Mt. Gox, the once-prominent cryptocurrency exchange now in bankruptcy proceedings, has transferred a significant amount of Bitcoin, valued at over $1 billion, to an unmarked address. According to Arkham Intelligence data, the exchange moved approximately 11,834 BTC—worth around $1.07 billion—into a wallet identified only as “1Mo1…9gR9” at around 3:17 UTC on Thursday. This transfer marks the first major movement of Mt. Gox’s Bitcoin holdings since late January, reigniting market speculation about the future of these assets.

Transaction Details and Market Implications

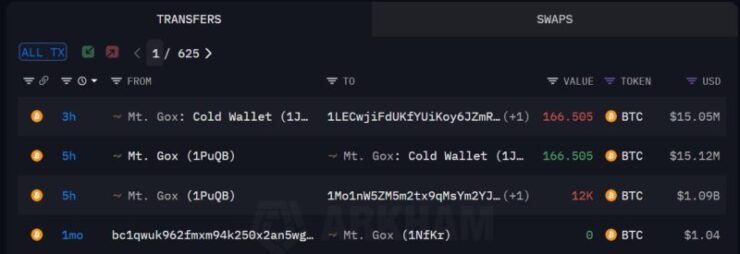

Alongside the massive transfer, Mt. Gox also moved 166.5 BTC—valued at about $15.12 million—into its cold wallet labeled “1Jbez,” shortly after the larger transaction. These moves have triggered speculation regarding the potential effects on the market, as Mt. Gox’s remaining 36,000 BTC (worth roughly $3.3 billion) has been closely watched by investors and analysts.

The timing of the transfer, during a period of Bitcoin’s market surge—reaching a price of approximately $90,100, up by 4% in 24 hours—raises questions about whether these funds will be used to settle claims with Mt. Gox’s creditors or if they could have an impact on Bitcoin’s price. Historically, any significant movements of Mt. Gox’s Bitcoin holdings have led to concerns about market volatility.

Mt. Gox Exchange and Progress of the Creditors’ Repayment Plan

Launched in 2010, Mt. Gox was once the world’s leading Bitcoin exchange, handling approximately 70% of global Bitcoin transactions by 2013. However, in early 2014, the platform suspended trading and withdrawals, eventually filing for bankruptcy after losing over 850,000 BTC due to security breaches. This incident left thousands of creditors awaiting compensation for their lost assets.

In July 2024, Mt. Gox initiated repayments by transferring 47,228 BTC, valued at approximately $2.7 billion, from its offline wallets. Subsequent payments followed, with a total of 59,000 BTC redistributed to creditors by the end of July. Over the years, the repayment process has encountered multiple delays. In October 2024, the rehabilitation trustee extended the repayment deadline by one year, now set for October 31, 2025. This extension was deemed necessary to address challenges such as incomplete creditor information and the complexities of distributing assets.

The distribution has not been without challenges. Some creditors faced issues during the repayment process, including difficulties in confirming repayment methods and receiving funds. These complications have contributed to the need for deadline extensions and have left many creditors awaiting resolution.

Implications for the Market

Historically, movements of Mt. Gox’s Bitcoin holdings have raised concerns about potential market impacts, especially if creditors decide to liquidate their assets upon repayment. However, recent transfers have had minimal immediate effects on Bitcoin’s price, possibly due to market absorption and anticipation of the repayments.

Quick Facts:

- Mt. Gox’s moved almost 12,000 BTC to an unmarked address, valued at over $1 billion.

- Mt. Gox retains over 36,000 BTC, approximately $3.3 billion at current prices.

- Despite the large transfer, Bitcoin’s price remained relatively stable, indicating market resilience.