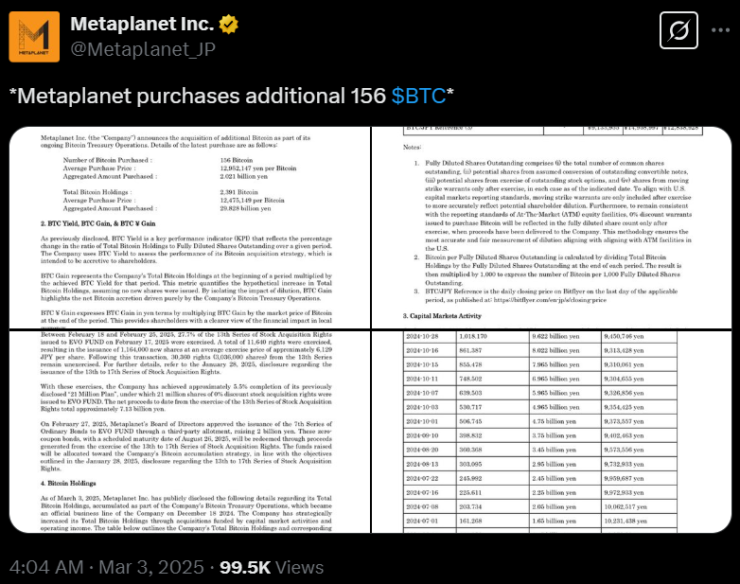

Metaplanet is making a bold bet on Bitcoin, adding 156 BTC to its growing treasury, bringing its total holdings to 2,391 BTC. The acquisition, part of the company’s ongoing Bitcoin Treasury Operations, brings its total holdings to 2,391 BTC, reinforcing its long-term bullish stance on digital assets.

Metaplanet’s latest purchase of 156 Bitcoin at an average price of 12,952,147 yen ($86,000) per BTC brings its total Bitcoin reserves to 2,391 BTC, an investment now worth 29.828 billion yen ($198 million).

The firm remains committed to expanding its Bitcoin treasury, viewing BTC as a strategic hedge against economic uncertainty, inflation, and fiat currency devaluation.

According to company reports:

- In Q4 2024, Metaplanet’s BTC yield surged to 309.8%, highlighting strong returns from its Bitcoin holdings.

- Year-to-date (Q1 2025), BTC yield stands at 31.8%, showing continued profitability despite market fluctuations.

These figures indicate strong performance from Metaplanet’s Bitcoin investment strategy, which has benefited from both market gains and increasing institutional adoption of BTC.

Funding Bitcoin Expansion

To fund its aggressive Bitcoin acquisition strategy, Metaplanet has turned to stock and bond issuances, securing capital from EVO FUND.

Stock Issuance Plan

- On January 28, 2025, Metaplanet’s Board approved issuing the 13th to 17th Series of Stock Acquisition Rights to EVO FUND.

- A total of 21 million shares will be issued in five batches of 4.2 million shares each, with the price determined based on market conditions.

Zero-Coupon Bond Issuance

- On February 10, 2025, the company approved issuing the 6th Series of Zero-Coupon Bonds worth 4 billion yen ($27 million).

- The bonds mature on August 12, 2025, and will be repaid using proceeds from the stock acquisition rights.

- Funds raised from this issuance will be used to purchase additional Bitcoin, further reinforcing Metaplanet’s BTC strategy.

Institutional Bitcoin Adoption is Accelerating

Metaplanet’s continued Bitcoin accumulation aligns with a growing trend of institutional investors treating BTC as a strategic reserve asset.

This move mirrors strategies from other companies, including:

- MicroStrategy, which has amassed over 200,000 BTC as part of its corporate treasury.

- Publicly traded firms, hedge funds, and nation-states are increasingly allocating capital to Bitcoin.

Metaplanet’s bold approach signals a shift in Japan’s traditional financial landscape, where Bitcoin adoption among institutions has been slower compared to Western counterparts.

By aggressively increasing its Bitcoin holdings, Metaplanet is positioning itself as one of Japan’s most forward-thinking firms in the digital asset space.

BTC’s scarcity, decentralization, and historical outperformance of fiat currencies make it a compelling long-term investment for companies looking to hedge against macroeconomic risks.

Final Takeaway

With strong BTC yields, fresh capital injections, and a clear roadmap for further accumulation, Metaplanet is doubling down on its Bitcoin-first strategy.

If Metaplanet’s strategy proves successful, it could spark a wave of Bitcoin adoption among Japanese corporations, reshaping the country’s financial landscape.

As institutional Bitcoin adoption grows, Metaplanet’s strategy may serve as a blueprint for companies looking to navigate an evolving financial landscape.