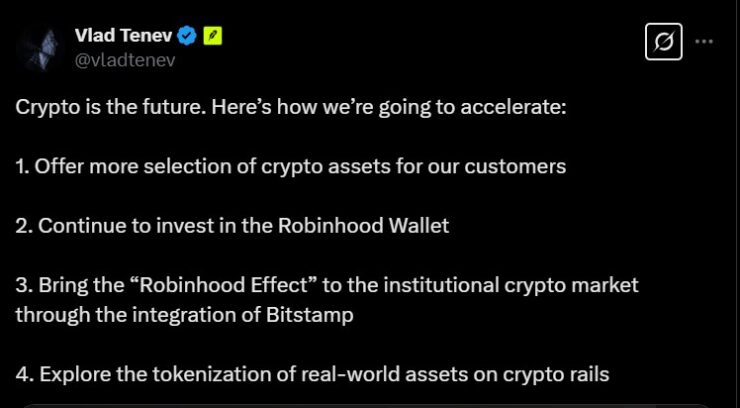

Robinhood CEO Vlad Tenev reaffirmed his belief that “crypto is the future”, outlining four key strategies the company plans to implement to accelerate its presence in the digital asset industry. Tokenization is the key to unleashing crypto’s true power,” Tenev stated in a video posted on X, emphasizing its potential to reshape global finance.

Tenev envisions a future where real-world assets such as equities and private investments are tokenized on blockchain networks, providing greater liquidity, accessibility, and efficiency. He noted that Robinhood sits at the intersection of traditional finance (TradFi) and decentralized finance (DeFi), uniquely positioning the platform to bridge the gap between the two worlds.

As regulatory clarity evolves, Tenev believes that tokenization will reshape investment opportunities, allowing retail investors to access markets historically reserved for institutions and high-net-worth individuals. With growing institutional adoption and financial giants exploring blockchain-powered financial products, Robinhood appears poised to expand its crypto offerings in alignment with this vision.

Challenges in the U.S. Regulatory Landscape

While Robinhood CEO Vlad Tenev remains optimistic about crypto’s future and the potential of tokenization, he cautioned that the lack of clear regulatory guidelines in the U.S. could hinder adoption and innovation. He warned that without definitive rules, the country risks falling behind other financial markets that are actively embracing blockchain-powered investments.

Tenev urged policymakers to develop a regulatory framework that fosters the integration of blockchain technology into the financial sector, ensuring that the U.S. remains competitive in the evolving global market.

However, with Tenev’s statement, it is worth noting a shift in regulatory momentum in recent weeks. With the departure of former SEC Chair Gary Gensler, the agency has begun dropping high-profile enforcement cases against major crypto firms like Coinbase, Uniswap, OpenSea, and Gemini. Additionally, the Trump administration has signaled its intent to introduce a more structured crypto regulatory framework, which could pave the way for new token listings and further adoption of blockchain-based assets in 2025.

Global Financial Institutions Embrace Tokenization

The concept of tokenization is gaining traction among major financial institutions worldwide. Asset managers like BlackRock, Fidelity, and Janus Henderson have initiated projects to tokenize assets such as real estate, artwork, and private equity. These initiatives aim to reduce operational costs, enhance liquidity, and democratize access to high-value investments. For instance, Janus Henderson plans to manage the $11 million Anemoy Liquid Treasury Fund by converting units into digital tokens on a blockchain, positioning itself for future financial market structures influenced by distributed ledger technology.

To achieve the planned tokenization effects, Tenev revealed that Robinhood plans to extend the “Robinhood Effect” beyond retail trading, leveraging Bitstamp’s infrastructure to tap into institutional markets, following the finalization of its $200 million acquisition of the global cryptocurrency exchange operating in over 50 countries

“As we integrate Bitstamp, it allows us access to the exchange market, which is an institutional market,” Tenev explained.

“We really see an opportunity there to drive the same Robinhood effect that we’ve brought to retail into the institutional space with crypto.”