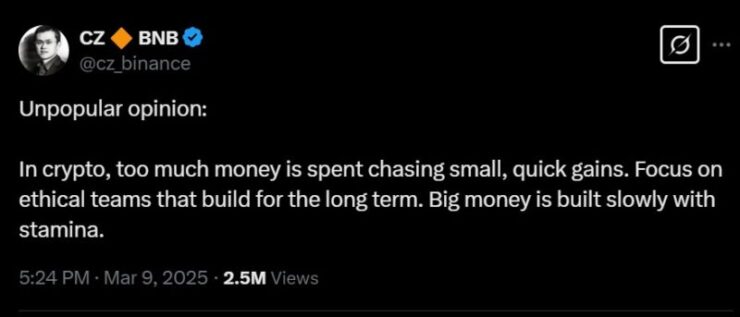

Binance founder Changpeng “CZ” Zhao has spoken out against the short-term profit-driven mindset that dominates much of the cryptocurrency industry. In a recent X post, CZ called attention to the unsustainable nature of speculative investments, urging the crypto community to prioritize ethical, long-term projects over quick cash grabs.

Unpopular opinion:

In crypto, too much money is spent chasing small, quick gains. Focus on ethical teams that build for the long term. Big money is built slowly with stamina.” CZ wrote.

His comments reflect a deep, shared concern that resonates in the mind of most crypto OG’s who have been in the space for a while and built great products from scratch. The feeling has been mutual among them about the instability of altcoins, particularly celebrity-peddled Memecoins, which often experience hype-driven surges followed by steep crashes, leaving investors with massive losses.

The Risk of Speculative Crypto Mania

The cryptocurrency industry has long been associated with rapid wealth accumulation, attracting traders eager for quick returns. However, CZ argues that this mentality weakens the overall stability of the market and stifles true blockchain innovation.

The dangers of short-term speculation are well-documented. Many projects that lack real-world utility manage to gain temporary traction through excessive hype, only to collapse once interest fades. This cycle of unsustainable growth and market crashes damages the industry’s credibility and deters institutional investors from fully embracing crypto as a legitimate asset class.

While the crypto space remains volatile, some projects have withstood the test of time by staying true to their core missions. Ethereum, Ripple, and Cardano are often cited as examples of slow, steady growth, where development is focused on long-term usability rather than short-term market movements.

These tried-and-tested blockchain networks continue to evolve with meaningful updates and improvements, proving their legitimacy as long-term investments. CZ’s remarks suggest that for the industry to mature, more investors should shift focus from hype cycles like the ongoing Memecoin trend to projects that offer real-world value and technological advancements.

Memecoin Volatility and Rug Pulls

The memecoin market has been particularly susceptible to volatility and fraudulent schemes. In 2024, investors lost over $500 million to memecoin rug pulls and scams, according to a report by Merkle Science. Notable incidents include the $HAWK token, launched by internet personality Haliey Welch (Hawk Tuah Girl), which soared to a $490 million market cap before plummeting amid accusations of a pump-and-dump scheme. Similarly, the $MOTHER memecoin, associated with Australian rapper Iggy Azalea, reached hundreds of millions in market cap but later experienced significant losses.

Quick Facts:

- Binance founder CZ criticizes the crypto industry’s focus on short-term gains, urging attention to ethical, long-term projects.

- According to CZ, Short-term investment strategies contribute to market instability and hinder blockchain innovation.

- In 2024, over $500 million was lost to memecoin rug pulls and scams, highlighting the risks of speculative investments.