Japan’s regulatory landscape is undergoing a dramatic shift, paving the way for stablecoin adoption. SBI VC Trade, the cryptocurrency subsidiary of SBI Holdings, is positioning itself at the forefront of this transformation, becoming the first registered platform in Japan to process USDC transactions. This move signals a broader acceptance of stablecoins in the country, potentially unlocking new opportunities for institutional and retail adoption.

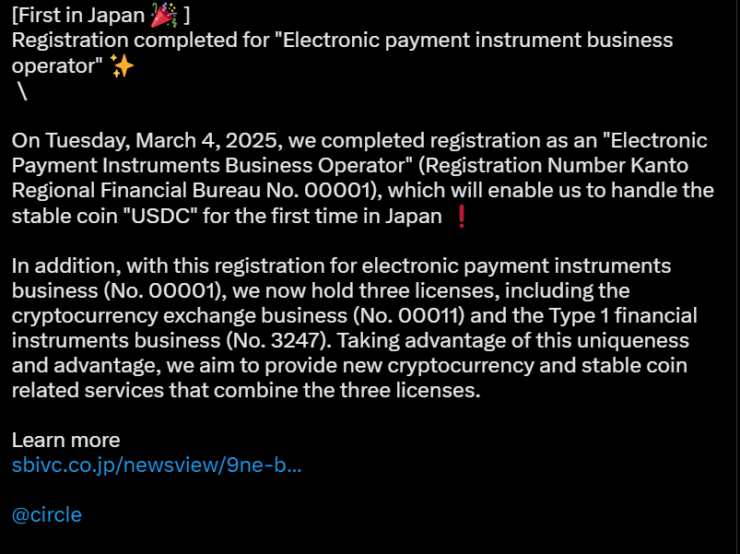

On March 4, SBI VC Trade announced that it had completed the first registration required for stablecoin transactions, clearing the path to launch USDC trading in Japan. The company is now awaiting full registration, which would officially establish it as one of Japan’s first regulated platforms offering stablecoin trading.

SBI VC Trade has already outlined its next steps, including a USDC trading trial for selected users set to begin on March 12. A full-scale launch is expected to follow, marking a significant milestone for Japan’s crypto ecosystem as it moves toward integrating stablecoins into its financial system.

Japan’s Regulatory Shift Toward Stablecoins

This development follows Japan’s decision to lift its ban on foreign stablecoins in 2023, a move that laid the groundwork for regulated entities like SBI to introduce digital dollar alternatives into the market.

On the same day as SBI’s USDC announcement, Japan’s Financial Services Agency (FSA) Commissioner Hideki Ito voiced his support for stablecoin adoption. Speaking at Fin/Sum 2025 during Japanese Fintech Week, Ito emphasized stablecoins’ role in modernizing financial systems:

“Stablecoins are used soundly for the sophistication of remittance and settlement. I hope it will be done.”

The FSA’s evolving stance underscores Japan’s pivot toward a more crypto-friendly regulatory environment, potentially positioning the country as a leading hub for compliant stablecoin transactions.

Why SBI’s USDC Move Matters

Stablecoins like USDC have long been touted as a bridge between traditional finance and crypto, offering a stable, on-chain equivalent of fiat currencies. SBI’s embrace of USDC is significant for several reasons:

- Institutional Adoption: With SBI’s backing, USDC could see increased use in corporate transactions, cross-border payments, and financial settlements.

- Regulatory Precedent: This marks Japan’s first major step in allowing foreign stablecoins under regulatory oversight.

- Crypto Market Expansion: A regulated stablecoin market in Japan could attract more institutional investors to the broader crypto space.

SBI has already positioned itself as a major player in global crypto partnerships, with close ties to Ripple and other U.S.-based blockchain firms. Its move toward stablecoin integration aligns with Japan’s ongoing push to modernize its digital payment infrastructure.

Japan’s easing of stablecoin restrictions is part of a larger trend where governments worldwide are moving to regulate and integrate digital asset settlements. With major economies exploring central bank digital currencies (CBDCs) and stablecoin frameworks, Japan’s progressive stance could set a precedent for other nations.

As the country finalizes its stablecoin policies, SBI’s USDC rollout will be closely watched by global regulators, financial institutions, and crypto firms. If successful, it could accelerate the adoption of stablecoins across Asia and beyond.

What Comes Next?

With its March 12 trial launch, SBI VC Trade is taking its first steps toward full-scale USDC trading in Japan. If approved for broader access, this could usher in a new era of stablecoin-driven financial services, bringing crypto further into mainstream finance.

As Japan embraces stablecoins, will other financial giants follow SBI’s lead? The next few months will be pivotal in shaping the future of digital dollar adoption in one of the world’s most technologically advanced economies.