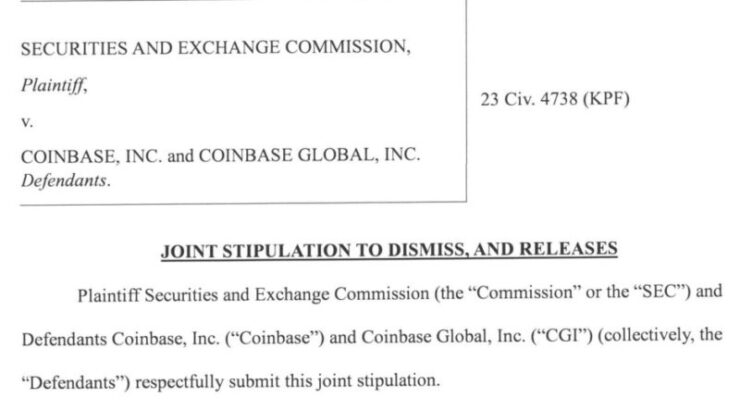

In a landmark move, the SEC has officially dropped its lawsuit against Coinbase, marking a major shift in U.S. crypto regulation. The dismissal, filed Thursday with the Southern District of New York, marks the end of one of the most high-profile legal battles between regulators and the crypto industry.

The SEC had initially accused Coinbase of operating as an unregistered securities exchange and enabling the trading of digital assets the agency classified as securities. While the SEC’s intent to drop the case had already been hinted at last week, a formal vote among the commissioners was required before the motion could be filed. With this final step, the regulator has effectively shut the door on re-litigating the matter.

SEC Acting Chair Mark Uyeda acknowledged the agency’s changing stance, stating,

“It’s time for the Commission to rectify its approach and develop crypto policy in a more transparent manner. The Crypto Task Force is designed to do just that.”

This signals a potential shift in the SEC’s broader regulatory strategy as pressure mounts for clearer guidelines rather than enforcement-driven oversight.

However, despite this legal victory for Coinbase, the exchange remains engaged in other regulatory disputes with the SEC. This includes its ongoing petition demanding the agency establish formal crypto regulations and its pursuit of internal SEC documents shedding light on the regulator’s internal decision-making around digital assets.

New SEC Leadership Ushers in Pro-Crypto Shift

The SEC’s dismissal of the Coinbase lawsuit is part of a broader shift in the agency’s regulatory approach under new leadership. Following President Donald Trump’s return to office, the SEC has undergone significant changes, including the departure of former Chair Gary Gensler and the appointment of Acting Chairman Mark Uyeda.

Under Uyeda’s leadership, the commission has established a specialized “crypto task force” led by Commissioner Hester Peirce, a longtime advocate for clearer and more accommodating digital asset regulations. This task force is working to replace the enforcement-heavy stance of the previous administration with a policy-driven approach aimed at bringing transparency and consistency to crypto regulation.

Even before the expected confirmation of Paul Atkins as the SEC’s permanent chair, Uyeda and Peirce—both former aides to Atkins during his tenure as an SEC commissioner—have already set the agency on a more lenient course. The SEC has dropped several high-profile crypto-related cases, including those involving Robinhood, Gemini, and Uniswap, while also pausing investigations into Binance and Tron.

One of the most notable regulatory reversals has been the SEC’s retreat from its strict interpretation of the Howey Test, the legal framework previously used to classify many crypto projects as securities. This shift signals a significant departure from the previous regulatory environment, which saw widespread enforcement actions against the industry.

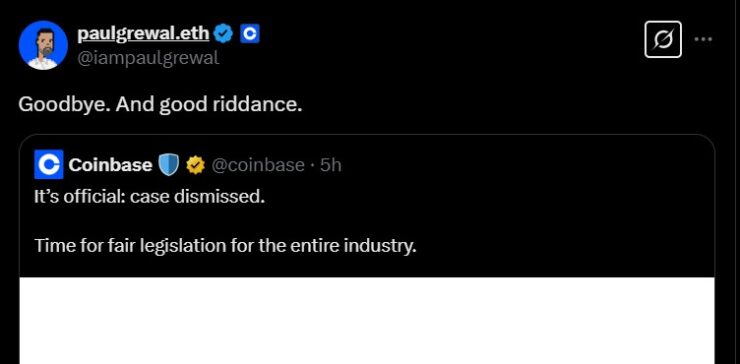

Coinbase’s Chief Legal Officer Paul Grewal wasted no time celebrating the decision, posting a blunt farewell to the SEC’s former stance on X:

Implications for the Crypto Industry

The SEC’s decision to drop the lawsuit against Coinbase is expected to have far-reaching implications for the cryptocurrency market. Market analysts anticipate that this move will boost investor confidence and potentially lead to increased institutional participation in the crypto space. Additionally, other crypto platforms previously under regulatory scrutiny, such as Binance and Kraken, may also benefit from this shift, as the SEC reevaluates its stance on enforcement actions against these entities.

Quick Facts:

- The SEC has dismissed its lawsuit against Coinbase, signaling a policy shift toward the crypto industry.

- Leadership changes within the SEC include Acting Chairman Mark Uyeda and Commissioner Hester Peirce heading a new crypto task force.

- The decision is expected to impact Coinbase’s stock and the broader cryptocurrency market.