A massive Chainlink (LINK) sell-off by a whale has sparked fresh debate in the crypto market, raising concerns about investor sentiment. Despite the significant liquidation, LINK’s price has remained resilient, even posting slight gains. This latest development has traders questioning whether this is a routine profit-taking move or an early signal of an impending downturn.

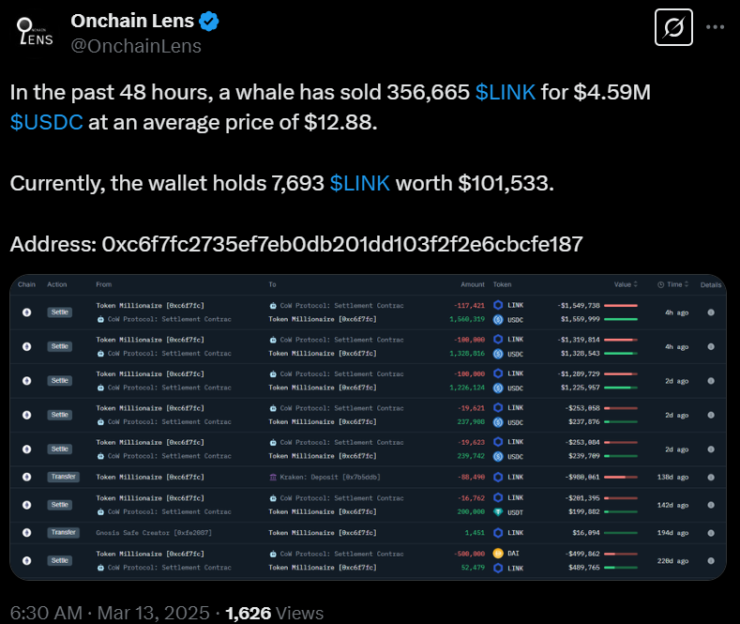

On-chain data from Onchain Lens revealed that a whale dumped 356,665 LINK, worth approximately $4.59 million, at an average price of $12.88. The transaction from wallet address 0xc6f7f has drawn attention due to its timing—coming amidst a broader market cooldown.

Historically, large-scale sell-offs from whales are seen as bearish indicators. They often suggest a lack of confidence in short-term price movements, prompting caution among retail traders. However, despite offloading a substantial amount, the whale still retains 7,693 LINK (worth roughly $101,533), implying they may be hedging their bets rather than fully exiting the market.

Market Reactions and Broader Crypto Trends

Despite the whale’s move, LINK has defied expectations, posting a 2% intraday gain and currently trading around $13.15. The token bottomed at $12.82 and peaked at $13.77 within the past 24 hours, aligning with the broader market’s slight recovery.

The market’s resilience coincides with the release of U.S. CPI data, which indicated a cooling inflation rate. This has tempered investor concerns, preventing a larger sell-off in Bitcoin (BTC) and major altcoins. However, uncertainty remains—will LINK maintain this momentum, or is the whale’s move an early warning of a deeper correction?

Despite the whale sell-off, some analysts remain bullish. Bitcoin Buddha, a well-known market analyst, suggested on X that LINK is recovering after testing the $12 support level, potentially paving the way for a rally.

Technical indicators support this outlook. A bullish engulfing pattern has formed on LINK’s weekly chart, which historically signals strong buying momentum. A report from CoinGape further suggests that if LINK can hold its key support zone between $6 and $9, a surge to $45 remains within reach.

What’s Next for LINK?

While the whale’s sell-off raises questions, it hasn’t derailed LINK’s upward trajectory—at least not yet. The token’s price action in the coming days will be crucial. If LINK can maintain support above $12.50, bulls may regain control. However, further whale sell-offs or macroeconomic shifts could introduce downside risks.

Investors should watch on-chain movements closely, as well as broader market conditions, to gauge whether this is a temporary shake-up or the beginning of a larger trend shift.