Bitcoin ETFs broke an eight-day losing streak on Friday, posting $94 million in net inflows. This reversal comes after a prolonged sell-off period that saw Bitcoin ETF holdings shrink by over $20 billion due to declining investor confidence and broader market corrections.

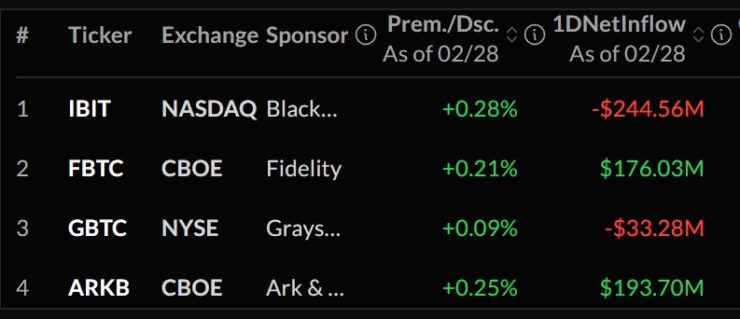

Leading the surge in inflows was Ark Invest and 21Shares’ ARKB fund, which pulled in $194 million, followed by Fidelity’s FBTC, which saw $176 million in net inflows. These additions suggest that some institutional investors are seeing Bitcoin’s price correction as a buying opportunity, despite broader concerns about macroeconomic conditions and risk asset volatility.

However, these gains were partially offset by continued outflows from BlackRock’s IBIT fund, which has experienced significant investor withdrawals. IBIT recorded a staggering $244.5 million in net outflows on Friday, marking its fifth consecutive day of withdrawals. Over the week, IBIT shed a total of $1.175 billion, setting a single-day outflow record on Wednesday.

ETF Investors React to Bitcoin’s Market Uncertainty

The fluctuations in ETF flows reflect broader market uncertainty. Bitcoin has been struggling to regain momentum following its worst February in a decade, during which it saw steep price corrections and heightened investor caution. The reversal of outflows into inflows could signal a shift in sentiment, but the ongoing volatility suggests that market participants remain cautious about long-term positioning.

Despite recent challenges, the broader adoption of Bitcoin ETFs has been notable. In 2024, the introduction of U.S. spot-based ETFs led to record-breaking crypto inflows, with Bitcoin ETFs leading the charge. These products attracted significant interest from institutional investors, including wealth management companies, hedge funds, and pension funds. For instance, the State of Wisconsin Investment Board more than doubled its holdings in the iShares Bitcoin Trust ETF to 6 million shares

Massive inflows in January helped propel Bitcoin past $100,000 for the first time, but the more recent wave of outflows has coincided with price pullbacks, reinforcing the close relationship between ETF flows and Bitcoin’s market trends.

What’s Next for Bitcoin ETFs?

Despite this first day of net inflows, the market remains in a wait-and-see mode. If inflows continue, it could indicate a renewed appetite for Bitcoin exposure among institutional investors.

The next few weeks will reveal whether this rebound signals renewed institutional interest or just a temporary break from sustained ETF outflows. Bitcoin’s price action and regulatory shifts will be key to watch.

Quick Facts:

- U.S. spot Bitcoin ETFs have recorded their first day of net positive inflows after a prolonged period of outflows.

- The ETFs experienced a decline of over $20 billion in value during the week, due to outflows and Bitcoin’s price drop.

- Bitcoin faced its worst February in a decade, marked by record ETF outflows and increased investor caution.