TIn a stunning regulatory reversal, the SEC has dropped its lawsuit against Kraken, signaling a major shift in U.S. crypto policy under the Trump administration. The lawsuit, originally filed in November 2024, sought to classify Kraken as an unregistered securities exchange and impose stricter oversight on its operations. However, according to Kraken, the SEC will dismiss the case with prejudice, meaning it cannot be refiled with the same claims.

The SEC’s decision marks a shift in crypto enforcement, allowing Kraken to continue operations without fines, penalties, or business changes.

Background of the SEC’s Lawsuit Against Kraken

The SEC had previously filed a lawsuit against Kraken, alleging that crypto exchange was operating as an unregistered broker, dealer, exchange, clearing agency and offering staking services that violated federal securities laws.. The lawsuit, initially filed in November 2023, also alleged that Kraken had commingled customer assets with its own funds, exposing users to “a significant risk of loss”, according to an independent auditor’s findings.

The legal battle was one of the SEC’s most aggressive enforcement actions against a crypto exchange, following a February 2023 settlement in which Kraken agreed to halt its crypto staking services for U.S. customers and pay $30 million in penalties.

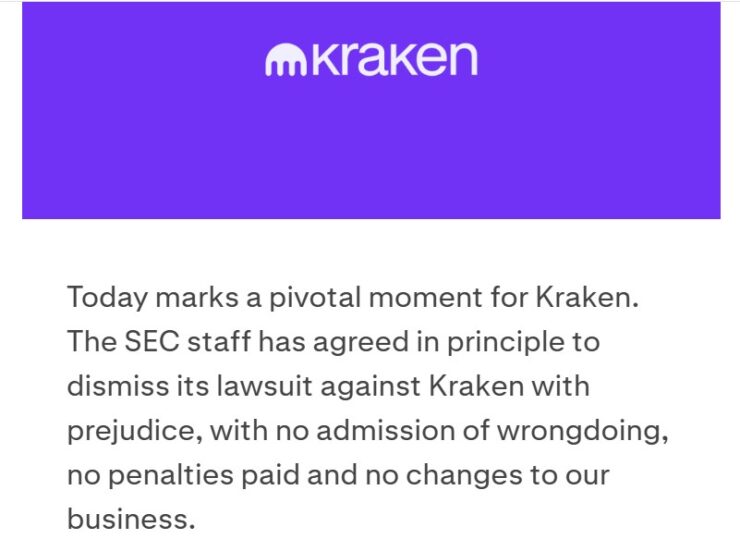

Announcing the case dismissal on its blog, kraken noted:

“The SEC’s decision to dismiss its lawsuit against us (and many others) is more than just a legal victory — it’s a turning point for the future of crypto in the U.S. It ends a wasteful, politically motivated campaign, lifts uncertainty that stifled innovation and investment, and clears the path toward a stable, forward-thinking regulatory regime.”

Shift in Regulatory Approach Under the New Administration

The dismissal of the lawsuit is part of a broader trend under the new administration, which has taken a softer approach to crypto enforcement compared to its predecessor. The SEC, which was previously aggressive in targeting crypto exchanges, staking services, and token issuers, now appears to be scaling back its legal battles against major players in the industry.

This policy shift follows growing criticism that the SEC’s enforcement-driven approach lacked regulatory clarity and stifled innovation. Under the new administration, regulators are focusing on creating a balanced framework that encourages crypto adoption while maintaining investor protections.

Over the past week, the U.S. Securities and Exchange Commission (SEC) has dropped cases against Coinbase Global and Consensys, alongside multiple investigations into crypto firms. The agency cited its ongoing efforts to establish a clearer regulatory framework for digital assets, with a newly formed SEC crypto task force spearheading the initiative.

The decision to drop the lawsuits aligns with a series of regulatory reversals following President Donald Trump’s return to the White House. The new administration has signaled a more accommodating stance toward the digital asset industry, aiming to foster innovation while ensuring consumer protection.

Quick Facts

- The SEC has dropped its lawsuit against Kraken, which sought to classify the exchange as an unregistered securities platform.

- The case was dismissed with prejudice, meaning the SEC cannot refile the lawsuit with the same allegations.

- Kraken will not pay fines, admit wrongdoing, or alter its business, marking a shift from previous crypto exchange settlements.

- The decision reflects a broader regulatory pivot under the Trump administration, moving toward a more lenient stance on crypto enforcement.