U.S. spot Bitcoin exchange-traded funds (ETFs) faced a massive $516.4 million in net outflows on Monday, marking the fifth-largest single-day withdrawal since these products debuted in January 2024. The outflows reflect mounting investor anxiety as Bitcoin’s price continues to falter, deepening a five-day net outflow streak now totaling $1.07 billion.

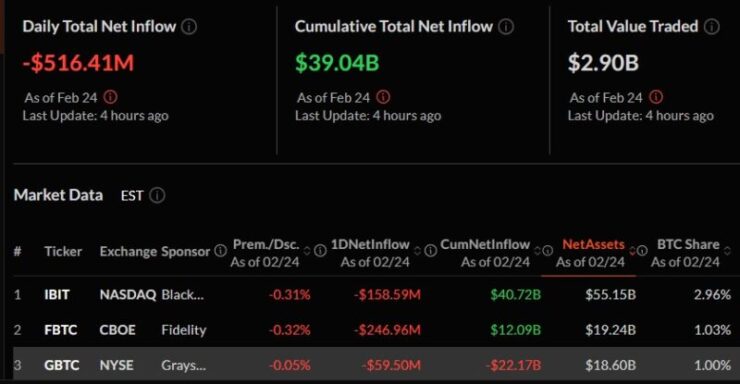

Fidelity’s FBTC bore the brunt of the exodus, with $247 million in redemptions, followed closely by BlackRock’s IBIT, which lost $158.6 million. Grayscale’s GBTC, once a dominant force in the market, saw $59.5 million in outflows. Notably, Ark Invest’s ARKB figures are still pending, suggesting total outflows could climb even higher, according to data from SosoValue.

This recent outflow wave follows a broader market pullback, echoing December 19’s record outflow of $671.9 million, which occurred after Bitcoin corrected from an all-time high above $108,000. The consistent withdrawals highlight a shift in market sentiment, with investors reassessing exposure amid volatile price movements.

Adding to the downturn, U.S. spot Ethereum ETFs also saw redemptions, with $78 million exiting on Monday. BlackRock’s ETHA led the losses, pushing Ethereum ETFs into a three-day outflow streak totaling $100 million.

Market Dynamics and Investor Sentiment

The significant ETF outflows coincide with Bitcoin’s price falling below $90,000 for the first time since November 2024, reaching lows of $87,950. This decline is attributed to a combination of geopolitical tensions, economic uncertainties, and recent security breaches in the crypto space, such as the $1.5 billion hack involving the Bybit exchange. These factors have collectively dampened investor confidence, leading to increased market volatility.

Beyond the immediate ETF outflows, the cryptocurrency market is navigating a complex landscape shaped by regulatory developments and technological advancements. The recent dismissal of a lawsuit against Coinbase and the conclusion of an SEC investigation into Robinhood’s crypto operations suggest potential regulatory easing. Experts anticipate further developments, including possible dismissals of other high-profile cases and the introduction of comprehensive regulatory frameworks, such as a stablecoin bill. These changes could introduce increased volatility, with initial market disruptions potentially followed by rebounds and heightened institutional interest.

Additionally, the entry of major financial entities like Citadel Securities into cryptocurrency market-making signifies growing institutional adoption.

Bitcoin ETFs Still Hold Strong With $39B Inflows Despite Market Turmoil

Despite the recent wave of outflows, Bitcoin exchange-traded funds (ETFs) continue to showcase their resilience, maintaining over $39 billion in cumulative net inflows. Collectively, these spot Bitcoin ETFs manage a staggering $111 billion in assets under management (AUM), a testament of the enduring investor interest in crypto-focused financial products—even amid heightened market volatility.

Trading activity saw a modest uptick on Monday, with spot Bitcoin ETFs recording $3.8 billion in volume. BlackRock’s IBIT dominated the trading charts, contributing $2.6 billion to the total. While this marks a slight recovery in activity, it still falls significantly short of the record-breaking $9.9 billion volume reached on March 5, 2024, and the $9.5 billion surge seen on January 23.

Quick Facts:

- U.S. spot-listed Bitcoin ETFs saw $516.4 million in outflows on February 24, 2025.

- Fidelity’s FBTC and BlackRock’s IBIT led the withdrawals with $246.96 million and $158.59 million, respectively.

- Bitcoin’s price dropped below $90,000, reaching a low of $87,950.

- Regulatory developments and increased institutional participation are influencing current market dynamics.