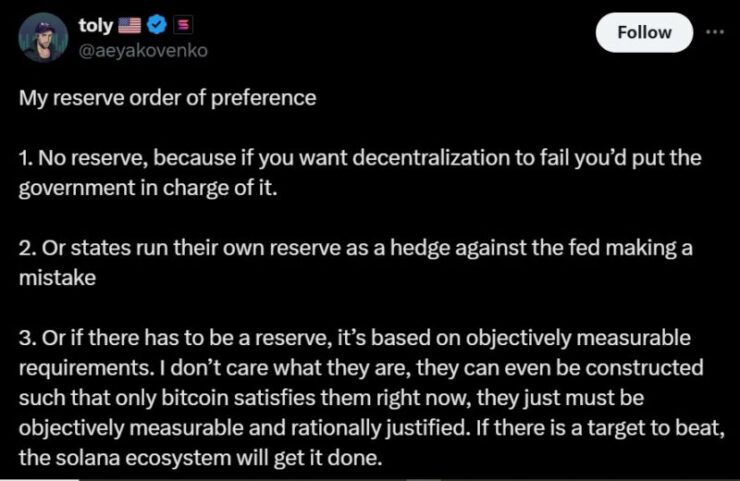

Anatoly Yakovenko, co-founder of Solana Labs, has distanced himself from the idea of a U.S. government-controlled crypto reserve, warning that it could undermine the fundamental principles of decentralization that underpin blockchain technology. In a series of social media posts, Yakovenko expressed concerns that the U.S. government managing a crypto reserve would diminish the very ethos of decentralized finance (DeFi), which relies on distributed control, autonomy, and transparency.

Yakovenko argued that while certain criteria could be established for a reserve, such as the inclusion of Bitcoin as a qualifying asset, the control of such reserves by the U.S. government would be a step back for the crypto community. He emphasized that any reserve structure should be “objectively measurable and rationally justified,” but expressed skepticism about the government’s ability to manage a reserve in a way that respects the decentralized nature of cryptocurrencies.

In his remarks, Yakovenko also suggested that if a reserve were to exist, it could be managed by state entities as a safeguard against potential missteps by the Federal Reserve. This perspective highlights his belief that decentralization should remain intact, even if government involvement in cryptocurrency becomes inevitable.

Crypto Industry Awaits White House Summit

The cryptocurrency industry is bracing for major revelations from the upcoming White House Crypto Summit, scheduled for Friday, where more details are expected on the potential formation of a national crypto reserve. One key topic under scrutiny is whether the reserve will include additional tokens, beyond the already discussed Bitcoin, XRP, Solana (SOL), and Cardano (ADA). Commerce Secretary Howard Lutnick hinted that a Bitcoin-focused strategic reserve has been on former President Trump’s radar since his campaign trail, but the treatment of other tokens may vary.

Although Bitcoin has long been seen as a store of value, other tokens like XRP, SOL, and ADA have raised questions about their viability for inclusion in a national reserve. These tokens, while popular, are not considered traditional stores of value, leading to concerns from some crypto leaders about the reserve’s intent.

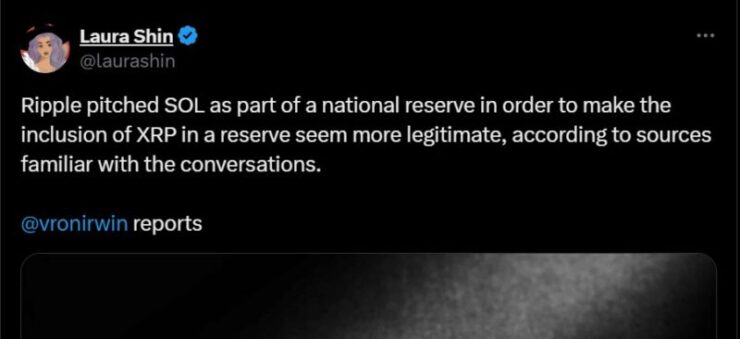

Ripple’s Role in Solana’s Inclusion in the Strategic Reserve

According to sources, Ripple made the pitch to the U.S. government during recent conversations to include Solana in the crypto reserve plan, which was revealed earlier this week. By aligning Solana with XRP in the reserve, Ripple is hoping to lend more legitimacy to the inclusion of its own token, which has faced years of scrutiny as a speculative asset. Ripple has long been criticized for XRP’s market capitalization, which stands at over $145 billion, despite ongoing questions about its utility and real-world applications.

The move, led by Ripple executives Brad Garlinghouse and Chief Legal Officer Stu Alderoty, aims to boost the credibility of the reserve by incorporating another well-established token alongside XRP. The inclusion of Solana, a high-performance blockchain with growing institutional support, is seen as a strategic effort to demonstrate that the reserve would not just focus on a single cryptocurrency, but instead be inclusive of multiple prominent tokens.

Impact on Solana Ecosystem and Broader Crypto Market

Yakovenko’s comments come at a time when the crypto market is closely watching the potential developments around government intervention and digital asset reserves. As countries like the U.S. and others explore the idea of national reserves for digital currencies, there is growing concern over how these moves could influence the core principles of decentralization that many crypto advocates champion.

For Solana, Yakovenko’s stance on decentralization aligns with the platform’s focus on scalability and open access. If a crypto reserve were implemented, the Solana ecosystem, known for its high throughput and decentralized validator network, could be impacted if government control reduces the level of decentralization that Solana and other blockchain networks strive for.

Quick Facts:

- Yakovenko warns that a U.S. crypto reserve would undermine decentralization, a core principle of blockchain.

- He suggests that state-managed reserves could serve as a hedge against the Federal Reserve’s potential mistakes.

- Yakovenko believes the decentralized nature of cryptocurrencies would be jeopardized under government oversight.