The memecoin frenzy has taken a massive hit, with trading volumes plunging and investor sentiment cooling, but analysts suggest that the sector isn’t dead but just entering a new phase of evolution.

According to CoinGecko founder Bobby Ong, a string of failed launches, insider-dominated projects, and rug pulls have drained liquidity and enthusiasm from the market. However, history suggests a few strong players could survive and even thrive in future market cycles.

Memecoins were one of the hottest sectors in late 2024, reaching an all-time high of $124 billion in total market capitalization on Dec. 5. However, that figure has since dropped to $54 billion, as speculative interest fades and traders refocus on Bitcoin (BTC), Ethereum (ETH), and other established assets.

Ong highlights two key events that accelerated the memecoin downturn:

- The Launch of Trump and Melania Memecoins (Jan. 18, 2025)

- These high-profile launches soaked up liquidity and attention, drawing funds away from other memecoins.

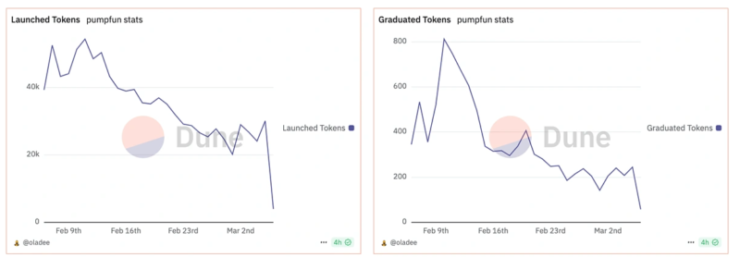

- While Pump.fun hit an all-time high of $3.3 billion in weekly trading volume, activity plummeted 63% from January to February.

- The Libra Memecoin Rug Pull (Feb. 2025)

- Promoted as a cryptocurrency tied to Argentine President Javier Milei, LIBRA saw insiders cash out $107 million before the token collapsed by 94% in hours.

- This shattered confidence in the memecoin sector, exposing how insiders and early investors often benefit at the expense of retail traders.

Following these events, Pump.fun’s token launch metrics dropped by over 90%, marking a steep decline in new token interest.

“If the launch of Trump and Melania memecoins wasn’t enough to end the mania, LIBRA was the final nail in the coffin,” Ong stated.

Are Memecoins Dead or Just Resetting?

Despite the downturn, Ong believes that memecoins have always been seasonal, with certain tokens standing the test of time while most fade into obscurity.

He predicts an “extreme case of power law”, where 99.99% of memecoins fail while a select few emerge as dominant long-term assets.

Ong points to Dogecoin (DOGE), Shiba Inu (SHIB), and BONK as examples of tokens that have survived market cycles.

“The most successful memes are those that have managed to build cult-like communities,” he said.

These projects have thrived by:

- Fostering passionate, engaged communities that resist selling pressure.

- Creating strong narratives and viral content that drive organic growth.

- Developing unique ecosystems or partnerships that extend their utility beyond speculation.

What’s Next for Memecoins?

With the crypto market shifting toward Bitcoin, Ethereum, and Layer-1 altcoins, memecoins are entering a more selective phase.

According to Santiment, this shift could signal a “healthier market cycle”, where stronger projects survive while low-effort cash grabs fade.

The future of memecoins will likely depend on community strength, innovation, and evolving market sentiment.

While the memecoin gold rush may be over, history suggests that narratives shift quickly in crypto and it may only be a matter of time before another viral token captures investor attention.