Arizona is leading the charge in crypto legislation, with two landmark bills advancing toward law to establish state-backed digital asset reserves. The Arizona Senate has successfully passed the Strategic Digital Assets Reserve bill (SB 1373) and the Strategic Bitcoin Reserve Act (SB 1025), positioning the state as a frontrunner in digital asset adoption within government financial management.

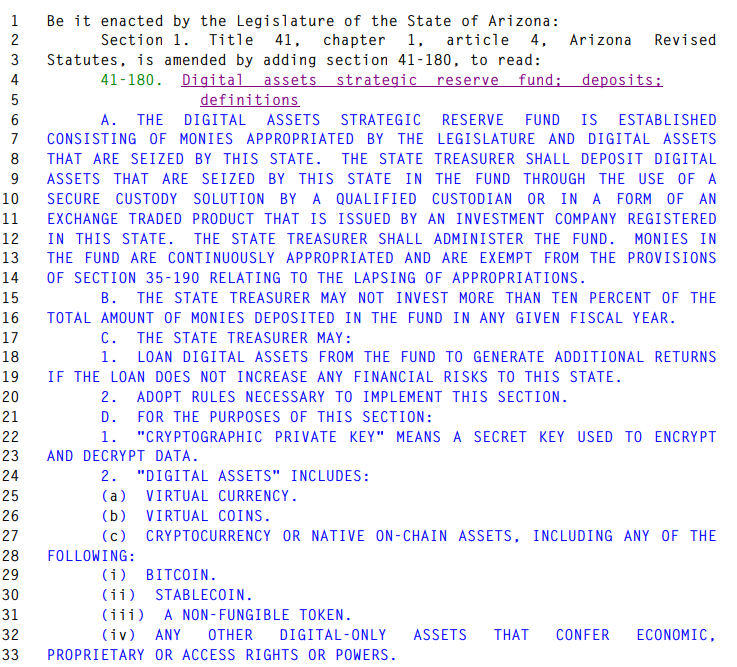

On February 27, the Senate passed SB 1373 (17-12), moving it to the Arizona House for review. The bill, sponsored by Republican Senator Mark Finchem, proposes the creation of a Digital Assets Strategic Reserve Fund. Under its framework, the state treasurer would oversee a fund consisting of appropriated legislative funds and seized cryptocurrency.

A crucial provision of SB 1373 caps crypto investments at 10% of the total fund deposits per fiscal year, mitigating exposure to excessive volatility. Additionally, the treasurer may loan digital assets to generate returns, provided it does not heighten financial risks for the state.

Meanwhile, a parallel bill, SB 1025, co-sponsored by Republican Senator Wendy Rogers and Representative Jeff Weninger, also passed the Senate on February 27 with a 17-11 vote. This proposal grants state investment authorities the power to allocate public funds to crypto assets, reinforcing Arizona’s stance on financial innovation. While Finchem’s bill emphasizes seized digital assets and appropriated reserves, Rogers and Weninger’s proposal is focused on direct government investment in crypto.

A Nationwide Trend: The Growing Push for Bitcoin Reserves

Arizona isn’t alone in this legislative push. 18 U.S. states currently have active crypto reserve bills awaiting Senate votes, with Arizona and Utah leading the race in final-stage approvals. On the flip side, crypto reserve proposals have failed to pass in states like Montana, Wyoming, North Dakota, South Dakota, and Pennsylvania.

The increasing support for Bitcoin reserves is tied to broader pro-crypto sentiments, particularly fueled by former President Donald Trump’s favorable stance on digital assets. Trump’s pro-crypto policies have sparked renewed interest in integrating Bitcoin into state treasuries, providing an alternative to traditional financial instruments.

Bitcoin’s Market Reaction: A Volatile Landscape

Despite legislative advancements, Bitcoin has struggled to maintain its momentum, plummeting 17% over the past week. Market uncertainty has been exacerbated by fears surrounding Trump’s sweeping tariff policies, leading to investor caution. While states are actively exploring crypto integration, macroeconomic instability continues to shape market movements.

What’s Next? The Future of State-Backed Crypto Investments

Arizona’s push for cryptocurrency-backed reserves signals a broader shift in state-level financial management. If these bills become law, Arizona could set a precedent for other states to follow, accelerating the mainstream adoption of digital assets in government treasuries. However, potential federal regulations on stablecoins and crypto market structures remain key factors that could shape the future of such initiatives.

As the bills move through the legislative pipeline, the question remains: Will Arizona’s bold bet on crypto reserves pave the way for a new era of state-backed digital assets, or will volatility and regulatory hurdles slow its momentum?