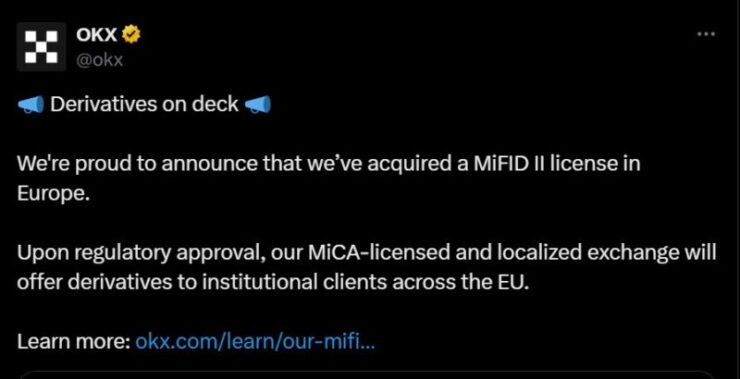

OKX Europe has acquired a MiFID II-licensed firm in Malta, marking a significant step toward offering regulated derivatives products across Europe.

This strategic move positions OKX to expand its institutional services within the European Economic Area (EEA), including all 27 EU member states, Iceland, Liechtenstein, and Norway.

Although the exchange did not disclose the name of the acquired firm, it confirmed that operations under the MiFID II license will commence later this year, pending final approval from the Malta Financial Services Authority (MFSA).

With this regulatory framework, OKX will offer a suite of compliant derivatives products tailored for institutional investors, further integrating traditional financial standards with the growing crypto market.

MiFID II (Markets in Financial Instruments Directive) is a European financial regulation that sets strict standards for investment services, ensuring greater transparency and investor protection.

By securing a MiFID II license through this acquisition, OKX gains a stronger foothold in the European financial sector, allowing it to offer regulated investment services tied to cryptocurrencies and digital assets.

With Europe emerging as a key market for institutional crypto adoption, OKX’s latest move aligns with its long-term vision of bridging traditional finance and digital assets under a clear regulatory framework.

Malta, often called the “Blockchain Island,” has been at the forefront of crypto-friendly regulations, making it an ideal location for OKX to expand its institutional offerings.

Why This Acquisition Matters for OKX

OKX has been actively securing regulatory approvals across multiple jurisdictions, particularly in Europe, where MiCA (Markets in Crypto-Assets) regulations are set to reshape the digital asset industry. By acquiring a MiFID II-compliant company, OKX positions itself ahead of regulatory changes, ensuring it can offer crypto-related financial products with full compliance.

The acquisition also enables OKX to expand its services beyond traditional exchange operations, opening doors to regulated investment products, derivatives trading, and structured financial offerings. This strategic positioning allows OKX to attract institutional investors seeking a compliant and secure gateway into the crypto market.

Institutional Crypto Expansion in Europe

OKX’s latest acquisition reflects a larger trend of institutional players doubling down on crypto-friendly regulatory frameworks in Europe. With MiCA regulations taking shape, exchanges are racing to secure proper licensing to maintain their European operations and tap into the growing institutional demand.

Competitors like Binance, Coinbase, and Kraken have expanded their presence in Europe by acquiring licenses, setting up regional headquarters, and enhancing compliance measures.

This recent upsurge in the demand for expansion into European core areas is a pointer to the increased demand for digital asset products by the growing young population in Europe, who are beginning to use bitcoin and cryptocurrencies as a hedge against ongoing global economic uncertainties.

With this proliferation in demand, regulatory approval is becoming a key differentiator for companies aiming to gain mainstream acceptance and long-term viability.

Quick Facts:

- OKX has acquired a MiFID II-licensed investment firm in Malta as part of its European expansion strategy.

- MiFID II compliance allows OKX to offer regulated investment services tied to cryptocurrencies.

- The move aligns with increasing institutional demand for crypto assets in Europe, as regulatory clarity improves.

- Competitors like Binance, Coinbase, and Kraken also secure European licenses, highlighting a broader shift towards regulated crypto services.