Coinbase CEO Brian Armstrong has weighed in on the debate surrounding the U.S. Crypto Strategic Reserve, advocating for an exclusive Bitcoin-only approach. His comments follow Donald Trump’s recent announcement that the U.S. is establishing a crypto reserve, which could include Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA).

Armstrong calls Bitcoin the only logical choice, likening it to gold for its decentralization and global acceptance. However, with multiple assets being considered, the debate over which cryptocurrencies should be included in a national reserve is gaining momentum.

Armstrong’s Bitcoin Stance Sparks Debate

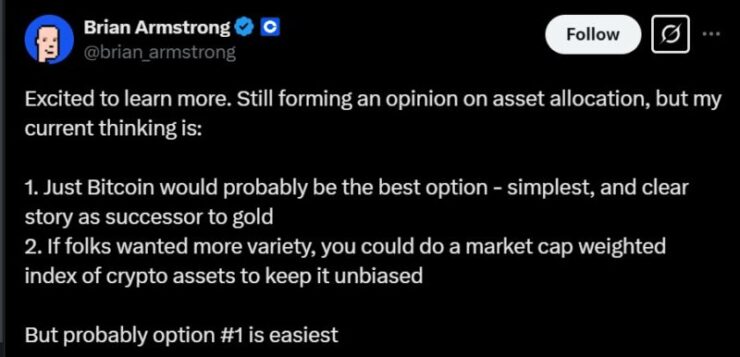

Taking to social media, Armstrong made his position clear:

“Just Bitcoin would probably be the best option—simplest, and clear story as successor to gold.”

He argues that Bitcoin’s decentralization, regulatory clarity, and resilience make it the strongest candidate for an official crypto reserve. By focusing solely on BTC, he believes the U.S. can establish a straightforward, easily understood reserve strategy rather than complicating it with multiple assets.

However, Armstrong also acknowledged an alternative approach—if diversification is preferred, he suggested a market cap-weighted index where assets are included based on their market dominance rather than political or ideological favoritism.

Despite Armstrong’s strong support for Bitcoin, the broader crypto industry remains divided. Many argue that a national reserve should reflect the evolving digital economy, including Ethereum’s smart contract capabilities, stablecoin’s role in payments, and Solana’s high-speed transactions. Popular XRP maximalist XRPcryptowolf replied to Amstrong’s position:

“Brian Armstrong is a BTC maxi so of course he would say this. There’s nothing wrong with having XRP and the other top 5 crypto in the national reserve. Amazon wasn’t the only top tech company in the world during the internet boom.”

Trump’s Crypto Reserve Proposal Shakes the Market

The cryptocurrency market has experienced a major resurgence, surging nearly 20% in total market capitalization following Donald Trump’s announcement of a U.S. Crypto Strategic Reserve. The proposal, which includes Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Cardano (ADA), and XRP, has not only reversed last week’s market decline but also reignited investor confidence in the long-term viability of digital assets.

In the immediate aftermath of Trump’s statement, several cryptocurrencies saw explosive gains. Cardano (ADA) led the surge, skyrocketing over 60% to break past $1.06, followed by XRP’s 24% jump to $2.82 and Solana’s 18% surge to $174. Even Trump’s memecoin (TRUMP) benefited from the renewed enthusiasm, climbing 19% in value.

Beyond market reactions, the establishment of a Crypto Strategic Reserve marks a major turning point in U.S. financial policy. It signals a clear shift from regulatory hostility to strategic adoption, potentially positioning the United States as a leader in the digital economy.

As discussions unfold, the long-term implications of the U.S. embracing digital assets as part of its financial infrastructure remain a key issue for investors, regulators, and policymakers alike. Whether this strategic shift cements the U.S. as a digital asset powerhouse or introduces new regulatory complexities will depend on how the government executes and manages its crypto reserve strategy in the months ahead

Quick Facts

- Coinbase CEO Brian Armstrong supports a Bitcoin-only approach for the U.S. crypto reserve, arguing that BTC is the simplest and best successor to gold.

- He alternatively suggests a market cap-weighted index if diversification is preferred.

- Trump’s crypto reserve announcement included BTC, ETH, XRP, SOL, and ADA, sparking debate over which assets should be included.

- The market reacted strongly, with Bitcoin hitting $94,000+, Ethereum rising 14.6%, and Cardano surging 58%.