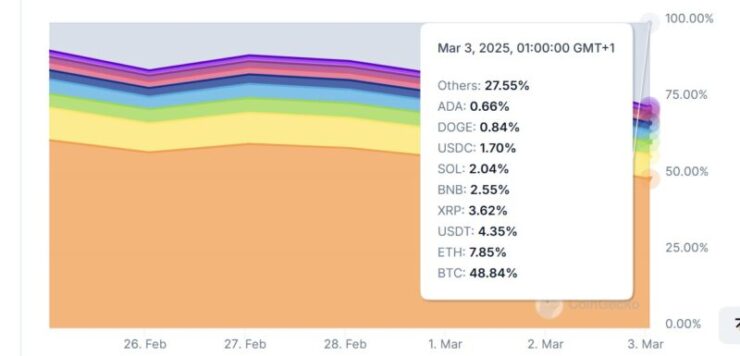

Donald Trump’s U.S. Crypto Strategic Reserve announcement has reshaped the crypto market, pushing Bitcoin’s dominance below 50% for the first time in months. The reserve, which includes Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA) alongside Bitcoin, has triggered a surge in altcoin investments, leading to a reshuffling of market power.

Bitcoin’s market share plunged from 55.4% to 49.6% after the announcement, one of its steepest declines. Though BTC rose 10% to $94,220, altcoins saw far greater gains.

Cardano (ADA) emerged as the biggest winner, skyrocketing over 60% to surpass the $1.06 mark. XRP followed closely, climbing 34.7%, while Solana (SOL) recorded a 25.5% gain. Ethereum (ETH) also benefited from the news, jumping 13.1%. The surge in altcoin prices has fueled speculation that investors are diversifying their holdings, anticipating a more multi-asset approach in future regulatory and governmental crypto strategies.

Market Reactions and Controversy

The inclusion of altcoins in the U.S. Crypto Strategic Reserve has sparked heated debate within the financial community. Peter Schiff, a longtime Bitcoin skeptic, questioned the decision to incorporate altcoins like XRP into an official national reserve, arguing that their long-term value is uncertain. Some Bitcoin maximalists, including Jeff Park of Bitwise, criticized the move as a “huge political miscalculation”, suggesting that the U.S. government should solely focus on Bitcoin as the primary digital asset for national reserves.

Nick Neuman, CEO of Casa, a Bitcoin custody firm, went further by dismissing the reserve’s multi-asset approach, claiming that Bitcoin is the only cryptocurrency with legitimate long-term utility. He argued that including assets like Solana and Cardano could introduce unnecessary risks and volatility into a government-backed digital asset reserve. Despite these criticisms, many traders and institutional investors see the move as a sign of broader crypto adoption at a governmental level, which could provide increased legitimacy to the entire industry.

The Bigger Picture for Crypto Markets

Introducing a government-backed crypto reserve represents a major shift in how digital assets are perceived in financial policy. While Bitcoin has long been seen as the primary store of value, the inclusion of Ethereum and other altcoins suggests a diversified approach to digital asset management at the national level. Some analysts believe this move could accelerate institutional investments into non-Bitcoin assets, leading to a more balanced market where altcoins hold greater influence.

However, concerns remain about how the reserve will be structured and regulated. Increased governmental involvement in cryptocurrency could lead to stricter oversight and compliance requirements, which may impact trading activities and long-term market stability. Additionally, Bitcoin supporters fear that BTC’s role as digital gold could be undermined if the government officially recognizes a wider basket of cryptocurrencies.

The immediate market response shows that investors are embracing a more diversified crypto ecosystem, but whether this shift will remain long-term depends on how the U.S. implements and manages its new crypto reserve strategy.

Quick Facts

- Bitcoin’s market dominance dropped from 55.4% to 49.6% following the announcement of the U.S. Crypto Strategic Reserve.

- Cardano (ADA) led the altcoin surge, gaining over 60%, while XRP rose by 34.7% and Solana by 25.5%.

- Bitcoin’s price increased by 10%, reaching $94,220, but was outpaced by the gains in alternative assets.

- Crypto industry leaders are divided on the inclusion of altcoins in the reserve, with Bitcoin maximalists criticizing the move while traders welcome broader adoption.