The cryptocurrency industry, valued at over $1 trillion, has experienced explosive growth in recent years, with Bitcoin alone seeing a meteoric rise from under $1,000 in 2017 to surpassing $60,000 in 2021. Regulatory rules have made it hard for cryptocurrency companies to grow because they leave banks unsure about working with them without facing penalties. This has slowed innovation and made it tough for people to use crypto easily.

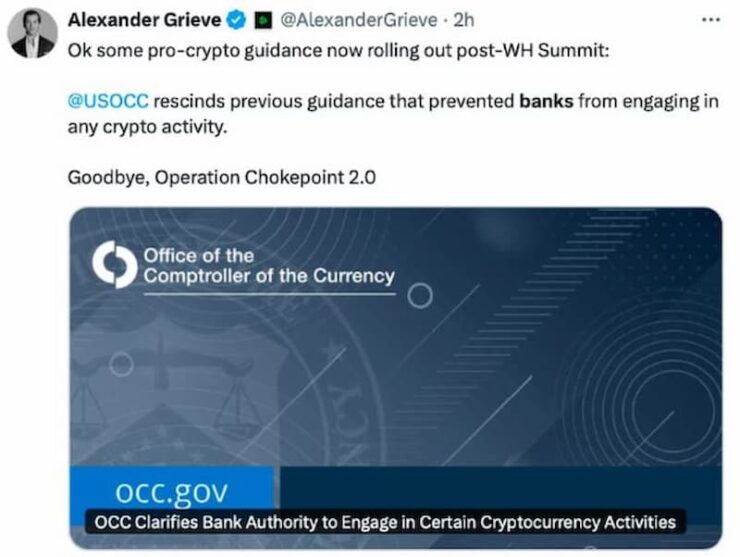

To fix this, the OCC has created clear guidelines to help banks and crypto companies work together without fear. This change supports Donald Trump’s promise to end unfair restrictions and aims to make the financial system more open, fair, and supportive of new ideas.

This decision not only empowers banks and crypto firms but also fosters the mainstream adoption of digital assets by addressing long-standing regulatory obstacles.

New Crypto Banking Guidelines

The OCC’s new guidelines explain how banks and cryptocurrency companies can work together without fear of breaking unclear rules or facing penalties. Before this, banks were hesitant to partner with crypto businesses because they didn’t know how to do it safely.

These guidelines give a clear set of rules, making it easier for banks to support crypto without getting into trouble as long as they follow safety practices. This change creates a safer and more stable way for banks and crypto companies to collaborate. It also boosts innovation while protecting both businesses and their customers in this growing industry.

Trump And The Fight Against Operation Chokepoint 2.0

Operation Chokepoint 2.0 had created barriers for crypto-focused companies, restricting their access to banking services. Trump targeted this controversial practice, claiming it hindered innovation and economic freedom.

His administration viewed the crackdown as government overreach, negatively impacting entrepreneurs and small businesses involved in crypto. The OCC’s latest move signals the dismantling of those restrictions while fostering collaboration between traditional finance and emerging technologies.

Why This Matters For The Crypto World

This is a big step forward for cryptocurrencies to become part of everyday banking. The new rules make it safe and clear for banks to work with crypto companies without worrying about breaking unclear regulations. This means banks can now welcome cryptocurrency customers with more confidence.

Businesses using digital currency and blockchain are anticipated to expand and innovate more quickly with this backing. This also means that individuals can utilize and handle digital assets like Bitcoin in simpler and safer ways. In general, this improvement makes cryptocurrencies safer and more widely available, which helps them become accessible to everyone.