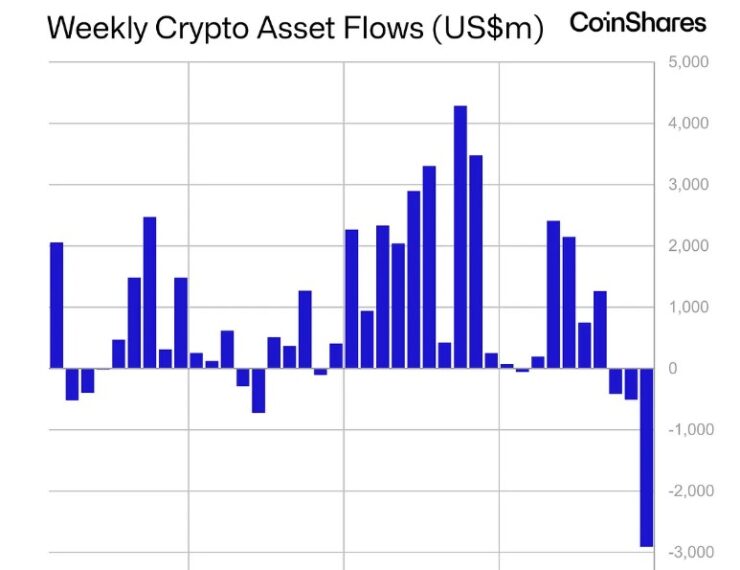

The cryptocurrency exchange-traded product (ETP) market has suffered its largest single-week sell-off in history, with investors pulling out a record-breaking $2.9 billion in the past week. The outflows come amid three consecutive weeks of withdrawals, wiping out a total of $3.8 billion from global crypto ETPs, according to a report from European investment firm CoinShares.

The dramatic reversal follows a 19-week streak of inflows, during which $29 billion flooded into crypto funds, signaling strong institutional interest. However, the latest wave of outflows suggests that market sentiment is shifting, with investors reacting to a combination of profit-taking, security concerns, and macroeconomic pressures.

Analysts point to multiple factors contributing to the unprecedented outflows. One of the biggest shocks to investor confidence was the $1.5 billion Bybit hack, which raised concerns about the security of centralized exchanges and custodial investment products. The incident sent ripples through the crypto market, reminding institutional players of the vulnerabilities associated with digital asset storage.

Adding to the sell-off pressure, the U.S. Federal Reserve adopted a more hawkish stance, signaling that interest rates could remain higher for longer. This has led to a more cautious approach from institutional investors, as traditional finance continues to weigh the risk-reward ratio of digital asset exposure.

Additionally, the sheer length of the 19-week inflow streak suggests that some investors were bound to take profits, especially given the recent gains in Bitcoin and Ethereum. CoinShares research head James Butterfill noted that these factors likely created a mix of profit-taking and weaker sentiment across the asset class, fueling the historic outflows.

Bitcoin and Ethereum Take the Hardest Hit

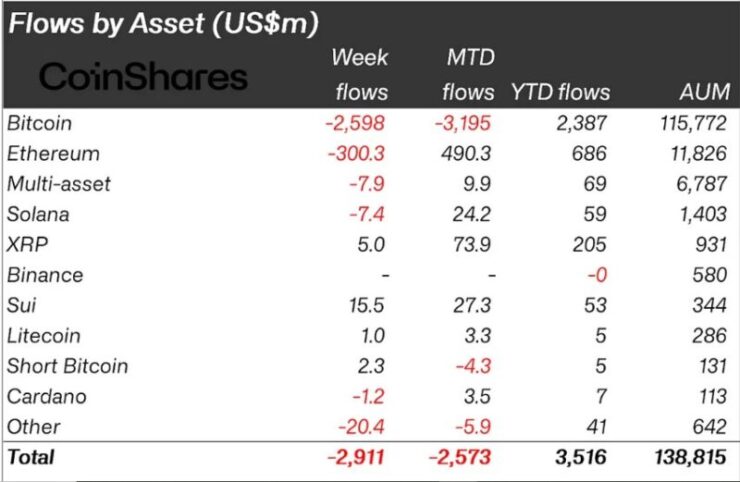

Bitcoin bore the brunt of the outflows, with institutional investors withdrawing a staggering $2.6 billion from Bitcoin-based ETPs. Despite Bitcoin’s recent price strength, which saw it climb past $94,000, the institutional retreat outlined the growing caution about short-term volatility. Ethereum was not spared either, experiencing $300 million in outflows—a stark contrast to the $490.3 million in inflows recorded earlier this month.

The shift in capital flows shows an evolving risk-reward assessment among institutional investors. While Ethereum remains a dominant player in DeFi and smart contracts, its market performance has been heavily influenced by regulatory uncertainty and broader macroeconomic trends. The downturn in institutional sentiment could slow down Ethereum’s price momentum in the near term, despite its continued network growth.

Altcoins Show Mixed Results Amid Market Shake-Up

Unlike Bitcoin and Ethereum, certain altcoins bucked the trend and saw an increase in ETP inflows. Sui (SUI) emerged as a standout performer, attracting $15.5 million in inflows, while XRP-based ETPs pulled in $5 million, signaling renewed confidence in the asset despite legal and regulatory challenges. These inflows suggest that investors are becoming more selective, moving capital into assets that offer unique utility or have strong long-term fundamentals.

However, the broader market remains highly reactive to macroeconomic and regulatory developments. With Bitcoin dominance slipping, many analysts believe that altcoins could continue to gain ground if investor confidence in alternative blockchain ecosystems strengthens. The divergence in capital flows reflects a more nuanced market outlook, where institutional players are reallocating funds based on specific narratives rather than broad market movements.

The Future of Crypto ETPs and Institutional Investment

The record-breaking outflows have pushed the total assets under management (AUM) for crypto ETPs down to $138.8 billion, a significant drop from the $173 billion peak recorded in January. This signals a potential cooling-off period for institutional interest, at least in the short term, as investors recalibrate their strategies in response to economic conditions and regulatory uncertainty.

Despite the pullback, many experts believe that the long-term trajectory of crypto ETPs remains positive. Institutional adoption has steadily increased over the past two years, and while outflows like these indicate temporary market adjustments, they do not necessarily signal a broader exodus from digital assets. Instead, the focus is now on how the crypto market will respond to macroeconomic shifts, regulatory developments, and the ongoing evolution of institutional-grade investment products.

Quick Facts

- Crypto ETPs recorded $2.9 billion in outflows, marking the largest weekly withdrawal in history.

- Bitcoin-based ETPs suffered the biggest loss, with $2.6 billion in investor withdrawals, while Ethereum saw $300 million in outflows.

- Altcoins like Sui (SUI) and XRP attracted inflows, with $15.5 million and $5 million, respectively.

- The total crypto ETP assets under management (AUM) fell to $138.8 billion, down from $173 billion in January.