Solana’s blockchain revenue has plummeted by 93% over the past two months, while its total value locked (TVL) in decentralized finance (DeFi) has fallen by nearly half. The decline follows the waning hype around memecoins, which had fueled a record surge in network activity earlier this year.

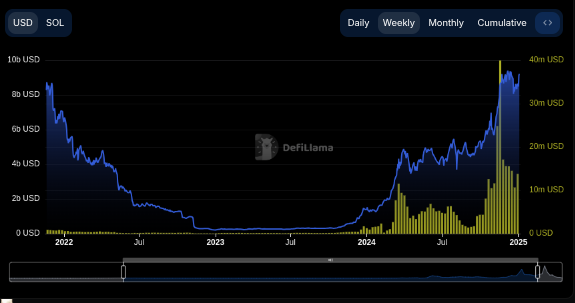

At its peak in mid-January, Solana’s weekly network revenue reached $55.3 million, driven by a frenzy of memecoin minting. Since then, revenue has nosedived to around $4 million, levels last seen in September, according to DefiLlama data.

Decentralized application (DApp) revenue has also dropped 86%, from $238 million to $32 million in the same period. Meanwhile, Solana’s TVL has fallen from over $12 billion in January to approximately $6.4 billion.

A major factor in Solana’s rise and fall has been memecoin trading, which accounted for about 80% of its revenues, according to a March 5 report by VanEck. Pump.fun, the most active platform for memecoin creation, saw daily revenue peak at $15 million in late January before crashing 95% to $800,000 by March 7, per Dune Analytics data.

The surge in memecoin activity reached its height when former President Donald Trump launched his token (TRUMP) on January 18, followed by his wife Melania’s token (MELANIA) two days later. “The launch of TRUMP and MELANIA marked the top for memecoins as it sucked liquidity and attention out of all the other cryptocurrencies,” said Bobby Ong, co-founder of CoinGecko, on March 6.

Both tokens saw brief spikes before collapsing. TRUMP has fallen 86% from its peak to $10.50, while MELANIA has plunged 95% in just seven weeks to $0.71. The broader memecoin market cap has suffered a 68% decline, dropping from its December peak of $137 billion to $44 billion, according to CoinMarketCap.

Solana’s Price Faces Pressure

Alongside revenue and TVL declines, Solana’s native token, SOL, has suffered a steep drop, falling 58% from its mid-January all-time high of $293 to $123. On Monday, SOL hit a seven-month low of $115, posting a 24.5% loss over five days.

Major liquidations exacerbated the drop. Over the past week, bears deployed $730 million in leveraged short positions, significantly outpacing $93.6 million in long positions, per Coinglass data. Solana lost key support levels at $125 and $120, leading to $174 million in long contract liquidations over the weekend.

“Solana has been on a consistent losing streak since March 5,” said a derivatives analyst. The data suggests SOL could drop further, with the next significant support level at $99.

Another factor weighing Solana’s price has been token unlocks from the FTX bankruptcy estate. Since March 1, 11.16 million SOL tokens have been released, increasing market supply and creating downward pressure on the price. “The FTX estate’s unlock schedule was actually already priced in to a certain extent, but the sentiment remains negative,” said Matthew Nay, a research analyst at Messari.

Macroeconomic conditions have also contributed to the sell-off. Concerns over Trump’s proposed trade tariffs and global inflation have hit risk assets. The combination of external pressures and Solana-specific factors has led to deeper losses than other major cryptocurrencies like XRP and Ethereum.

The decline in memecoin activity is evident in Pump.fun’s usage metrics. The platform’s daily fees have plummeted 99% from a January peak of $15.5 million to just $117,000 on March 10. Daily active addresses have also halved from 290,000 to 146,000.

While Pump.fun has generated nearly $585 million in cumulative revenue since its launch last year, predictions suggest it may struggle to exceed $615 million by the end of the month.

Despite the downturn, some analysts believe Solana could recover. “Solana had a meme coin summer, and we saw all the tokens that launched generating incredible revenue numbers,” said Nay. “I think that’ll always be there within crypto.” However, he noted that interest in Solana may continue to cool in the short term.

Looking ahead, Solana’s future will depend on whether it can sustain demand beyond memecoins. With sentiment weak and technical indicators still bearish, investors remain cautious about a potential rebound.