Global financial markets experienced a notable uptick following Ukraine’s agreement to a U.S.-proposed 30-day ceasefire in its ongoing conflict with Russia. This development, coupled with a de-escalation in U.S.-Canada trade tensions, has bolstered investor sentiment, leading to significant gains across various asset classes, including cryptocurrencies.

On March 11, 2025, Ukraine consented to a 30-day ceasefire proposed by the United States, aiming to halt the hostilities that have persisted for nearly three years. While awaiting Russia’s formal response, the announcement has already instilled optimism in global markets. In anticipation of reduced geopolitical risks, major stock indices reversed earlier losses, with U.S. markets shifting from negative to positive territory.

“Ukraine expressed readiness to accept the U.S. proposal to enact an immediate, interim 30-day ceasefire, which can be extended by mutual agreement of the parties, and which is subject to acceptance and concurrent implementation by the Russian Federation,” The Ukranian Government said in the release

The cryptocurrency market responded positively to the geopolitical developments, with Bitcoin (BTC) surging past the $83,000 mark—a significant milestone reflecting renewed investor confidence. This surge further exemplifies Bitcoin’s sensitivity to macroeconomic and geopolitical events, as investors often view it as a hedge against traditional market fluctuations.

Easing U.S.-Canada Trade Tensions

Contributing to the positive market sentiment, Ontario Premier Doug Ford agreed to suspend a 25% electricity export surcharge previously imposed on several U.S. states. This move alleviated concerns over escalating trade disputes between the U.S. and Canada, further enhancing investor confidence and supporting market gains.

The temporary suspension of the electricity surcharge marks a positive step as it opens the door for more comprehensive negotiations addressing various trade issues, including tariffs on steel, aluminum, and other commodities. Both nations have expressed a willingness to engage in dialogue, aiming to restore and strengthen their historically robust economic partnership.

Broader Market Performance

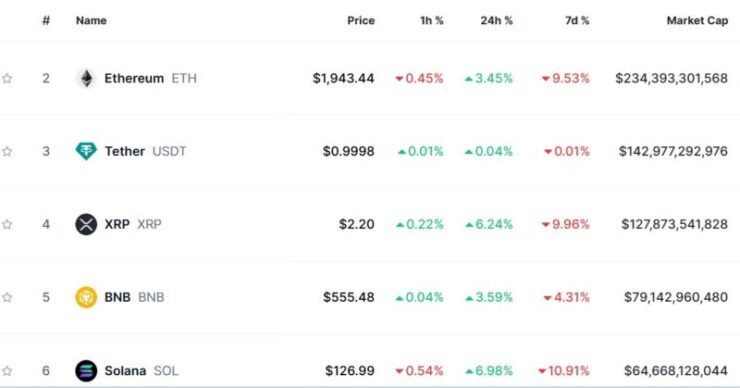

The cryptocurrency market responded positively to these recent geopolitical and trade developments, with major assets surging over the last 24 hours. Bitcoin led the rally, climbing 4.38% to $83,300 as investors reacted to the Ukraine ceasefire and the de-escalation of the U.S.-Canada trade tensions.

Ethereum followed suit, gaining 3.59% to trade at $1,938.22. Among altcoins, Solana saw the biggest gains, jumping 6.49% to $126.60. The high-performance blockchain has maintained strong investor interest despite market volatility. Cardano and Dogecoin recorded strong rallies, climbing 5.75% and 5.69% respectively. BNB also showed a solid recovery, trading up 3.58% at $555.96. Binance’s native token has remained resilient, with increasing use cases within its exchange ecosystem and DeFi projects contributing to its market strength. Overall, If market conditions remain favorable, Bitcoin’s sustained movement above $83K could set the stage for further rallies across altcoins.

Quick Facts:

- Ukraine has agreed to a 30-day ceasefire proposed by the United States, awaiting Russia’s formal response.

- Ontario’s Premier suspended a 25% electricity export surcharge to U.S. states, reducing trade friction.

- Bitcoin surged past $83,000 as investors responded positively to easing geopolitical risks and trade tensions.

- The cryptocurrency market rebounded strongly, with major assets posting gains amid renewed investor confidence.