The US Senate Banking Committee is set to vote on a Republican-led stablecoin framework bill on March 13, marking a crucial moment for stablecoin regulation in the United States.

Dubbed the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, the bill, introduced by Senator Bill Hagerty, has undergone key updates following bipartisan consultations. The outcome of this vote could have significant implications for stablecoin issuers, foreign competitors, and the broader crypto market.

The revised bill introduces stricter regulations for stablecoin issuers, particularly those operating in the US vs. foreign markets.

Major Provisions of the Bill

- Federal Reserve Oversight for Large Issuers – Stablecoins with a market cap over $10 billion, such as Tether (USDT) and Circle’s USDC, would be regulated under Federal Reserve supervision.

- State-Level Regulation for Smaller Issuers – Stablecoins under $10 billion could opt for state-level oversight, allowing smaller players more regulatory flexibility.

- Tighter Rules for Foreign Stablecoin Issuers – The bill imposes strict reserve, liquidity, and compliance standards on non-US stablecoin issuers, potentially making it difficult for them to operate in the American market.

- Enhanced Consumer Protections – The updated version strengthens insolvency protections, risk mitigation measures, and transparency requirements for issuers.

Senator Kirsten Gillibrand, a Democratic co-sponsor, stated that the bill introduces “significant improvements” to ensure consumer safety and regulatory clarity.

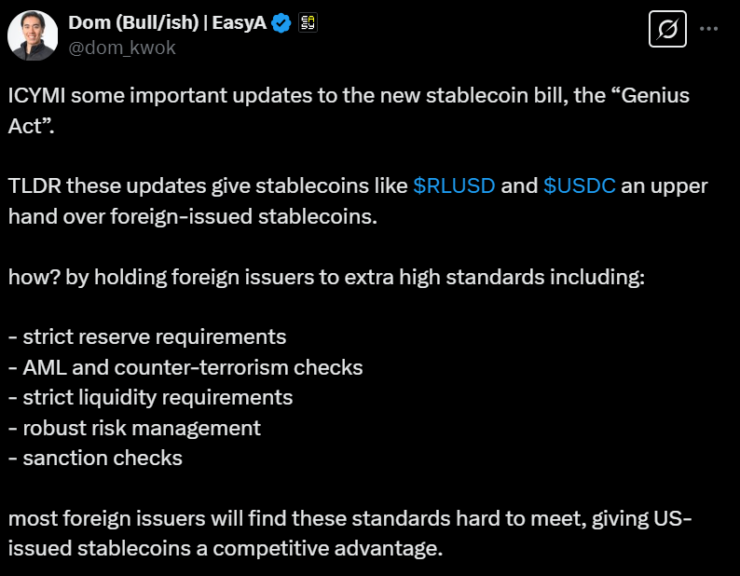

US-Based Stablecoins Gain a Competitive Edge

The biggest takeaway from the bill’s revisions? US-issued stablecoins could gain a massive advantage over foreign competitors.

Dom Kwok, co-founder of Web3 learning app EasyA, noted that the updated GENIUS Act favors US-based stablecoins like USDC and Ripple Labs’ Ripple USD (RLUSD) by setting higher regulatory barriers for non-US issuers.

- Foreign stablecoins will face extreme scrutiny on reserve management, liquidity thresholds, anti-money laundering (AML) policies, and sanctions compliance.

- Crypto lawyer Jeremy Hogan echoed this view, stating that “most foreign issuers will find these standards hard to meet”, effectively giving USDC and RLUSD an upper hand in the market.

This move aligns with broader US efforts to regain dominance in the global stablecoin market, where Tether (USDT) currently leads with a $100 billion market cap.

The March 13 Senate Banking Committee vote is just the first step.

If the bill clears committee, it will proceed to the full Senate for debate and voting. If passed, it must survive the House of Representatives, where modifications could be introduced.

- If both chambers approve the bill without changes, it will go directly to President Donald Trump for approval or veto.

- If the House alters the bill, further negotiations will be required before it reaches the president’s desk.

The Bigger Picture

The GENIUS Act represents a pivotal moment in US crypto regulation. A clear federal framework for stablecoins could boost investor confidence, attract institutional adoption, and establish the US as a global leader in digital asset stability.

However, if overly restrictive rules deter foreign competition, it could reduce stablecoin diversity and increase reliance on US-backed digital dollars, potentially consolidating power among a handful of domestic issuers.

For now, all eyes are on the Senate Banking Committee’s decision. The outcome could set the stage for the next chapter of stablecoin regulation—and reshape the digital currency landscape for years to come.