. If regulatory clarity emerges, Latin America could become a global leader in stablecoin adoption, bridging the gap between traditional finance and digital assets.

For now, USDT and USDC continue to gain ground, offering millions in the region a hedge against economic instability. The question is: Will this trend reshape Latin America’s financial future?