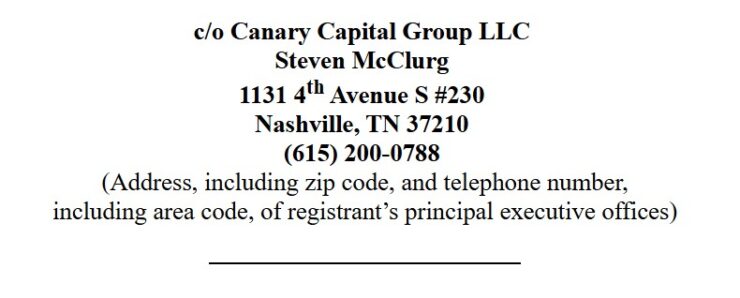

Canary Capital, the investment firm founded by former Valkyrie Funds co-founder Steven McClurg, is making a bold move in the cryptocurrency space by filing an S-1 with the U.S. Securities and Exchange Commission (SEC) to launch an exchange-traded fund (ETF) that tracks Axelar’s native token, AXL. The filing marks the beginning of what could be a significant institutional product aimed at capitalizing on the growing importance of cross-chain protocols like Axelar in the blockchain ecosystem.

Steven McClurg, CEO of Canary Capital, expressed high confidence in Axelar’s future potential, praising its development team and its critical role in blockchain interoperability.

“The hottest NEW protocol was Axelar.Nearly every other protocol team I spoke with said they are working with Axelar on interoperability, and mentioned them as the best tech team.

I expect AXL to have the highest return in 2025 out of the tokens I watch. ($5 price target this year),” McClurg stated.

Axelar’s Role in Blockchain Interoperability

Axelar, a leading cross-chain protocol, is continuing to make strides in the blockchain ecosystem by enabling secure and decentralized transactions across multiple blockchains. The protocol stands out for its unique proof-of-stake consensus model, which allows anyone to participate in the network. This decentralization contrasts with many other interoperability solutions that rely on a small set of validators.

Axelar’s increasing role in facilitating cross-chain communication is being reflected in its partnerships with major industry players. The protocol has already been integrated by high-profile platforms such as J.P. Morgan’s Kinexys, Microsoft’s Azure marketplace, and popular decentralized applications like Uniswap and MetaMask. These integrations underscore Axelar’s growing influence and its critical role in improving blockchain interoperability.

In addition to its expanding presence, Axelar recently made a strategic move by appointing Brian Brooks, the former Coinbase Chief Legal Officer and Acting Comptroller of the Currency, to its newly formed Institutional Advisory Board.

Axelar’s AXL Token Soars After Canary Capital ETF Filing

Axelar’s AXL token experienced a significant surge following the news that Canary Capital is seeking to launch the “Canary AXL ETF.” The announcement caused AXL’s price to jump by over 14%. Although the token’s price settled slightly to $0.43 by 5:27 p.m. ET, it still represented a notable 10% increase over the past 24 hours, outpacing other cryptocurrencies during the same period.

Canary Capital’s filing for an ETF tracking the price of Axelar’s AXL token represents a significant milestone for both the firm and the broader cryptocurrency market. This makes Canary the first financial institution to propose such an ETF, further solidifying Axelar’s importance in the blockchain interoperability space.

The filing comes amid a broader trend of rising institutional interest in altcoin-based ETFs. This follows the launch of Bitcoin and Ethereum-based ETFs last year, and is further amplified by the shift in the U.S. administration under President Donald Trump, who has been seen as more crypto-friendly. Along with Canary’s filing, Bitwise also submitted an S-1 registration with the SEC to launch an ETF focused on Aptos, signaling that more institutions are exploring cryptocurrency ETFs based on a range of digital assets..

Quick Facts:

- Canary Capital has filed an S-1 with the SEC to launch an ETF tracking Axelar’s AXL token.

- Axelar has integrated with platforms like Uniswap, MetaMask, J.P. Morgan, and Microsoft.

- Brian Brooks, former Coinbase Chief Legal Officer joins Axelar’s Institutional Advisory Board to guide regulatory alignment and adoption in traditional finance.