The decentralized finance (DeFi) ecosystem is facing a new ethical and governance dilemma after Bybit formally requested that ParaSwap return transaction fees collected from a $1.4 billion hack linked to the Lazarus Group. The request, which was met with skepticism from ParaSwap’s decentralized autonomous organization (DAO), has ignited a heated debate over the responsibilities of DeFi protocols when handling funds tied to illicit activities.

On March 4, a proposal appeared on ParaSwap’s DAO forum, requesting the return of 44.67 Wrapped Ether (wETH) valued at nearly $100,000 to a designated wallet. The proposal suggested that these funds were fees earned from transactions conducted by the Bybit hackers.

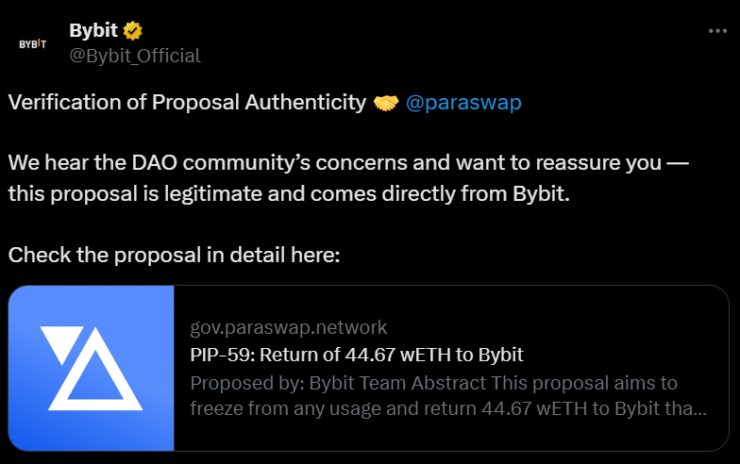

Initial reactions from the ParaSwap community were cautious, with several DAO members demanding verification before advancing the proposal. On March 5, Bybit confirmed via its official X account that it was indeed behind the request, seeking to reclaim fees tied to the Lazarus Group’s illicit transactions.

DeFi’s Ethical Dilemma

The request has divided the ParaSwap community. DeFi researcher and ParaSwap DAO delegate Ignas outlined the complex implications of granting Bybit’s request:

“The DAO profiting from the hack is bad optics, and returning it would show support for another industry player. But keeping the funds may attract regulatory scrutiny and legal headaches.”

While some argue that refunding the fees demonstrates industry cooperation and accountability, others warn that doing so would set a dangerous precedent, potentially undermining DeFi’s core principles:

“Code is law. The DAO earned the fees legitimately via smart contracts. And if funds are returned now, what about future cases? It sets a dangerous precedent.”

The Ripple Effect

ParaSwap is not the only DeFi protocol that unintentionally processed funds from the Bybit hack. The hackers used THORChain to launder stolen assets, causing THORChain’s swap volume to surge past $1 billion by February 27. By March 4, the protocol had generated $5 million in fees, with total trading volume reaching $5.4 billion.

If Bybit extends its recovery efforts to THORChain, the exchange could potentially recover significantly more funds than from ParaSwap alone. However, this would further test the boundaries of DeFi governance, raising the question: How far should DAOs go in returning funds linked to illicit activities?

Bybit’s request highlights DeFi’s growing regulatory scrutiny and the evolving debate over the responsibility of decentralized platforms in financial crime. With governments and regulators watching closely, decisions made by DAOs today could shape the future of how DeFi protocols handle illicit funds and regulatory compliance.

If ParaSwap agrees to return the funds, it could set a new precedent for DeFi accountability. However, refusing the request could reinforce the principle of smart contract immutability, maintaining DeFi’s core ethos of trustless, permissionless transactions.

What Happens Next?

With the DeFi industry at a crossroads, ParaSwap’s DAO must now decide whether to return the funds or hold firm on its “code is law” stance. Meanwhile, Bybit’s pursuit of additional refunds from other protocols like THORChain could spark an even larger industry-wide debate on the role of DeFi in mitigating financial crime.

Will DAOs take a proactive approach to returning funds from hacks, or will they hold firm on their decentralized principles? The decisions made in the coming weeks could reshape DeFi’s governance landscape for years to come.